Press release

Foreign Exchange Services Market Current Scenario with Future Trends Analysis to 2031

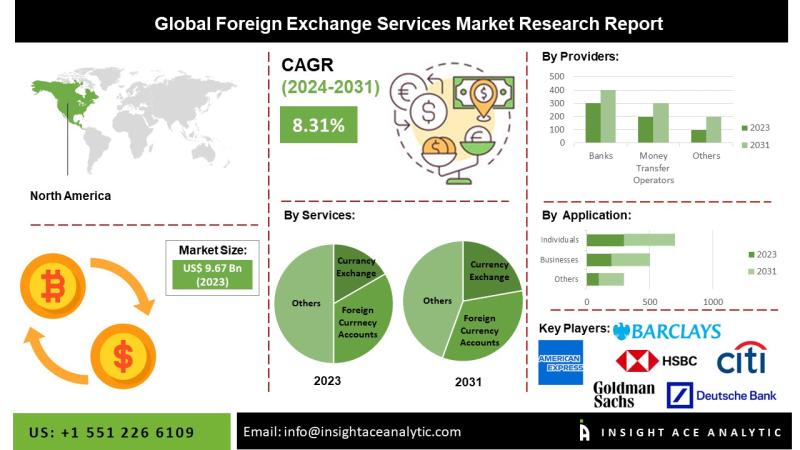

Foreign Exchange Services Market Size, Share & Trends Analysis Report By Services (Currency Exchange, Remittance Services, Foreign Currency Accounts, Others), by Providers (Banks, Money Transfer Operators, Others), by Application (Businesses, Individuals), By Region, And Segment Forecasts, 2024-2031.

The Global Foreign Exchange Services Market Size is valued at 9.67 billion in 2023 and is predicted to reach 18.27 billion by the year 2031 at a 8.31% CAGR during the forecast period for 2024-2031.

Get A Free Report Brochure: https://www.insightaceanalytic.com/buy-report/1718

Latest Drivers Restraint and Opportunities Market Snapshot:

The following are the primary obstacles to the foreign exchange services market 's expansion:

• Concerns Regarding Regulations

• Inadequate Funding

• Fluctuations in the Price of Currencies

Key factors influencing the global foreign exchange services market are:

• Increasing demand for international money transfers

• Growing interest in global trade and tourism

• Technological advancement

Future expansion opportunities for the global foreign exchange services market include:

• Raising spending on research and development

• Increasing disposable income

• Growing population

Market Analysis:

The demand for foreign currency services is on the rise as a result of the trend toward increasing global remittances. The demand for foreign currency services has increased as a result of globalization, as an increasing number of individuals transmit money to their loved ones who live abroad. The widespread drive by several nations to facilitate international money transfers is also resulting in an increase in business for foreign exchange firms.

Order this Premium Report: https://www.insightaceanalytic.com/buy-report/1718

List of Prominent Players in the Foreign Exchange Services Market:

• Barclays,

• Citigroup Inc.,

• American Express Company,

• Standard Chartered,

• Deutsche Bank AG,

• JPMorgan Chase & Co.,

• Wells Fargo,

• Goldman Sachs,

• HSBC Group,

• Western Union Holdings

Recent Developments:

• In March 2024, Visa (NYSE: V) and Western Union (NYSE: WU) have entered into a seven-year partnership. Western Union customers are now able to transfer funds to friends and family in 40 countries across five regions using Visa and bank accounts that meet the criteria of the new agreement.

• In January 2023, according to GS Retail Co., terminals will now be available at the outlets of the GS25 convenience store chain and GS The Fresh supermarket unit for the purpose of exchanging foreign currencies. The forex currency exchange devices will be tested at the company's ten locations. The shop is expanding its financial service options by installing kiosks to satisfy the increasing demand from travelers.

Foreign Exchange Services Market Dynamics:

Market Drivers: Technological advancement

The transformation of foreign exchange services delivery and consumption, which has been facilitated by the increased use of digital technology, has contributed to growth in the foreign exchange market. Many clients now have access to these services, which are now more convenient, speedier, and more accessible. Furthermore, the demand for foreign exchange services has increased because of the increasing trade and investment flows between nations, which are a result of global trade. Furthermore, businesses are compelled to exchange one currency for another to conduct cross-border transactions because of e-commerce and cross-border investments. Foreign exchange service providers provide the necessary instruments and services to facilitate this process. As a result, it is probable that the market for foreign exchange services will expand in the years to come.

Challenges: Fluctuations in the Price of Currencies

The foreign exchange services market is significantly influenced by the economic stability of a nation, as unstable economies result in lower volumes of currency transactions, lower profitability for foreign exchange service providers, and increased exchange rate volatility. Additionally, political and economic events that impact a nation's stability can lead to changes in the foreign exchange services market, which complicates the process of conducting cross-border business for individuals, companies, and organizations.

Get Specific Chapter/Information From The Report: https://www.insightaceanalytic.com/customisation/1718

North America is Expected to Grow with the Highest CAGR During the Forecast Period

In the near future, the North American foreign exchange services market is expected to experience a rapid CAGR and register a substantial revenue share. This is due to the increasing prevalence of electronic and online foreign exchange services, which enhance the ease and simplicity of trading for individuals and businesses. The increasing prevalence of digital technology is the cause of this trend. The foreign exchange services market is a component of the financial services industry in North America. It provides individuals and corporations with solutions for currency exchange and risk management. Additionally, the majority of the market in North America is dominated by large banks, other financial institutions, and specialty foreign currency service providers.

