Press release

Alternative Investments Market is Booming Worldwide | YieldStreet, Fundrise, Masterworks.io

Advance Market Analytics published a new research publication on "Alternative Investments Market Insights, to 2028" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Alternative Investments market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/181523-global-alternative-investments-market#utm_source=OpenPR/Rahul

Some of the key players profiled in the study are:

YieldStreet, Inc. (United States), Fundrise, LLC (United States), Masterworks.io, LLC (United States), Institutional Capital Network (United States), Wefunder (United States), Rally (United States), Livestock Wealth (South Africa), Oppenheimer & Co. Inc. (United States), Gresham House (United Kingdom), Nippon Life India AIF (India), BlackRock, Inc. (United States).

Scope of the Report of Alternative Investments

An alternative investment is an investment in any assets except stock, bonds, and cash. Alternative investment can be either in tangible assets like infrastructures, precious metals, or any other commodity, or in financial assets like private equity, hedge funds, and private debt. Private equity is becoming an attractive option for the investors and will create many significant opportunities for the market as after the recession many public companies went private to restructure and rebuild themselves before going public and increasing the number of startups worldwide.

The titled segments and sub-section of the market are illuminated below:

by Type (Private Equity, Real Estate, Venture Capital, Real Assets, Hedge Funds), End-user (Investors, Financial Advisors, Alternative Investment Firms)

Market Trends:

Growing Popularity of Co-Investments and Accumulation of Dry Powder in Private Equity

Opportunities:

Impact of ESG Integration on Real Assets Investing Will Open Significant Opportunities

Market Drivers:

Increased Preference of Alternative Investments for More Attractive Risk-Adjusted Returns

Low Correlation Compared to Other Assets

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Alternative Investments Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/181523-global-alternative-investments-market#utm_source=OpenPR/Rahul

Strategic Points Covered in Table of Content of Global Alternative Investments Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Alternative Investments market

Chapter 2: Exclusive Summary - the basic information of the Alternative Investments Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Alternative Investments

Chapter 4: Presenting the Alternative Investments Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2015-2020

Chapter 6: Evaluating the leading manufacturers of the Alternative Investments market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2023-2028)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

finally, Alternative Investments Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/reports/181523-global-alternative-investments-market#utm_source=OpenPR/Rahul

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA - 08837

Phone: +1(201) 7937323, +1(201) 7937193

sales@advancemarketanalytics.com

About Author:

Advance Market Analytics is Global leaders of Market Research Industry provides the quantified B2B research to Fortune 500 companies on high growth emerging opportunities which will impact more than 80% of worldwide companies' revenues.

Our Analyst is tracking high growth study with detailed statistical and in-depth analysis of market trends & dynamics that provide a complete overview of the industry. We follow an extensive research methodology coupled with critical insights related industry factors and market forces to generate the best value for our clients. We Provides reliable primary and secondary data sources, our analysts and consultants derive informative and usable data suited for our clients business needs. The research study enables clients to meet varied market objectives a from global footprint expansion to supply chain optimization and from competitor profiling to M&As.

Get Free Exclusive PDF Sample Copy of This Research @ https://www.advancemarketanalytics.com/sample-report/181523-global-alternative-investments-market#utm_source=OpenPR/Rahul

Some of the key players profiled in the study are:

YieldStreet, Inc. (United States), Fundrise, LLC (United States), Masterworks.io, LLC (United States), Institutional Capital Network (United States), Wefunder (United States), Rally (United States), Livestock Wealth (South Africa), Oppenheimer & Co. Inc. (United States), Gresham House (United Kingdom), Nippon Life India AIF (India), BlackRock, Inc. (United States).

Scope of the Report of Alternative Investments

An alternative investment is an investment in any assets except stock, bonds, and cash. Alternative investment can be either in tangible assets like infrastructures, precious metals, or any other commodity, or in financial assets like private equity, hedge funds, and private debt. Private equity is becoming an attractive option for the investors and will create many significant opportunities for the market as after the recession many public companies went private to restructure and rebuild themselves before going public and increasing the number of startups worldwide.

The titled segments and sub-section of the market are illuminated below:

by Type (Private Equity, Real Estate, Venture Capital, Real Assets, Hedge Funds), End-user (Investors, Financial Advisors, Alternative Investment Firms)

Market Trends:

Growing Popularity of Co-Investments and Accumulation of Dry Powder in Private Equity

Opportunities:

Impact of ESG Integration on Real Assets Investing Will Open Significant Opportunities

Market Drivers:

Increased Preference of Alternative Investments for More Attractive Risk-Adjusted Returns

Low Correlation Compared to Other Assets

Region Included are: North America, Europe, Asia Pacific, Oceania, South America, Middle East & Africa

Country Level Break-Up: United States, Canada, Mexico, Brazil, Argentina, Colombia, Chile, South Africa, Nigeria, Tunisia, Morocco, Germany, United Kingdom (UK), the Netherlands, Spain, Italy, Belgium, Austria, Turkey, Russia, France, Poland, Israel, United Arab Emirates, Qatar, Saudi Arabia, China, Japan, Taiwan, South Korea, Singapore, India, Australia and New Zealand etc.

