Press release

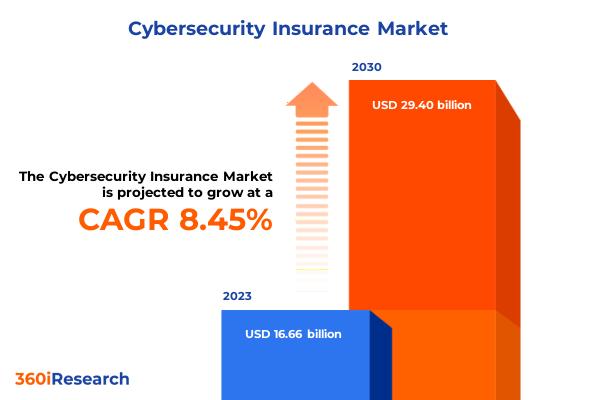

Cybersecurity Insurance Market worth $29.40 billion by 2030, growing at a CAGR of 8.45% - Exclusive Report by 360iResearch

The "Cybersecurity Insurance Market by Insurance Risk Coverage (Data Breach, Data Liability), Offering (Service, Solution), Compliance Requirement, Insurance Type, Organization Size, End User - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.

The Global Cybersecurity Insurance Market to grow from USD 16.66 billion in 2023 to USD 29.40 billion by 2030, at a CAGR of 8.45%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/cybersecurity-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Cybersecurity insurance is a specialized and niche type of insurance policy designed to mitigate the risks associated with digital operations and online presence. Cybersecurity insurance policies may cover incident response expenses, legal fees, regulatory fines, ransom payments, and costs associated with notifying affected customers and restoring their personal data. Continuous evolutions in the digital landscape have exposed businesses to an array of cyber threats, including data breaches, network damage, and business interruption caused by malicious activities such as hacking, ransomware, and distributed denial-of-service (DDoS) attacks. Regulatory requirements concerning data privacy mandate data protection and incident reporting, further driving the demand for insurance solutions. However, delays in claim settlement, unfair settlement criteria, and fraudulent insurance practices impede the widespread adoption of cybersecurity insurance. Additionally, the lack of standardization for cybersecurity insurance policies can create complications in choosing an appropriate insurance policy for end users. However, major providers are exploring the integration of advanced technologies such as AI, ML, and big data analytics technologies to standardize, streamline, and improve the accuracy of deploying cybersecurity insurance policies. Additionally, governance bodies globally are implementing regulations that mandate the need for cybersecurity insurance.

America's high demand for cybersecurity insurance is attributable to the high awareness of cyber risks and the presence of key insurance providers. Corporations in the US and Canada are highly adaptive to cybersecurity insurance policies due to the advanced digital infrastructure and the increased occurrence of cyber incidents. The presence of established and robust technological corporations also necessitates the provision of cybersecurity insurance. The European cybersecurity insurance market is witnessing robust growth, propelled by the General Data Protection Regulation (GDPR), which has heightened focus on data security and the consequences of privacy breaches. European nations, including the United Kingdom, Germany, and France are seeing an upsurge in demand for cyber insurance policies. The European region is also characterized by a collaborative approach between the public and the private sector to develop cyber resilience. The Asia-Pacific region presents a high-growth landscape for cybersecurity insurance. The region is experiencing the need for cybersecurity insurance due to mounting cyberattacks and an evolving regulatory environment, particularly in countries such as Japan, Australia, and Singapore. China and India are characterized by the presence of a nascent and evolving digital infrastructure, advancing technological start-up ecosystem, and small and medium-sized enterprises(SMEs) and offer significant growth opportunities.

Market Segmentation & Coverage:

This research report categorizes the Cybersecurity Insurance Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Insurance Risk Coverage, market is studied across Data Breach and Data Liability. The Data Breach is further studied across Data Loss, Denial of Service & Down-Time, and Ransomeware Attack. The Data Breach is projected to witness significant market share during forecast period.

Based on Offering, market is studied across Service and Solution. The Service is further studied across Consulting & Advisory and Security Awareness Training. The Solution is further studied across Cybersecurity Insurance Analytics Platform, Cybersecurity Solution, and Disaster Recovery & Business Continuity. The Cybersecurity Solution is further studied across Cyber Risk & Vulnerability Assessment and Cybersecurity Resilience. The Service is projected to witness significant market share during forecast period.

Based on Compliance Requirement, market is studied across Data Privacy Compliance, Financial Services Compliance, GDPR Compliance, and Healthcare Compliance. The GDPR Compliance is projected to witness significant market share during forecast period.

Based on Insurance Type, market is studied across Packaged and Stand-alone. The Stand-alone is projected to witness significant market share during forecast period.

