Press release

Explore the Booming Mobile Payment Technologies Market - Trends, Innovations, and Future Growth Prospects

The Business Research Company has recently revised its global market reports, now incorporating the most current data for 2024 along with projections extending up to 2033.

Mobile Payment Technologies Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

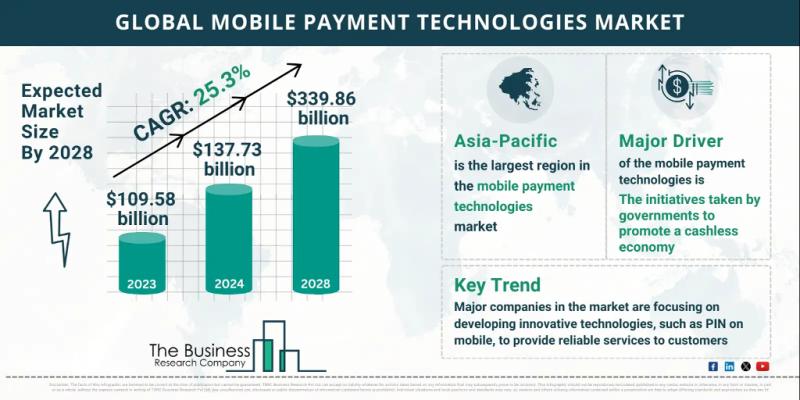

The Market Size Is Expected To Reach $339.86 billion In 2028 At A CAGR Of 25.3% :

The mobile payment technologies market size has grown exponentially in recent years. It will grow from $109.58 billion in 2023 to $137.73 billion in 2024 at a compound annual growth rate (CAGR) of 25.7%. The growth in the historic period can be attributed to smartphone penetration, digital wallets, consumer convenience, security measures, contactless payments.

The mobile payment technologies market size is expected to see exponential growth in the next few years. It will grow to $339.86 billion in 2028 at a compound annual growth rate (CAGR) of 25.3%. The growth in the forecast period can be attributed to contactless payments continue to rise, emerging markets adoption, iot integration, qr code payments. Major trends in the forecast period include biometric authentication, blockchain and cryptocurrency, retailer-specific apps, iot payments.

Request A Sample Of This Report - https://www.thebusinessresearchcompany.com/sample.aspx?id=2523&type=smp

Mobile Payment Technologies Market Major Segments

The mobile payment technologies market covered in this report is segmented -

1) By Solutions: Point-Of Sale (POS), In-Store Payments, Remote Payments

2) By Remote Payments: Internet Payments, Sms Payments, Direct Carrier Billing, Mobile Banking

3) By Application: Retail & E-Commerce, Healthcare, Bfsi, Enterprise

SubSegment: Near-Field Communication (NFC) Payments, Sound-Wave Based Payments, Magnetic Secure Transmission (MST) Payments, Mobile Wallets, Quick Response (QR) Code Payments

Key Driver - Government-Led Initiatives Drive Mobile Payment Technologies For A Cashless Economy

The initiatives taken by governments to promote a cashless economy is a major driver for the growth of the mobile payment technologies market. A cashless economy is the one in which financial transactions are not done with banknotes or physical currency but via digital modes of payment. In this regard, government across the world along with the central banks are taking several initiatives to move towards a cashless economy, which ultimately leads to the growth of the mobile payment technologies market. For instance, in August 2021, the Government of India launched a digital payment method e-RUPI, a cashless and contactless digital payment method. e-RUPI is essentially a digital voucher that a beneficiary receives by SMS or a QR code on his phone. It is a pre-paid coupon that can be used at any location that takes it.

Customise This Report As Per Your Requirements - https://www.thebusinessresearchcompany.com/Customise?id=2523&type=smp

Prominent Trend - The Convergence Of IOT And Mobile Payments Revolutionizes The Mobile Payment Technologies Market

The integration of Internet of Things (IoT) with mobile payments is an emerging trend in the mobile payment technologies market. IoT is a system of interrelated computing devices, mechanical and digital machines, or people that can transfer data over a network without requiring any human-to-human or human-to-computer interaction. The integration of IoT in mobile payment technologies eases the payment experience of consumers and merchants, ensuring smooth and efficient payments on both ends. Due to increased convenience and safety provided by IoT-based mobile payments, many people are moving towards mobile payment technologies. For example, MasterCard integrated IoT for bringing payments to a wide range of consumer products for around 44 billion devices that are expected to be connected to the internet by 2021. The company is also planning to come up with the latest IoT-based devices to boost digital payments.

Mobile Payment Technologies Market Players

Major companies operating in the mobile payment technologies market include PayPal Holdings Inc., Mastercard Incorporated, Bharti Airtel Limited, Google LLC, Apple Inc., First Data Corporation, American Express Company, Vodacom Group Limited, Millicom International Cellular S.A., Mahindra Comviva Technologies Limited, Orange S.A., Dwolla Inc., Worldpay Inc., One97 Communications Limited, AT&T Inc., Safaricom Limited, MTN Group Limited, Econet Wireless Zimbabwe Limited, Visa Inc., BlueSnap Inc., PayU Holdings Pvt. Ltd., Bank of America Corporation, Amazon.com Inc., Citrus Payment Solutions Pvt. Ltd., Stripe Inc., SIX Payment Services AG, Paysafe Group Limited, Wirecard AG, Novatti Group Limited, Vodafone Group Plc, Microsoft Corporation, Samsung Electronics Co. Ltd., Square Inc., Ant Group Co. Ltd., Tencent Holdings Limited, Discover Financial Services, JPMorgan Chase & Co.

