Press release

Digital Remittance Market Growing with a CAGR of 16.3%, Top Players, Size, Share, Market Worth, Trends by 2032

The digital remittance market sizeis experiencing significant growth, driven by several key market growth factors and trends. The increasing adoption of smartphones and internet connectivity worldwide has facilitated the rise of digital platforms for remittance transactions. These platforms provide convenient and cost-effective remittance solutions, attracting both senders and recipients. In addition, the growing global migration, characterized by a large number of people living and working abroad, has created a steady demand for remittance services. As these individuals seek efficient and secure ways to transfer funds to their families back home, digital remittance platforms have emerged as a preferred choice due to their speed, convenience, and competitive exchange rates. Another factor driving digital remittance market growth is the ongoing digitization of financial services. Traditional remittance methods often involve complex paperwork, lengthy processing times, and high transaction fees. Digital remittance platforms offer streamlined processes, instant transfers, and lower fees, presenting an attractive alternative to traditional brick-and-mortar money transfer providers.

Request PDF Brochure: https://www.alliedmarketresearch.com/request-sample/2968

Allied Market Research published a report, titled, "Digital Remittance Market by Type (Inward Digital Remittance and Outward Digital Remittance), Channel (Banks, Money Transfer Operators, and Others) and End User (Business and Personal): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global digital remittance industry generated $19.0 billion in 2022 and is anticipated to generate $83.6 billion by 2032, witnessing a CAGR of 16.3% from 2023 to 2032.

Prime Determinants of Growth:

The growth of the digital remittance market is attributed to factors like the increasing adoption of smartphones and internet connectivity, a growing migrant population, the need for cross-border money transfers, and advancements in fintech and digital payment technologies. However, regulatory challenges and compliance requirements pose a significant restraint on the digital remittance market. On the contrary, there is significant untapped potential in emerging markets. Many developing countries have large populations with limited access to traditional banking services. With the availability of affordable smartphones and increasing internet penetration, digital remittance solutions can reach these underserved populations. By providing convenient and affordable remittance services, companies can tap into a vast customer base and establish themselves as key players in the growing digital economy. This expansion into emerging markets not only drives the growth of the digital remittance market but also promotes financial inclusion and economic empowerment for individuals in these regions.

COVID-19 Scenario:

The outbreak of the COVID-19 pandemic had a moderate economic impact on the digital remittance market. The global economic crisis induced by the pandemic resulted in lower remittance volumes as many migrant workers, who make up a sizable portion of the remittance market, have seen job losses, reduced working hours, or income reductions. This resulted in a decline in the quantity of money sent by migrants to their home countries, hurting the broader remittance business.

In addition, digital remittance providers have expanded their network of digital channels and created partnerships with financial institutions, mobile network operators, and fintech companies to combat the constraints of physical branch closures and mobility limitations. These partnerships allow them to reach a larger consumer base and provide more options for sending and receiving remittances.

Buy This Report@ https://bit.ly/3Qlm20P

The outward digital remittance segment to maintain its leadership status throughout the forecast period-

Based on type, the outward digital remittance segment held the highest market share in 2022, accounting for more than two-thirds of the global digital remittance market revenue, and is estimated to maintain its leadership status throughout the forecast period. The growth is attributed to the integration of blockchain technology, which has introduced transparency and security to outward digital remittance transactions. Blockchain-based platforms enable real-time tracking of funds, reducing the risk of fraud and enhancing trust among users. Therefore, such factors are expected to create market growth opportunities. However, the inward digital remittance segment is projected to manifest the highest CAGR of 18.5% from 2023 to 2032. Due to the rise of digital wallets and mobile payment systems, this has presented opportunities for inward digital remittance. These platforms provide convenient and instant transfer options, allowing recipients to receive funds directly into their digital wallets or bank accounts, bypassing traditional banking channels, which is expected to positively impact market growth.

