Press release

Artificial Intelligence (AI) Insurtech Market Size, Share, Trends, Growth Opportunities, Key Drivers and Competitive Outlook

**Artificial Intelligence (AI) Insurtech Market**

**Introduction**

Artificial Intelligence (AI) is transforming the insurance industry by enhancing automation, improving customer experiences, and optimizing operational efficiency. AI-driven insurtech solutions are reshaping risk assessment, claims processing, fraud detection, and personalized policy recommendations. The integration of AI in insurtech is reducing costs while increasing efficiency, allowing insurers to offer more competitive and customer-centric products. Companies are leveraging AI to analyze massive datasets, streamline underwriting processes, and improve decision-making. The AI insurtech market is gaining momentum as insurers seek to modernize their operations and enhance customer engagement.

Report URL

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-insurtech-market

**Market Size**

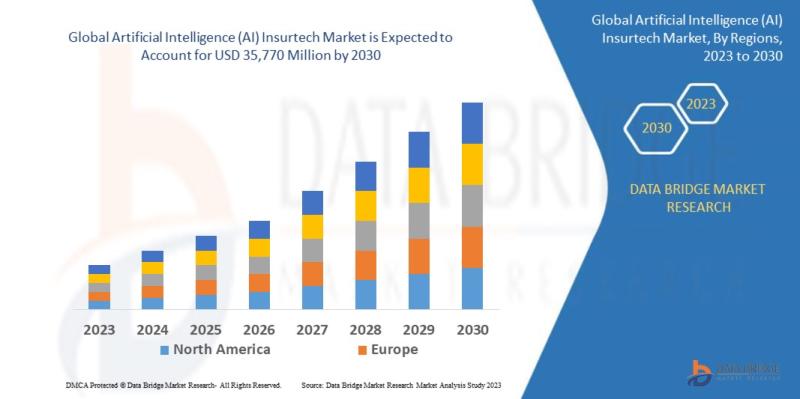

Data Bridge Market Research analyses that the global artificial intelligence (AI) insurtech market which was USD 3,640 million in 2022, is expected to reach USD 35,770 million by 2030, and is expected to undergo a CAGR of 33.06% during the forecast period of 2023 to 2030. "Hardware" segment dominates the component segment of the Global artificial intelligence (AI) insurtech market, as hardware allows the efficient execution of AI applications for tasks such as underwriting, claims processing and risk assessment in the insuretech sector, where data security and processing speed are crucial . In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Some of the major players operating in the global artificial intelligence (AI) insurtech market are:

Microsoft (U.S.)

Infosys Limited (India)

Tractable Ltd (U.S.)

Insurify, Inc. (U.S.)

Slice Insurance Technologies Inc., (U.S.)

Google (U.S.)

Oracle (U.S.)

Amazon Web Services Inc. (U.S.)

IBM (U.S.)

Avaamo (U.S.)

Cape Analytics (U.S.)

Wipro (India)

Acko General Insurance (India)

Shift Technology (France)

Quantemplate (U.K.)

Zurich (Switzerland)

Lemonade Insurance Agency, LLC (U.S.)

**Market Share**

Several leading companies dominate the AI insurtech market. Established insurance firms and technology providers are investing heavily in AI-powered solutions to gain a competitive edge. Companies specializing in AI-driven insurance technology are securing substantial market shares by offering innovative solutions that cater to diverse insurance needs. Insurtech startups are also playing a crucial role in disrupting traditional insurance models. The collaboration between insurance companies and AI solution providers is expanding the market share of AI insurtech solutions. The adoption of AI by insurers is reshaping the competitive landscape and redefining the market dynamics.

**Market Trends**

AI-driven automation is a major trend in the insurtech market. Insurance companies are increasingly using AI for chatbots, virtual assistants, and claims automation. Machine learning algorithms are enhancing fraud detection and risk assessment capabilities. Predictive analytics is helping insurers make data-driven decisions and improve customer experience. The rise of telematics and IoT-enabled insurance policies is another trend shaping the AI insurtech market. Personalized policy recommendations based on AI-driven analytics are gaining traction. AI-powered underwriting is streamlining policy approvals and reducing manual intervention. The continuous advancements in AI are driving innovation in the insurance sector.