Based on Organization Size, market is studied across Large Enterprises and SMEs. The SMEs is projected to witness significant market share during forecast period.

Based on End User, market is studied across Insurance Provider and Technology Provider. The Insurance Provider is further studied across Financial Services, Healthcare & Life Science, IT & Telecommunications, Retail & eCommerce, and Travel, Tourism, & Hospitality. The Technology Provider is further studied across Government Agencies, Insurance Companies, and Third-party Administrators. The Technology Provider is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 42.36% in 2023, followed by Europe, Middle East & Africa.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/cybersecurity-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Cybersecurity Insurance Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Cybersecurity Insurance Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Cybersecurity Insurance Market, highlighting leading vendors and their innovative profiles. These include Allianz SE, American International Group, Inc., Arceo.ai by Resilience Cyber Insurance Solutions LLC, Arthur J. Gallagher & Co., AXA XL, Axis Capital Holdings Limited, BCS Insurance Company, Beazley PLC, Bitsight Technologies, Inc., Chubb Limited, Cisco Systems, Inc., CNA Financial Corporation, Coalition, Inc., Corvus Insurance, Fortinet, Inc., HDFC ERGO General Insurance Company Ltd., Hiscox Ltd., Liberty Mutual Group, The Hartford Financial Services Group, Inc., The Travelers Indemnity Company, Tokio Marine Holdings, Inc, and Zurich Insurance Group.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Cybersecurity Insurance Market, by Insurance Risk Coverage

7. Cybersecurity Insurance Market, by Offering

8. Cybersecurity Insurance Market, by Compliance Requirement

9. Cybersecurity Insurance Market, by Insurance Type

10. Cybersecurity Insurance Market, by Organization Size

11. Cybersecurity Insurance Market, by End User

12. Americas Cybersecurity Insurance Market

13. Asia-Pacific Cybersecurity Insurance Market

14. Europe, Middle East & Africa Cybersecurity Insurance Market

15. Competitive Landscape

16. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Cybersecurity Insurance Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Cybersecurity Insurance Market?

3. What is the competitive strategic window for opportunities in the Cybersecurity Insurance Market?

4. What are the technology trends and regulatory frameworks in the Cybersecurity Insurance Market?

5. What is the market share of the leading vendors in the Cybersecurity Insurance Market?

6. What modes and strategic moves are considered suitable for entering the Cybersecurity Insurance Market?

Read More @ https://www.360iresearch.com/library/intelligence/cybersecurity-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

The Global Cybersecurity Insurance Market to grow from USD 16.66 billion in 2023 to USD 29.40 billion by 2030, at a CAGR of 8.45%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/cybersecurity-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=sample

Cybersecurity insurance is a specialized and niche type of insurance policy designed to mitigate the risks associated with digital operations and online presence. Cybersecurity insurance policies may cover incident response expenses, legal fees, regulatory fines, ransom payments, and costs associated with notifying affected customers and restoring their personal data. Continuous evolutions in the digital landscape have exposed businesses to an array of cyber threats, including data breaches, network damage, and business interruption caused by malicious activities such as hacking, ransomware, and distributed denial-of-service (DDoS) attacks. Regulatory requirements concerning data privacy mandate data protection and incident reporting, further driving the demand for insurance solutions. However, delays in claim settlement, unfair settlement criteria, and fraudulent insurance practices impede the widespread adoption of cybersecurity insurance. Additionally, the lack of standardization for cybersecurity insurance policies can create complications in choosing an appropriate insurance policy for end users. However, major providers are exploring the integration of advanced technologies such as AI, ML, and big data analytics technologies to standardize, streamline, and improve the accuracy of deploying cybersecurity insurance policies. Additionally, governance bodies globally are implementing regulations that mandate the need for cybersecurity insurance.

America's high demand for cybersecurity insurance is attributable to the high awareness of cyber risks and the presence of key insurance providers. Corporations in the US and Canada are highly adaptive to cybersecurity insurance policies due to the advanced digital infrastructure and the increased occurrence of cyber incidents. The presence of established and robust technological corporations also necessitates the provision of cybersecurity insurance. The European cybersecurity insurance market is witnessing robust growth, propelled by the General Data Protection Regulation (GDPR), which has heightened focus on data security and the consequences of privacy breaches. European nations, including the United Kingdom, Germany, and France are seeing an upsurge in demand for cyber insurance policies. The European region is also characterized by a collaborative approach between the public and the private sector to develop cyber resilience. The Asia-Pacific region presents a high-growth landscape for cybersecurity insurance. The region is experiencing the need for cybersecurity insurance due to mounting cyberattacks and an evolving regulatory environment, particularly in countries such as Japan, Australia, and Singapore. China and India are characterized by the presence of a nascent and evolving digital infrastructure, advancing technological start-up ecosystem, and small and medium-sized enterprises(SMEs) and offer significant growth opportunities.