Money transfer operators segment to maintain its lead position throughout the forecast period-

Based on channel, the money transfer operators segment held the highest market share in 2022, accounting for more than three-fifths of the global digital remittance market revenue, and is estimated to maintain its lead position throughout the forecast period. This is because technological advancements have transformed MTOs' operations, enhancing their digital remittance capabilities. MTOs are developing user-friendly mobile apps and online platforms that allow customers to initiate remittance transactions anytime, anywhere, and track their transfers in real time.

However, the others segment is projected to manifest the highest CAGR of 18.6% from 2022 to 2032. Others include post offices and mobile operators. Post offices leverage their trusted brand reputation and physical presence to offer accessible remittance services. They often provide competitive exchange rates, cash pick-up, and delivery options, attracting customers who prefer traditional channels for their money transfer needs. In addition, mobile operators capitalize on the increasing penetration of mobile phones and mobile money platforms to offer innovative remittance solutions. These operators provide customers with mobile wallets, allowing them to send and receive money digitally, leveraging the convenience of mobile technology.

The personal segment to maintain its leadership status throughout the forecast period-

Based on end user, the personal segment held the highest market share in 2022, accounting for more than two-thirds of the global digital remittance market revenue. This is attributed to the growth of international education and the rise in the number of students studying abroad, which present opportunities for digital remittance providers in the personal segment. The same segment is projected to manifest the highest CAGR of 17.5% from 2022 to 2032. The adoption of cloud-based accounting systems and digital financial management tools has created opportunities for digital remittance providers in the business segment. These technologies enable seamless integration with digital remittance platforms, streamlining payment processes, and enhancing financial visibility for businesses.

Europe to maintain its dominance by 2032-

Based on region, North America held the highest market share in terms of revenue in 2022, garnering nearly two-fifths of the global digital remittance market. The North American region has seen an increase in the number of fintech businesses focused on digital remittance services. These firms use technology, user-friendly interfaces, and competitive pricing to gain market share, fostering innovation and boosting competition. On the other hand, the Europe region is likely to maintain its dominance in terms of revenue during the forecast period. However, the Asia-Pacific region is expected to witness the fastest CAGR of 19.7% from 2023 to 2032. With the expansion of e-commerce in the Asia-Pacific area, there is a greater need for seamless cross-border payments. Individuals and organizations can make foreign payments for online purchases via digital remittance platforms, which provide integrated solutions. This promotes the expansion of cross-border e-commerce and provides consumers with a convenient payment mechanism.

Therefore, international student support, foreign direct investment, and E-commerce payments drive the adoption and growth of the digital remittance market in the Asia-Pacific region.

Leading Market Players: -

Azimo Ltd.

Digital Wallet Inc.

MoneyGram.

Nium Pte. Ltd.

PayPal Holdings Inc.

Ria Financial Services.

TransferGo Ltd.

Western Union Holdings, Inc.

Wise Payments Limited

WorldRemit

The report provides a detailed analysis of these key players in the global digital remittance market. These players have adopted different strategies, such as expansion, mergers, and product launches, to increase their market share and maintain dominant positions in different regions. The report is valuable in highlighting business performance, operating segments, product portfolios, and strategic moves of market players to showcase the competitive scenario.

Want to Access the Statistical Data and Graphs, Key Players' Strategies:

https://www.alliedmarketresearch.com/digital-remittance-market/purchase-options

Digital Remittance Market Key Segments:

By Type:

Inward Digital Remittance

Outward Digital Remittance

By End User:

Business

Personal

By Channel:

Banks

Money Transfer Operators

Others

Trending Reports in BFSI Industry

B2B Payments Market https://www.alliedmarketresearch.com/b2b-payments-market-A08183

EMV Smart Cards Market https://www.alliedmarketresearch.com/emv-smart-cards-market-A14987

Student Loan Market https://www.alliedmarketresearch.com/student-loan-market-A17046

Extended Warranty Market https://www.alliedmarketresearch.com/extended-warranty-market

Parametric Insurance Market https://www.alliedmarketresearch.com/parametric-insurance-market-A14966

Financial Advisory Services Market https://www.alliedmarketresearch.com/financial-advisory-services-market-A06946

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Request PDF Brochure: https://www.alliedmarketresearch.com/request-sample/2968

Allied Market Research published a report, titled, "Digital Remittance Market by Type (Inward Digital Remittance and Outward Digital Remittance), Channel (Banks, Money Transfer Operators, and Others) and End User (Business and Personal): Global Opportunity Analysis and Industry Forecast, 2022-2032". According to the report, the global digital remittance industry generated $19.0 billion in 2022 and is anticipated to generate $83.6 billion by 2032, witnessing a CAGR of 16.3% from 2023 to 2032.