**Market Growth**

The AI insurtech market is experiencing rapid growth due to the increasing demand for digital insurance solutions. Insurers are leveraging AI to improve customer service, reduce operational costs, and enhance risk assessment accuracy. AI-driven insurtech platforms are enabling faster claims processing, leading to higher customer satisfaction. The adoption of AI-powered predictive modeling is improving fraud detection and loss prevention strategies. Cloud-based AI solutions are supporting scalability and flexibility for insurers. The growing integration of AI in insurtech is expected to drive substantial market growth in the coming years.

**Market Demand**

The demand for AI insurtech solutions is surging as insurers seek to enhance operational efficiency and customer engagement. The increasing preference for digital-first insurance services is driving the adoption of AI-powered solutions. Customers are demanding seamless and personalized insurance experiences, prompting insurers to invest in AI-driven automation. The need for accurate risk assessment and fraud prevention is further fueling demand for AI insurtech solutions. Regulatory compliance requirements are also pushing insurers to adopt AI-based tools for data analysis and reporting. The growing awareness of AI's potential to revolutionize insurance operations is driving market demand.

**Factors Driving Growth**

Several factors are contributing to the growth of the AI insurtech market. The rapid digitalization of the insurance industry is a major driver of AI adoption. The increasing volume of insurance data is necessitating AI-powered analytics to extract valuable insights. The rising threat of insurance fraud is compelling insurers to implement AI-driven fraud detection mechanisms. The growing need for personalized insurance products is fueling the demand for AI-powered underwriting and policy recommendations. The emergence of blockchain and AI integration is enhancing transparency and security in insurance transactions. The expansion of insurtech startups and collaborations between insurers and AI providers are accelerating market growth. The continuous advancements in AI technologies are driving innovation in the insurtech sector, paving the way for a data-driven and customer-centric insurance landscape.

Browse Trending Reports:

https://resseleaseubmission.blogspot.com/2025/01/cushings-disease-market-size-share.html

https://resseleaseubmission.blogspot.com/2025/01/automotive-crank-trigger-market-size.html

https://resseleaseubmission.blogspot.com/2025/01/celtic-salt-market-size-share-trends.html

https://resseleaseubmission.blogspot.com/2025/01/medical-tuning-fork-market-size-share.html

https://resseleaseubmission.blogspot.com/2025/01/mortuary-equipment-market-size-share.html

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com

**Introduction**

Artificial Intelligence (AI) is transforming the insurance industry by enhancing automation, improving customer experiences, and optimizing operational efficiency. AI-driven insurtech solutions are reshaping risk assessment, claims processing, fraud detection, and personalized policy recommendations. The integration of AI in insurtech is reducing costs while increasing efficiency, allowing insurers to offer more competitive and customer-centric products. Companies are leveraging AI to analyze massive datasets, streamline underwriting processes, and improve decision-making. The AI insurtech market is gaining momentum as insurers seek to modernize their operations and enhance customer engagement.

Report URL

https://www.databridgemarketresearch.com/reports/global-artificial-intelligence-ai-insurtech-market

**Market Size**

Data Bridge Market Research analyses that the global artificial intelligence (AI) insurtech market which was USD 3,640 million in 2022, is expected to reach USD 35,770 million by 2030, and is expected to undergo a CAGR of 33.06% during the forecast period of 2023 to 2030. "Hardware" segment dominates the component segment of the Global artificial intelligence (AI) insurtech market, as hardware allows the efficient execution of AI applications for tasks such as underwriting, claims processing and risk assessment in the insuretech sector, where data security and processing speed are crucial . In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Some of the major players operating in the global artificial intelligence (AI) insurtech market are:

Microsoft (U.S.)

Infosys Limited (India)

Tractable Ltd (U.S.)