Market Segmentation & Coverage:

This research report categorizes the Cybersecurity Insurance Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Insurance Risk Coverage, market is studied across Data Breach and Data Liability. The Data Breach is further studied across Data Loss, Denial of Service & Down-Time, and Ransomeware Attack. The Data Breach is projected to witness significant market share during forecast period.

Based on Offering, market is studied across Service and Solution. The Service is further studied across Consulting & Advisory and Security Awareness Training. The Solution is further studied across Cybersecurity Insurance Analytics Platform, Cybersecurity Solution, and Disaster Recovery & Business Continuity. The Cybersecurity Solution is further studied across Cyber Risk & Vulnerability Assessment and Cybersecurity Resilience. The Service is projected to witness significant market share during forecast period.

Based on Compliance Requirement, market is studied across Data Privacy Compliance, Financial Services Compliance, GDPR Compliance, and Healthcare Compliance. The GDPR Compliance is projected to witness significant market share during forecast period.

Based on Insurance Type, market is studied across Packaged and Stand-alone. The Stand-alone is projected to witness significant market share during forecast period.

Based on Organization Size, market is studied across Large Enterprises and SMEs. The SMEs is projected to witness significant market share during forecast period.

Based on End User, market is studied across Insurance Provider and Technology Provider. The Insurance Provider is further studied across Financial Services, Healthcare & Life Science, IT & Telecommunications, Retail & eCommerce, and Travel, Tourism, & Hospitality. The Technology Provider is further studied across Government Agencies, Insurance Companies, and Third-party Administrators. The Technology Provider is projected to witness significant market share during forecast period.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 42.36% in 2023, followed by Europe, Middle East & Africa.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/cybersecurity-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Cybersecurity Insurance Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Cybersecurity Insurance Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Cybersecurity Insurance Market, highlighting leading vendors and their innovative profiles. These include Allianz SE, American International Group, Inc., Arceo.ai by Resilience Cyber Insurance Solutions LLC, Arthur J. Gallagher & Co., AXA XL, Axis Capital Holdings Limited, BCS Insurance Company, Beazley PLC, Bitsight Technologies, Inc., Chubb Limited, Cisco Systems, Inc., CNA Financial Corporation, Coalition, Inc., Corvus Insurance, Fortinet, Inc., HDFC ERGO General Insurance Company Ltd., Hiscox Ltd., Liberty Mutual Group, The Hartford Financial Services Group, Inc., The Travelers Indemnity Company, Tokio Marine Holdings, Inc, and Zurich Insurance Group.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Cybersecurity Insurance Market, by Insurance Risk Coverage

7. Cybersecurity Insurance Market, by Offering

8. Cybersecurity Insurance Market, by Compliance Requirement

9. Cybersecurity Insurance Market, by Insurance Type

10. Cybersecurity Insurance Market, by Organization Size

11. Cybersecurity Insurance Market, by End User

12. Americas Cybersecurity Insurance Market

13. Asia-Pacific Cybersecurity Insurance Market

14. Europe, Middle East & Africa Cybersecurity Insurance Market

15. Competitive Landscape

16. Competitive Portfolio

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Cybersecurity Insurance Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Cybersecurity Insurance Market?

3. What is the competitive strategic window for opportunities in the Cybersecurity Insurance Market?

4. What are the technology trends and regulatory frameworks in the Cybersecurity Insurance Market?

5. What is the market share of the leading vendors in the Cybersecurity Insurance Market?

6. What modes and strategic moves are considered suitable for entering the Cybersecurity Insurance Market?

Read More @ https://www.360iresearch.com/library/intelligence/cybersecurity-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

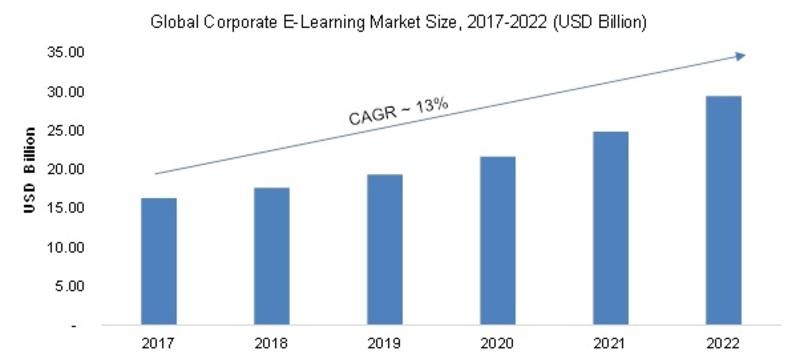

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...