Press release

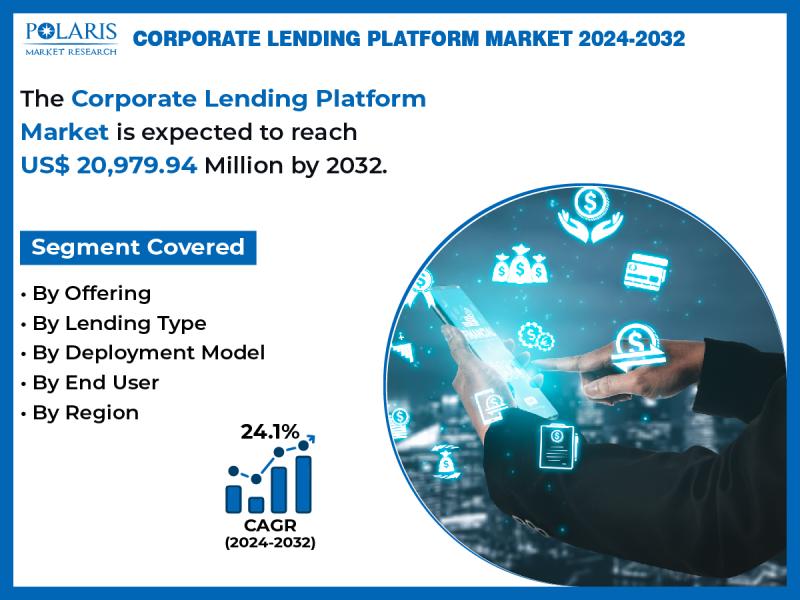

Corporate Lending Platform Market to Grow at CAGR of 24.1% Reaching USD 20,979.94 Million By 2032

Polaris Market Research, a leading market research organization, has released a report titled "Corporate Lending Platform Market: Global Industry Share, Trends, Size, Growth, Opportunity and Forecast 2024-2032." The study delivers a thorough analysis of the industry, including competitor and regional analysis, and highlights the latest advancements in the market.

Global Corporate Lending Platform Market size and share is currently valued at USD 3,016.02 million in 2023 and is anticipated to generate an estimated revenue of USD 20,979.94 million by 2032, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 24.1% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 - 2032.

𝐆𝐞𝐭 𝐚𝐧 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/industry-analysis/corporate-lending-platform-market/request-for-sample

Corporate lending includes conventional banks, online lenders, and alternate fiscal establishments providing loans and connected commodities to businesses for business-linked occasions. Lenders who offer business loans and alternate corporate lending commodities frequently establish competence that needs to be connected to years in business, yearly proceeds, and credit score. Loan size, interest rates, and loan entitlement normally rely on the product and the lender. Funding can be interim with compensation in a few months or extended with disbursements expanded over the years. Loanees will frequently be questioned for a personal guarantee and security for fastened funding for their business.

The corporate lending platform market share is flourishing because of the growing demand for efficient loan genesis and processing. Businesses are growingly looking for systematic solutions to obtain financing and handle financial operations. These platforms use progressive technologies such as AI and ML to mechanize chores, estimate creditworthiness, and accelerate loan consent. Also, the transformation towards online and mobile banking is propelling notable growth in the market. With additional businesses selecting digital banking solutions, there is a growing demand for well-organized lending procedures.

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐨𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

Some of the major global players include:

• Comarch

• FICO

• Finastra

• FIS

• Fiserv

• HES FinTech

• Intellect Design Arena

• JurisTech

• Newgen

• Oracle

• Sigma Infosolutions

• Tavant

• TCS

• Temenos AG

• Wipro

𝐁𝐮𝐲 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/buy/3820/2

𝐌𝐚𝐫𝐤𝐞𝐭'𝐬 𝐌𝐚𝐣𝐨𝐫 𝐅𝐚𝐜𝐭𝐬

• The global corporate lending platform industry was valued at USD 3,016.02 million in 2023 and is expected to grow to USD 20,979.94 million by 2032.

• The market is anticipated to expand at a CAGR of 24.1% during the forecast period.

• In 2023, North America is anticipated to dominate the market.

• Asia Pacific observed the highest growth rate in the market.

𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬:

Loan Origination and Underwriting: Platforms facilitate the application process, assess creditworthiness, and automate loan approvals.

Loan Servicing: Managing and servicing loans throughout their lifecycle, including payment processing and customer support.

Risk Management: Utilizing data and advanced analytics to assess and mitigate lending risks.

Compliance and Documentation: Ensuring adherence to regulatory requirements and managing documentation electronically.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐓𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭, 𝐡𝐞𝐫𝐞: https://www.polarismarketresearch.com/industry-analysis/corporate-lending-platform-market

𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐇𝐚𝐬 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐞𝐝 𝐭𝐡𝐞 𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐁𝐚𝐬𝐞𝐝 𝐎𝐧 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠, 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐓𝐲𝐩𝐞, 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 𝐌𝐨𝐝𝐞𝐥, 𝐀𝐧𝐝 𝐄𝐧𝐝-𝐔𝐬𝐞𝐫:

Corporate Lending Platform, Offering Outlook (Revenue - USD Million, 2019 - 2032)

• Solutions

• Services

Corporate Lending Platform, Lending Type Outlook (Revenue - USD Million, 2019 - 2032)

• Microfinance Lending

• Commercial Lending

• SME Lending

• Others

Corporate Lending Platform, Deployment Model Outlook (Revenue - USD Million, 2019 - 2032)

