Press release

Digital Lending Platforms: Revolutionizing Financial Access and Convenience

Digital lending platforms have transformed the financial landscape by providing faster, more accessible loan services to individuals and businesses. These platforms leverage technology to simplify the borrowing process, reduce paperwork, and offer loans with greater transparency and speed than traditional lenders. Through innovations such as artificial intelligence (AI), machine learning (ML), and big data, digital lending platforms make credit more accessible, particularly for underserved populations and small businesses. As the world embraces digital transformation, the digital lending market continues to expand rapidly, reshaping how people and businesses access funds.

Market Size of Digital Lending Platforms

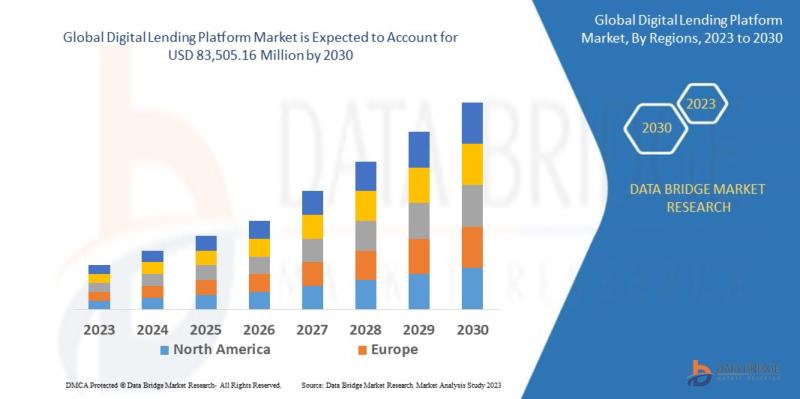

The digital lending market has seen exponential growth, driven by the increasing adoption of digital finance solutions and a surge in online transactions. Currently, the global digital lending platform market is valued at around $15 billion and is expected to grow at a compound annual growth rate (CAGR) of approximately 20% over the next five years. This growth reflects the demand for convenient, fast, and secure lending services among both consumers and businesses.

North America leads the market, with the United States holding a significant share due to the strong fintech ecosystem, supportive regulatory environment, and widespread smartphone adoption. Asia-Pacific, however, is experiencing the fastest growth, especially in countries like China and India, where financial inclusion initiatives and the rising use of mobile payment systems have fueled demand for digital loans. As technology adoption increases globally, the market size for digital lending platforms is expected to continue its upward trajectory.

Market Share and Key Players

The digital lending platform market comprises a mix of established players, fintech startups, and technology providers that have disrupted traditional lending models. Key players include companies like LendingClub, SoFi, Prosper, Avant, and Upstart in the United States, as well as prominent international players such as Ant Financial, Paytm, and Funding Circle. These companies offer various loan products, from personal and business loans to peer-to-peer lending and Buy Now, Pay Later (BNPL) solutions.

LendingClub and SoFi have captured significant market shares in the personal loan segment, using AI and data analytics to streamline the lending process and assess borrower risk more accurately. In contrast, Ant Financial and Paytm have established dominant positions in Asia through their innovative mobile-first platforms, which have made financial services accessible to millions of previously unbanked individuals. While the United States and China currently hold the largest shares in digital lending, other regions, particularly emerging markets, are catching up as fintech adoption spreads.

Market segmentation within the industry varies, with personal loans being the largest segment, followed by business loans and BNPL services. Peer-to-peer (P2P) lending and small business lending are also rapidly growing segments, driven by the rising number of small and medium-sized enterprises (SMEs) seeking quick and accessible financing. As consumer demand for digital services increases, new players and products are expected to enter the market, further diversifying the competitive landscape.

The Evolution of Digital Lending Platforms

Digital lending platforms have come a long way since their inception. The early days of digital lending began with peer-to-peer (P2P) lending platforms, which aimed to connect borrowers directly with lenders, bypassing traditional financial institutions. These platforms initially faced challenges related to risk assessment, regulatory scrutiny, and limited consumer trust. However, as technology advanced, digital lending platforms evolved to address these challenges and offer a more robust and secure alternative to traditional lending.