Have Any Questions Regarding Global Alternative Investments Market Report, Ask Our Experts@ https://www.advancemarketanalytics.com/enquiry-before-buy/181523-global-alternative-investments-market#utm_source=OpenPR/Rahul

Strategic Points Covered in Table of Content of Global Alternative Investments Market:

Chapter 1: Introduction, market driving force product Objective of Study and Research Scope the Alternative Investments market

Chapter 2: Exclusive Summary - the basic information of the Alternative Investments Market.

Chapter 3: Displaying the Market Dynamics- Drivers, Trends and Challenges & Opportunities of the Alternative Investments

Chapter 4: Presenting the Alternative Investments Market Factor Analysis, Porters Five Forces, Supply/Value Chain, PESTEL analysis, Market Entropy, Patent/Trademark Analysis.

Chapter 5: Displaying the by Type, End User and Region/Country 2015-2020

Chapter 6: Evaluating the leading manufacturers of the Alternative Investments market which consists of its Competitive Landscape, Peer Group Analysis, BCG Matrix & Company Profile

Chapter 7: To evaluate the market by segments, by countries and by Manufacturers/Company with revenue share and sales by key countries in these various regions (2023-2028)

Chapter 8 & 9: Displaying the Appendix, Methodology and Data Source

finally, Alternative Investments Market is a valuable source of guidance for individuals and companies.

Read Detailed Index of full Research Study at @ https://www.advancemarketanalytics.com/reports/181523-global-alternative-investments-market#utm_source=OpenPR/Rahul

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA - 08837

Phone: +1(201) 7937323, +1(201) 7937193

sales@advancemarketanalytics.com

About Author:

Advance Market Analytics is Global leaders of Market Research Industry provides the quantified B2B research to Fortune 500 companies on high growth emerging opportunities which will impact more than 80% of worldwide companies' revenues.

Our Analyst is tracking high growth study with detailed statistical and in-depth analysis of market trends & dynamics that provide a complete overview of the industry. We follow an extensive research methodology coupled with critical insights related industry factors and market forces to generate the best value for our clients. We Provides reliable primary and secondary data sources, our analysts and consultants derive informative and usable data suited for our clients business needs. The research study enables clients to meet varied market objectives a from global footprint expansion to supply chain optimization and from competitor profiling to M&As.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

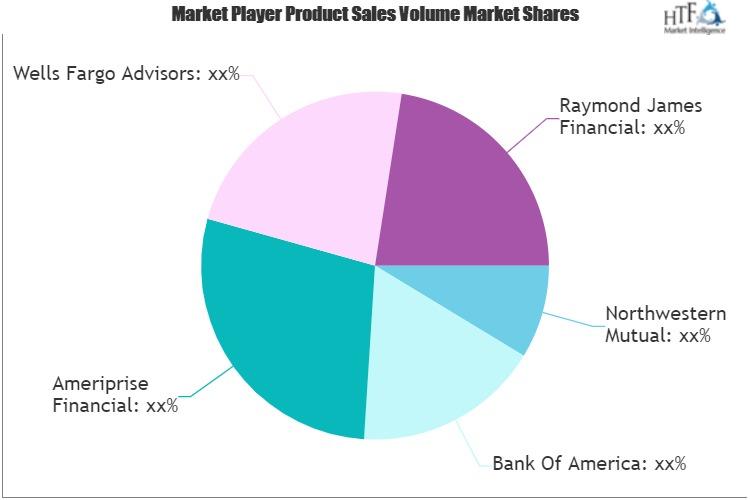

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

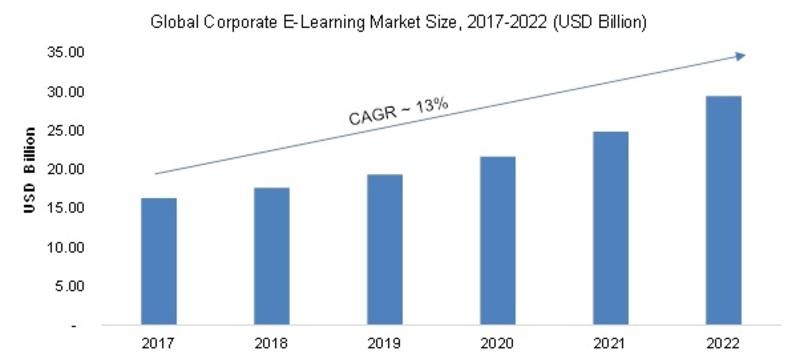

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...