Insurify, Inc. (U.S.)

Slice Insurance Technologies Inc., (U.S.)

Google (U.S.)

Oracle (U.S.)

Amazon Web Services Inc. (U.S.)

IBM (U.S.)

Avaamo (U.S.)

Cape Analytics (U.S.)

Wipro (India)

Acko General Insurance (India)

Shift Technology (France)

Quantemplate (U.K.)

Zurich (Switzerland)

Lemonade Insurance Agency, LLC (U.S.)

**Market Share**

Several leading companies dominate the AI insurtech market. Established insurance firms and technology providers are investing heavily in AI-powered solutions to gain a competitive edge. Companies specializing in AI-driven insurance technology are securing substantial market shares by offering innovative solutions that cater to diverse insurance needs. Insurtech startups are also playing a crucial role in disrupting traditional insurance models. The collaboration between insurance companies and AI solution providers is expanding the market share of AI insurtech solutions. The adoption of AI by insurers is reshaping the competitive landscape and redefining the market dynamics.

**Market Trends**

AI-driven automation is a major trend in the insurtech market. Insurance companies are increasingly using AI for chatbots, virtual assistants, and claims automation. Machine learning algorithms are enhancing fraud detection and risk assessment capabilities. Predictive analytics is helping insurers make data-driven decisions and improve customer experience. The rise of telematics and IoT-enabled insurance policies is another trend shaping the AI insurtech market. Personalized policy recommendations based on AI-driven analytics are gaining traction. AI-powered underwriting is streamlining policy approvals and reducing manual intervention. The continuous advancements in AI are driving innovation in the insurance sector.

**Market Growth**

The AI insurtech market is experiencing rapid growth due to the increasing demand for digital insurance solutions. Insurers are leveraging AI to improve customer service, reduce operational costs, and enhance risk assessment accuracy. AI-driven insurtech platforms are enabling faster claims processing, leading to higher customer satisfaction. The adoption of AI-powered predictive modeling is improving fraud detection and loss prevention strategies. Cloud-based AI solutions are supporting scalability and flexibility for insurers. The growing integration of AI in insurtech is expected to drive substantial market growth in the coming years.

**Market Demand**

The demand for AI insurtech solutions is surging as insurers seek to enhance operational efficiency and customer engagement. The increasing preference for digital-first insurance services is driving the adoption of AI-powered solutions. Customers are demanding seamless and personalized insurance experiences, prompting insurers to invest in AI-driven automation. The need for accurate risk assessment and fraud prevention is further fueling demand for AI insurtech solutions. Regulatory compliance requirements are also pushing insurers to adopt AI-based tools for data analysis and reporting. The growing awareness of AI's potential to revolutionize insurance operations is driving market demand.

**Factors Driving Growth**

Several factors are contributing to the growth of the AI insurtech market. The rapid digitalization of the insurance industry is a major driver of AI adoption. The increasing volume of insurance data is necessitating AI-powered analytics to extract valuable insights. The rising threat of insurance fraud is compelling insurers to implement AI-driven fraud detection mechanisms. The growing need for personalized insurance products is fueling the demand for AI-powered underwriting and policy recommendations. The emergence of blockchain and AI integration is enhancing transparency and security in insurance transactions. The expansion of insurtech startups and collaborations between insurers and AI providers are accelerating market growth. The continuous advancements in AI technologies are driving innovation in the insurtech sector, paving the way for a data-driven and customer-centric insurance landscape.

Browse Trending Reports:

https://resseleaseubmission.blogspot.com/2025/01/cushings-disease-market-size-share.html

https://resseleaseubmission.blogspot.com/2025/01/automotive-crank-trigger-market-size.html

https://resseleaseubmission.blogspot.com/2025/01/celtic-salt-market-size-share-trends.html

https://resseleaseubmission.blogspot.com/2025/01/medical-tuning-fork-market-size-share.html

https://resseleaseubmission.blogspot.com/2025/01/mortuary-equipment-market-size-share.html

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...