With the rise of data analytics, AI, and ML, digital lending platforms have transformed how loans are processed and approved. AI algorithms now analyze vast amounts of data to assess borrower risk, enabling platforms to make lending decisions quickly and accurately. Additionally, digital lending platforms have expanded their services to include business loans, mortgage refinancing, student loans, and BNPL options. The digital lending process has become more streamlined, with platforms offering fully automated experiences that allow borrowers to apply, receive approvals, and access funds online or via mobile apps.

Today's digital lending platforms focus on customer experience, transparency, and personalized lending options. Many platforms have embraced open banking and application programming interfaces (APIs) to access a wider range of financial data, improving their ability to assess creditworthiness and offer tailored solutions. As digital lending continues to evolve, platforms are increasingly focusing on integrating these technologies to deliver more efficient, secure, and personalized experiences to their users.

Market Trends in Digital Lending Platforms

The digital lending platform market is characterized by several key trends that are shaping its future. One of the most prominent trends is the integration of AI and ML in credit assessment and decision-making. By leveraging data-driven models, digital lending platforms can analyze non-traditional data, such as social media activity, e-commerce transactions, and mobile usage patterns, to assess borrowers' creditworthiness. This enables platforms to extend credit to individuals and businesses who may not qualify under traditional lending criteria, thus promoting financial inclusion.

The growth of BNPL services is another significant trend. BNPL allows consumers to make purchases and pay in installments without incurring interest, provided they meet the payment terms. BNPL has become particularly popular among younger consumers who prefer this flexible payment option over traditional credit cards. Digital lending platforms are capitalizing on the BNPL trend by offering these services through e-commerce partnerships, helping merchants increase sales while providing consumers with more payment choices.

Blockchain technology is also starting to make its mark in the digital lending space. By using decentralized ledgers, digital lending platforms can increase transparency, reduce fraud, and simplify cross-border lending. Although still in the early stages of adoption, blockchain technology holds the potential to enhance security, trust, and efficiency in the digital lending process.

Another trend driving growth is the focus on small and medium-sized enterprises (SMEs) and microloans. SMEs often face challenges accessing credit through traditional banks due to strict lending requirements. Digital lending platforms are stepping in to fill this gap by providing alternative financing options, including microloans and revenue-based financing, which allow businesses to access funds based on their cash flow rather than conventional credit ratings. This approach enables more SMEs to obtain the capital they need to grow and thrive, particularly in emerging markets.

Factors Driving Growth in Digital Lending Platforms

Several factors are driving the growth of digital lending platforms, including the increasing penetration of smartphones and internet connectivity. As more consumers gain access to mobile devices and the internet, digital lending becomes more accessible to a broader audience. This trend is particularly impactful in emerging markets, where traditional banking infrastructure may be lacking, but mobile penetration is high. In these regions, digital lending platforms are often the primary source of financial services, bridging the gap for the unbanked and underbanked populations.

The need for fast, convenient, and secure lending solutions is another significant growth driver. Traditional loan processes are often time-consuming, requiring extensive paperwork and multiple in-person visits. Digital lending platforms eliminate these barriers by allowing users to complete the application process online and receive funds quickly. This convenience appeals to consumers and businesses alike, who value speed and efficiency when accessing credit.

Increasing consumer preference for personalized services is also contributing to the rise of digital lending platforms. Digital lending platforms can leverage data analytics to offer tailored loan products and terms that align with individual borrowers' needs. For example, a self-employed individual may receive a different loan structure than someone with a salaried job, taking into account factors like cash flow patterns and income variability. This personalization enhances customer satisfaction and drives higher adoption rates.

Supportive government regulations and fintech-friendly policies are helping drive the expansion of digital lending. In many countries, regulators are creating frameworks that support digital finance while ensuring consumer protection and data privacy. For instance, India's Reserve Bank has introduced guidelines to foster digital lending innovation while addressing transparency and accountability. These policies encourage digital lending platforms to operate more openly and securely, fostering growth while safeguarding consumers.

Finally, the growing awareness of financial inclusion is fueling demand for digital lending platforms. Many people, particularly in developing countries, lack access to traditional banking services due to factors like limited infrastructure or lack of credit history. Digital lending platforms can bridge this gap by using alternative data and innovative credit assessment models to extend loans to those who would otherwise be excluded from the financial system. By promoting financial inclusion, digital lending platforms not only drive market growth but also support economic development.