Segmentation of Foreign Exchange Services Market-

By Providers-

• Banks

• Money Transfer Operators

• Others

By Services-

• Currency Exchange

• Remittance Services

• Foreign Currency Accounts

• Others

By Application-

• Businesses

• Individuals

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Details insights on this market: https://www.insightaceanalytic.com/report/foreign-exchange-services-market-/1718

Corporate Office :

Office No.5170, 5th Floor Marvel Fuego, Magarpatta Rd, Pune, 411028

Sales Office (U.S.) :

344 Grove St Unit #967 Jersey City, NJ 07302

email: info@insightaceanalytic.com

North America:

+1 551 226 6109

Asia:

+91 79 72967118

Contact Us:

info@insightaceanalytic.com

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

Twitter: https://twitter.com/InsightaceA

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

The Global Foreign Exchange Services Market Size is valued at 9.67 billion in 2023 and is predicted to reach 18.27 billion by the year 2031 at a 8.31% CAGR during the forecast period for 2024-2031.

Get A Free Report Brochure: https://www.insightaceanalytic.com/buy-report/1718

Latest Drivers Restraint and Opportunities Market Snapshot:

The following are the primary obstacles to the foreign exchange services market 's expansion:

• Concerns Regarding Regulations

• Inadequate Funding

• Fluctuations in the Price of Currencies

Key factors influencing the global foreign exchange services market are:

• Increasing demand for international money transfers

• Growing interest in global trade and tourism

• Technological advancement

Future expansion opportunities for the global foreign exchange services market include:

• Raising spending on research and development

• Increasing disposable income

• Growing population

Market Analysis:

The demand for foreign currency services is on the rise as a result of the trend toward increasing global remittances. The demand for foreign currency services has increased as a result of globalization, as an increasing number of individuals transmit money to their loved ones who live abroad. The widespread drive by several nations to facilitate international money transfers is also resulting in an increase in business for foreign exchange firms.

Order this Premium Report: https://www.insightaceanalytic.com/buy-report/1718

List of Prominent Players in the Foreign Exchange Services Market:

• Barclays,

• Citigroup Inc.,

• American Express Company,

• Standard Chartered,

• Deutsche Bank AG,

• JPMorgan Chase & Co.,

• Wells Fargo,

• Goldman Sachs,

• HSBC Group,

• Western Union Holdings

Recent Developments:

• In March 2024, Visa (NYSE: V) and Western Union (NYSE: WU) have entered into a seven-year partnership. Western Union customers are now able to transfer funds to friends and family in 40 countries across five regions using Visa and bank accounts that meet the criteria of the new agreement.

• In January 2023, according to GS Retail Co., terminals will now be available at the outlets of the GS25 convenience store chain and GS The Fresh supermarket unit for the purpose of exchanging foreign currencies. The forex currency exchange devices will be tested at the company's ten locations. The shop is expanding its financial service options by installing kiosks to satisfy the increasing demand from travelers.

Foreign Exchange Services Market Dynamics:

Market Drivers: Technological advancement

The transformation of foreign exchange services delivery and consumption, which has been facilitated by the increased use of digital technology, has contributed to growth in the foreign exchange market. Many clients now have access to these services, which are now more convenient, speedier, and more accessible. Furthermore, the demand for foreign exchange services has increased because of the increasing trade and investment flows between nations, which are a result of global trade. Furthermore, businesses are compelled to exchange one currency for another to conduct cross-border transactions because of e-commerce and cross-border investments. Foreign exchange service providers provide the necessary instruments and services to facilitate this process. As a result, it is probable that the market for foreign exchange services will expand in the years to come.

Challenges: Fluctuations in the Price of Currencies

The foreign exchange services market is significantly influenced by the economic stability of a nation, as unstable economies result in lower volumes of currency transactions, lower profitability for foreign exchange service providers, and increased exchange rate volatility. Additionally, political and economic events that impact a nation's stability can lead to changes in the foreign exchange services market, which complicates the process of conducting cross-border business for individuals, companies, and organizations.

Get Specific Chapter/Information From The Report: https://www.insightaceanalytic.com/customisation/1718

North America is Expected to Grow with the Highest CAGR During the Forecast Period

In the near future, the North American foreign exchange services market is expected to experience a rapid CAGR and register a substantial revenue share. This is due to the increasing prevalence of electronic and online foreign exchange services, which enhance the ease and simplicity of trading for individuals and businesses. The increasing prevalence of digital technology is the cause of this trend. The foreign exchange services market is a component of the financial services industry in North America. It provides individuals and corporations with solutions for currency exchange and risk management. Additionally, the majority of the market in North America is dominated by large banks, other financial institutions, and specialty foreign currency service providers.

Segmentation of Foreign Exchange Services Market-

By Providers-

• Banks

• Money Transfer Operators

• Others

By Services-

• Currency Exchange

• Remittance Services

• Foreign Currency Accounts

• Others

By Application-

• Businesses

• Individuals

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Details insights on this market: https://www.insightaceanalytic.com/report/foreign-exchange-services-market-/1718

Corporate Office :

Office No.5170, 5th Floor Marvel Fuego, Magarpatta Rd, Pune, 411028

Sales Office (U.S.) :

344 Grove St Unit #967 Jersey City, NJ 07302

email: info@insightaceanalytic.com

North America:

+1 551 226 6109

Asia:

+91 79 72967118

Contact Us:

info@insightaceanalytic.com

InsightAce Analytic Pvt. Ltd.

Visit: www.insightaceanalytic.com

Tel : +1 551 226 6109

Asia: +91 79 72967118

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

Twitter: https://twitter.com/InsightaceA

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...