Prime Determinants of Growth:

The growth of the digital remittance market is attributed to factors like the increasing adoption of smartphones and internet connectivity, a growing migrant population, the need for cross-border money transfers, and advancements in fintech and digital payment technologies. However, regulatory challenges and compliance requirements pose a significant restraint on the digital remittance market. On the contrary, there is significant untapped potential in emerging markets. Many developing countries have large populations with limited access to traditional banking services. With the availability of affordable smartphones and increasing internet penetration, digital remittance solutions can reach these underserved populations. By providing convenient and affordable remittance services, companies can tap into a vast customer base and establish themselves as key players in the growing digital economy. This expansion into emerging markets not only drives the growth of the digital remittance market but also promotes financial inclusion and economic empowerment for individuals in these regions.

COVID-19 Scenario:

The outbreak of the COVID-19 pandemic had a moderate economic impact on the digital remittance market. The global economic crisis induced by the pandemic resulted in lower remittance volumes as many migrant workers, who make up a sizable portion of the remittance market, have seen job losses, reduced working hours, or income reductions. This resulted in a decline in the quantity of money sent by migrants to their home countries, hurting the broader remittance business.

In addition, digital remittance providers have expanded their network of digital channels and created partnerships with financial institutions, mobile network operators, and fintech companies to combat the constraints of physical branch closures and mobility limitations. These partnerships allow them to reach a larger consumer base and provide more options for sending and receiving remittances.

Buy This Report@ https://bit.ly/3Qlm20P

The outward digital remittance segment to maintain its leadership status throughout the forecast period-

Based on type, the outward digital remittance segment held the highest market share in 2022, accounting for more than two-thirds of the global digital remittance market revenue, and is estimated to maintain its leadership status throughout the forecast period. The growth is attributed to the integration of blockchain technology, which has introduced transparency and security to outward digital remittance transactions. Blockchain-based platforms enable real-time tracking of funds, reducing the risk of fraud and enhancing trust among users. Therefore, such factors are expected to create market growth opportunities. However, the inward digital remittance segment is projected to manifest the highest CAGR of 18.5% from 2023 to 2032. Due to the rise of digital wallets and mobile payment systems, this has presented opportunities for inward digital remittance. These platforms provide convenient and instant transfer options, allowing recipients to receive funds directly into their digital wallets or bank accounts, bypassing traditional banking channels, which is expected to positively impact market growth.

Money transfer operators segment to maintain its lead position throughout the forecast period-

Based on channel, the money transfer operators segment held the highest market share in 2022, accounting for more than three-fifths of the global digital remittance market revenue, and is estimated to maintain its lead position throughout the forecast period. This is because technological advancements have transformed MTOs' operations, enhancing their digital remittance capabilities. MTOs are developing user-friendly mobile apps and online platforms that allow customers to initiate remittance transactions anytime, anywhere, and track their transfers in real time.

However, the others segment is projected to manifest the highest CAGR of 18.6% from 2022 to 2032. Others include post offices and mobile operators. Post offices leverage their trusted brand reputation and physical presence to offer accessible remittance services. They often provide competitive exchange rates, cash pick-up, and delivery options, attracting customers who prefer traditional channels for their money transfer needs. In addition, mobile operators capitalize on the increasing penetration of mobile phones and mobile money platforms to offer innovative remittance solutions. These operators provide customers with mobile wallets, allowing them to send and receive money digitally, leveraging the convenience of mobile technology.