Browse Trending Reports:

https://jondevide92.blogspot.com/2024/10/non-chocolate-candy-market-size-share_28.html

https://jondevide92.blogspot.com/2024/10/motorcycles-market-size-share-trends.html

https://jondevide92.blogspot.com/2024/10/maintenance-repair-and-operations-mro.html

Conclusion

Digital lending platforms have emerged as a vital force in the financial services industry, providing accessible, fast, and secure loan options to a wide range of consumers and businesses. With growing smartphone penetration, data-driven technologies, and increasing demand for convenient credit access, the digital lending market is expected to continue its rapid expansion. Trends like AI-powered credit assessment, BNPL services, and blockchain adoption are reshaping the industry, making digital lending platforms more versatile and inclusive. As digital lending platforms evolve, they are likely to remain at the forefront of financial innovation, expanding access to credit and promoting financial inclusion on a global scale.

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com"

Market Size of Digital Lending Platforms

The digital lending market has seen exponential growth, driven by the increasing adoption of digital finance solutions and a surge in online transactions. Currently, the global digital lending platform market is valued at around $15 billion and is expected to grow at a compound annual growth rate (CAGR) of approximately 20% over the next five years. This growth reflects the demand for convenient, fast, and secure lending services among both consumers and businesses.

North America leads the market, with the United States holding a significant share due to the strong fintech ecosystem, supportive regulatory environment, and widespread smartphone adoption. Asia-Pacific, however, is experiencing the fastest growth, especially in countries like China and India, where financial inclusion initiatives and the rising use of mobile payment systems have fueled demand for digital loans. As technology adoption increases globally, the market size for digital lending platforms is expected to continue its upward trajectory.

Market Share and Key Players

The digital lending platform market comprises a mix of established players, fintech startups, and technology providers that have disrupted traditional lending models. Key players include companies like LendingClub, SoFi, Prosper, Avant, and Upstart in the United States, as well as prominent international players such as Ant Financial, Paytm, and Funding Circle. These companies offer various loan products, from personal and business loans to peer-to-peer lending and Buy Now, Pay Later (BNPL) solutions.

LendingClub and SoFi have captured significant market shares in the personal loan segment, using AI and data analytics to streamline the lending process and assess borrower risk more accurately. In contrast, Ant Financial and Paytm have established dominant positions in Asia through their innovative mobile-first platforms, which have made financial services accessible to millions of previously unbanked individuals. While the United States and China currently hold the largest shares in digital lending, other regions, particularly emerging markets, are catching up as fintech adoption spreads.

Market segmentation within the industry varies, with personal loans being the largest segment, followed by business loans and BNPL services. Peer-to-peer (P2P) lending and small business lending are also rapidly growing segments, driven by the rising number of small and medium-sized enterprises (SMEs) seeking quick and accessible financing. As consumer demand for digital services increases, new players and products are expected to enter the market, further diversifying the competitive landscape.

The Evolution of Digital Lending Platforms

Digital lending platforms have come a long way since their inception. The early days of digital lending began with peer-to-peer (P2P) lending platforms, which aimed to connect borrowers directly with lenders, bypassing traditional financial institutions. These platforms initially faced challenges related to risk assessment, regulatory scrutiny, and limited consumer trust. However, as technology advanced, digital lending platforms evolved to address these challenges and offer a more robust and secure alternative to traditional lending.

With the rise of data analytics, AI, and ML, digital lending platforms have transformed how loans are processed and approved. AI algorithms now analyze vast amounts of data to assess borrower risk, enabling platforms to make lending decisions quickly and accurately. Additionally, digital lending platforms have expanded their services to include business loans, mortgage refinancing, student loans, and BNPL options. The digital lending process has become more streamlined, with platforms offering fully automated experiences that allow borrowers to apply, receive approvals, and access funds online or via mobile apps.

Today's digital lending platforms focus on customer experience, transparency, and personalized lending options. Many platforms have embraced open banking and application programming interfaces (APIs) to access a wider range of financial data, improving their ability to assess creditworthiness and offer tailored solutions. As digital lending continues to evolve, platforms are increasingly focusing on integrating these technologies to deliver more efficient, secure, and personalized experiences to their users.