View The Full Report Here - https://www.thebusinessresearchcompany.com/report/mobile-payment-technologies-global-market-report

Largest And Fastest Growing Region In The Market

The Asia-Pacific was the largest region in the mobile payment technologies market in 2023. Asia-Pacific is expected to be the fastest-growing region in the mobile payment technologies industry report during the forecast period. The regions covered in the mobile payment technologies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Mobile Payment Technologies Market Report Structure

3. Mobile Payment Technologies Market Trends And Strategies

4. Mobile Payment Technologies Market - Macro Economic Scenario

5. Mobile Payment Technologies Market Size And Growth

…..

27. Mobile Payment Technologies Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

Mobile Payment Technologies Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

The Market Size Is Expected To Reach $339.86 billion In 2028 At A CAGR Of 25.3% :

The mobile payment technologies market size has grown exponentially in recent years. It will grow from $109.58 billion in 2023 to $137.73 billion in 2024 at a compound annual growth rate (CAGR) of 25.7%. The growth in the historic period can be attributed to smartphone penetration, digital wallets, consumer convenience, security measures, contactless payments.

The mobile payment technologies market size is expected to see exponential growth in the next few years. It will grow to $339.86 billion in 2028 at a compound annual growth rate (CAGR) of 25.3%. The growth in the forecast period can be attributed to contactless payments continue to rise, emerging markets adoption, iot integration, qr code payments. Major trends in the forecast period include biometric authentication, blockchain and cryptocurrency, retailer-specific apps, iot payments.

Request A Sample Of This Report - https://www.thebusinessresearchcompany.com/sample.aspx?id=2523&type=smp

Mobile Payment Technologies Market Major Segments

The mobile payment technologies market covered in this report is segmented -

1) By Solutions: Point-Of Sale (POS), In-Store Payments, Remote Payments

2) By Remote Payments: Internet Payments, Sms Payments, Direct Carrier Billing, Mobile Banking

3) By Application: Retail & E-Commerce, Healthcare, Bfsi, Enterprise

SubSegment: Near-Field Communication (NFC) Payments, Sound-Wave Based Payments, Magnetic Secure Transmission (MST) Payments, Mobile Wallets, Quick Response (QR) Code Payments

Key Driver - Government-Led Initiatives Drive Mobile Payment Technologies For A Cashless Economy

The initiatives taken by governments to promote a cashless economy is a major driver for the growth of the mobile payment technologies market. A cashless economy is the one in which financial transactions are not done with banknotes or physical currency but via digital modes of payment. In this regard, government across the world along with the central banks are taking several initiatives to move towards a cashless economy, which ultimately leads to the growth of the mobile payment technologies market. For instance, in August 2021, the Government of India launched a digital payment method e-RUPI, a cashless and contactless digital payment method. e-RUPI is essentially a digital voucher that a beneficiary receives by SMS or a QR code on his phone. It is a pre-paid coupon that can be used at any location that takes it.

Customise This Report As Per Your Requirements - https://www.thebusinessresearchcompany.com/Customise?id=2523&type=smp

Prominent Trend - The Convergence Of IOT And Mobile Payments Revolutionizes The Mobile Payment Technologies Market

The integration of Internet of Things (IoT) with mobile payments is an emerging trend in the mobile payment technologies market. IoT is a system of interrelated computing devices, mechanical and digital machines, or people that can transfer data over a network without requiring any human-to-human or human-to-computer interaction. The integration of IoT in mobile payment technologies eases the payment experience of consumers and merchants, ensuring smooth and efficient payments on both ends. Due to increased convenience and safety provided by IoT-based mobile payments, many people are moving towards mobile payment technologies. For example, MasterCard integrated IoT for bringing payments to a wide range of consumer products for around 44 billion devices that are expected to be connected to the internet by 2021. The company is also planning to come up with the latest IoT-based devices to boost digital payments.

Mobile Payment Technologies Market Players

Major companies operating in the mobile payment technologies market include PayPal Holdings Inc., Mastercard Incorporated, Bharti Airtel Limited, Google LLC, Apple Inc., First Data Corporation, American Express Company, Vodacom Group Limited, Millicom International Cellular S.A., Mahindra Comviva Technologies Limited, Orange S.A., Dwolla Inc., Worldpay Inc., One97 Communications Limited, AT&T Inc., Safaricom Limited, MTN Group Limited, Econet Wireless Zimbabwe Limited, Visa Inc., BlueSnap Inc., PayU Holdings Pvt. Ltd., Bank of America Corporation, Amazon.com Inc., Citrus Payment Solutions Pvt. Ltd., Stripe Inc., SIX Payment Services AG, Paysafe Group Limited, Wirecard AG, Novatti Group Limited, Vodafone Group Plc, Microsoft Corporation, Samsung Electronics Co. Ltd., Square Inc., Ant Group Co. Ltd., Tencent Holdings Limited, Discover Financial Services, JPMorgan Chase & Co.

View The Full Report Here - https://www.thebusinessresearchcompany.com/report/mobile-payment-technologies-global-market-report

Largest And Fastest Growing Region In The Market

The Asia-Pacific was the largest region in the mobile payment technologies market in 2023. Asia-Pacific is expected to be the fastest-growing region in the mobile payment technologies industry report during the forecast period. The regions covered in the mobile payment technologies market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Mobile Payment Technologies Market Report Structure

3. Mobile Payment Technologies Market Trends And Strategies

4. Mobile Payment Technologies Market - Macro Economic Scenario

5. Mobile Payment Technologies Market Size And Growth

…..

27. Mobile Payment Technologies Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...