• On-premise

• Cloud-based

Corporate Lending Platform, End User Outlook (Revenue - USD Million, 2019 - 2032)

• Banks

• Non-Banking Financial Corporations

• Credit Unions

• Others

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Parking Management Systems Market: https://www.polarismarketresearch.com/industry-analysis/parking-management-systems-market

Over-The-Top Devices And Services Market: https://www.polarismarketresearch.com/industry-analysis/over-the-top-devices-and-services-market

Cryptocurrency Market: https://www.polarismarketresearch.com/industry-analysis/cryptocurrency-market

Real Estate Crowdfunding Market: https://www.polarismarketresearch.com/industry-analysis/real-estate-crowdfunding-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐈𝐧𝐟𝐨:

Polaris Market Research

Phone: +1-929-297-9727

Email: sales@polarismarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

Global Corporate Lending Platform Market size and share is currently valued at USD 3,016.02 million in 2023 and is anticipated to generate an estimated revenue of USD 20,979.94 million by 2032, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 24.1% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2024 - 2032.

𝐆𝐞𝐭 𝐚𝐧 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/industry-analysis/corporate-lending-platform-market/request-for-sample

Corporate lending includes conventional banks, online lenders, and alternate fiscal establishments providing loans and connected commodities to businesses for business-linked occasions. Lenders who offer business loans and alternate corporate lending commodities frequently establish competence that needs to be connected to years in business, yearly proceeds, and credit score. Loan size, interest rates, and loan entitlement normally rely on the product and the lender. Funding can be interim with compensation in a few months or extended with disbursements expanded over the years. Loanees will frequently be questioned for a personal guarantee and security for fastened funding for their business.

The corporate lending platform market share is flourishing because of the growing demand for efficient loan genesis and processing. Businesses are growingly looking for systematic solutions to obtain financing and handle financial operations. These platforms use progressive technologies such as AI and ML to mechanize chores, estimate creditworthiness, and accelerate loan consent. Also, the transformation towards online and mobile banking is propelling notable growth in the market. With additional businesses selecting digital banking solutions, there is a growing demand for well-organized lending procedures.

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐨𝐫 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬

Some of the major global players include:

• Comarch

• FICO

• Finastra

• FIS

• Fiserv

• HES FinTech

• Intellect Design Arena

• JurisTech

• Newgen

• Oracle

• Sigma Infosolutions

• Tavant

• TCS

• Temenos AG

• Wipro

𝐁𝐮𝐲 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/buy/3820/2

𝐌𝐚𝐫𝐤𝐞𝐭'𝐬 𝐌𝐚𝐣𝐨𝐫 𝐅𝐚𝐜𝐭𝐬

• The global corporate lending platform industry was valued at USD 3,016.02 million in 2023 and is expected to grow to USD 20,979.94 million by 2032.

• The market is anticipated to expand at a CAGR of 24.1% during the forecast period.

• In 2023, North America is anticipated to dominate the market.

• Asia Pacific observed the highest growth rate in the market.

𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬:

Loan Origination and Underwriting: Platforms facilitate the application process, assess creditworthiness, and automate loan approvals.

Loan Servicing: Managing and servicing loans throughout their lifecycle, including payment processing and customer support.

Risk Management: Utilizing data and advanced analytics to assess and mitigate lending risks.

Compliance and Documentation: Ensuring adherence to regulatory requirements and managing documentation electronically.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐓𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭, 𝐡𝐞𝐫𝐞: https://www.polarismarketresearch.com/industry-analysis/corporate-lending-platform-market

𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐇𝐚𝐬 𝐒𝐞𝐠𝐦𝐞𝐧𝐭𝐞𝐝 𝐭𝐡𝐞 𝐂𝐨𝐫𝐩𝐨𝐫𝐚𝐭𝐞 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐁𝐚𝐬𝐞𝐝 𝐎𝐧 𝐎𝐟𝐟𝐞𝐫𝐢𝐧𝐠, 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐓𝐲𝐩𝐞, 𝐃𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 𝐌𝐨𝐝𝐞𝐥, 𝐀𝐧𝐝 𝐄𝐧𝐝-𝐔𝐬𝐞𝐫:

Corporate Lending Platform, Offering Outlook (Revenue - USD Million, 2019 - 2032)

• Solutions

• Services

Corporate Lending Platform, Lending Type Outlook (Revenue - USD Million, 2019 - 2032)

• Microfinance Lending

• Commercial Lending

• SME Lending

• Others

Corporate Lending Platform, Deployment Model Outlook (Revenue - USD Million, 2019 - 2032)

• On-premise

• Cloud-based

Corporate Lending Platform, End User Outlook (Revenue - USD Million, 2019 - 2032)

• Banks

• Non-Banking Financial Corporations

• Credit Unions

• Others

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

Parking Management Systems Market: https://www.polarismarketresearch.com/industry-analysis/parking-management-systems-market

Over-The-Top Devices And Services Market: https://www.polarismarketresearch.com/industry-analysis/over-the-top-devices-and-services-market

Cryptocurrency Market: https://www.polarismarketresearch.com/industry-analysis/cryptocurrency-market

Real Estate Crowdfunding Market: https://www.polarismarketresearch.com/industry-analysis/real-estate-crowdfunding-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐈𝐧𝐟𝐨:

Polaris Market Research

Phone: +1-929-297-9727

Email: sales@polarismarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...