The personal segment to maintain its leadership status throughout the forecast period-

Based on end user, the personal segment held the highest market share in 2022, accounting for more than two-thirds of the global digital remittance market revenue. This is attributed to the growth of international education and the rise in the number of students studying abroad, which present opportunities for digital remittance providers in the personal segment. The same segment is projected to manifest the highest CAGR of 17.5% from 2022 to 2032. The adoption of cloud-based accounting systems and digital financial management tools has created opportunities for digital remittance providers in the business segment. These technologies enable seamless integration with digital remittance platforms, streamlining payment processes, and enhancing financial visibility for businesses.

Europe to maintain its dominance by 2032-

Based on region, North America held the highest market share in terms of revenue in 2022, garnering nearly two-fifths of the global digital remittance market. The North American region has seen an increase in the number of fintech businesses focused on digital remittance services. These firms use technology, user-friendly interfaces, and competitive pricing to gain market share, fostering innovation and boosting competition. On the other hand, the Europe region is likely to maintain its dominance in terms of revenue during the forecast period. However, the Asia-Pacific region is expected to witness the fastest CAGR of 19.7% from 2023 to 2032. With the expansion of e-commerce in the Asia-Pacific area, there is a greater need for seamless cross-border payments. Individuals and organizations can make foreign payments for online purchases via digital remittance platforms, which provide integrated solutions. This promotes the expansion of cross-border e-commerce and provides consumers with a convenient payment mechanism.

Therefore, international student support, foreign direct investment, and E-commerce payments drive the adoption and growth of the digital remittance market in the Asia-Pacific region.

Leading Market Players: -

Azimo Ltd.

Digital Wallet Inc.

MoneyGram.

Nium Pte. Ltd.

PayPal Holdings Inc.

Ria Financial Services.

TransferGo Ltd.

Western Union Holdings, Inc.

Wise Payments Limited

WorldRemit

The report provides a detailed analysis of these key players in the global digital remittance market. These players have adopted different strategies, such as expansion, mergers, and product launches, to increase their market share and maintain dominant positions in different regions. The report is valuable in highlighting business performance, operating segments, product portfolios, and strategic moves of market players to showcase the competitive scenario.

Want to Access the Statistical Data and Graphs, Key Players' Strategies:

https://www.alliedmarketresearch.com/digital-remittance-market/purchase-options

Digital Remittance Market Key Segments:

By Type:

Inward Digital Remittance

Outward Digital Remittance

By End User:

Business

Personal

By Channel:

Banks

Money Transfer Operators

Others

Trending Reports in BFSI Industry

B2B Payments Market https://www.alliedmarketresearch.com/b2b-payments-market-A08183

EMV Smart Cards Market https://www.alliedmarketresearch.com/emv-smart-cards-market-A14987

Student Loan Market https://www.alliedmarketresearch.com/student-loan-market-A17046

Extended Warranty Market https://www.alliedmarketresearch.com/extended-warranty-market

Parametric Insurance Market https://www.alliedmarketresearch.com/parametric-insurance-market-A14966

Financial Advisory Services Market https://www.alliedmarketresearch.com/financial-advisory-services-market-A06946

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

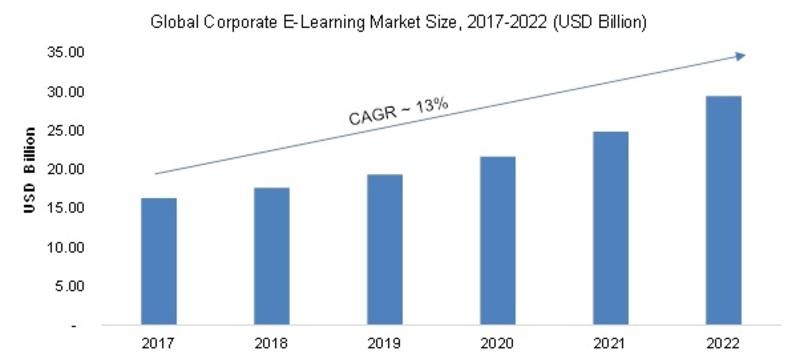

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...