Market Trends in Digital Lending Platforms

The digital lending platform market is characterized by several key trends that are shaping its future. One of the most prominent trends is the integration of AI and ML in credit assessment and decision-making. By leveraging data-driven models, digital lending platforms can analyze non-traditional data, such as social media activity, e-commerce transactions, and mobile usage patterns, to assess borrowers' creditworthiness. This enables platforms to extend credit to individuals and businesses who may not qualify under traditional lending criteria, thus promoting financial inclusion.

The growth of BNPL services is another significant trend. BNPL allows consumers to make purchases and pay in installments without incurring interest, provided they meet the payment terms. BNPL has become particularly popular among younger consumers who prefer this flexible payment option over traditional credit cards. Digital lending platforms are capitalizing on the BNPL trend by offering these services through e-commerce partnerships, helping merchants increase sales while providing consumers with more payment choices.

Blockchain technology is also starting to make its mark in the digital lending space. By using decentralized ledgers, digital lending platforms can increase transparency, reduce fraud, and simplify cross-border lending. Although still in the early stages of adoption, blockchain technology holds the potential to enhance security, trust, and efficiency in the digital lending process.

Another trend driving growth is the focus on small and medium-sized enterprises (SMEs) and microloans. SMEs often face challenges accessing credit through traditional banks due to strict lending requirements. Digital lending platforms are stepping in to fill this gap by providing alternative financing options, including microloans and revenue-based financing, which allow businesses to access funds based on their cash flow rather than conventional credit ratings. This approach enables more SMEs to obtain the capital they need to grow and thrive, particularly in emerging markets.

Factors Driving Growth in Digital Lending Platforms

Several factors are driving the growth of digital lending platforms, including the increasing penetration of smartphones and internet connectivity. As more consumers gain access to mobile devices and the internet, digital lending becomes more accessible to a broader audience. This trend is particularly impactful in emerging markets, where traditional banking infrastructure may be lacking, but mobile penetration is high. In these regions, digital lending platforms are often the primary source of financial services, bridging the gap for the unbanked and underbanked populations.

The need for fast, convenient, and secure lending solutions is another significant growth driver. Traditional loan processes are often time-consuming, requiring extensive paperwork and multiple in-person visits. Digital lending platforms eliminate these barriers by allowing users to complete the application process online and receive funds quickly. This convenience appeals to consumers and businesses alike, who value speed and efficiency when accessing credit.

Increasing consumer preference for personalized services is also contributing to the rise of digital lending platforms. Digital lending platforms can leverage data analytics to offer tailored loan products and terms that align with individual borrowers' needs. For example, a self-employed individual may receive a different loan structure than someone with a salaried job, taking into account factors like cash flow patterns and income variability. This personalization enhances customer satisfaction and drives higher adoption rates.

Supportive government regulations and fintech-friendly policies are helping drive the expansion of digital lending. In many countries, regulators are creating frameworks that support digital finance while ensuring consumer protection and data privacy. For instance, India's Reserve Bank has introduced guidelines to foster digital lending innovation while addressing transparency and accountability. These policies encourage digital lending platforms to operate more openly and securely, fostering growth while safeguarding consumers.

Finally, the growing awareness of financial inclusion is fueling demand for digital lending platforms. Many people, particularly in developing countries, lack access to traditional banking services due to factors like limited infrastructure or lack of credit history. Digital lending platforms can bridge this gap by using alternative data and innovative credit assessment models to extend loans to those who would otherwise be excluded from the financial system. By promoting financial inclusion, digital lending platforms not only drive market growth but also support economic development.

Browse Trending Reports:

https://jondevide92.blogspot.com/2024/10/non-chocolate-candy-market-size-share_28.html

https://jondevide92.blogspot.com/2024/10/motorcycles-market-size-share-trends.html

https://jondevide92.blogspot.com/2024/10/maintenance-repair-and-operations-mro.html

Conclusion

Digital lending platforms have emerged as a vital force in the financial services industry, providing accessible, fast, and secure loan options to a wide range of consumers and businesses. With growing smartphone penetration, data-driven technologies, and increasing demand for convenient credit access, the digital lending market is expected to continue its rapid expansion. Trends like AI-powered credit assessment, BNPL services, and blockchain adoption are reshaping the industry, making digital lending platforms more versatile and inclusive. As digital lending platforms evolve, they are likely to remain at the forefront of financial innovation, expanding access to credit and promoting financial inclusion on a global scale.

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: corporatesales@databridgemarketresearch.com"

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...