Press release

GLOBAL CYBER SECURITY INSURANCES MARKET TO WITNESS STELLAR CAGR DURING THE FORECAST PERIOD

According to a new market report published by BlueWeave Consulting, The Global Cyber Security Insurance Market was valued at US$ 3,329.0 Mn in 2016 and is expected to expand at a CAGR of 25.3% from 2018 to 2026, reaching US$ 32,543.6 Mn by the end of the forecast period. According to the report, North America was the largest contributor in terms of revenue to the cyber security insurance market in 2016.

Cyber insurance helps protect businesses against losses resulting from cyber-attacks or data breaches. Cyber insurance coverage can include data loss and restoration, extortion, legal fees, and more. Cyber security insurance increases and improves cyber security with the benefits of good security, and internalizing of the costs of poor security. There are many benefits that coincide with investing in insurance.

Request for Sample of this Report@ https://bit.ly/2SGnESR

The growth of the US cyber insurance market is due to the introduction of legislation in most states to take appropriate security measures to protect against cyber risks and report serious breaches to national authorities. This led to an increase in demand for cyber insurance products covering personal data breach. The U.S. is the largest market for the cyber security insurance market. The U.S. economy loses US$57 billion-US$109 billion per year due to malicious cyber activity, according to White House Council of Economic Advisers.

Cyber challenges in Asia Pacific region, such as low cyber security investments and long dwell times, can be attributed to the complex geopolitical tensions, exposed critical infrastructure, and the severe shortage of cyber security talents in the region. Brazil is undergoing a digital revolution with few parallels in the developing world. The rate of digital penetration and social media adoption has risen exponentially over the past decade. Over 50% of Brazilians are active Internet users, & Brazilian financial institutions were early adopters of online services. Cyber security and online fraud are major concerns, with annual losses reaching billions of dollars.

Scope of the Report

The global market for cyber security insurance is segmented on the basis of service type, enterprise size, industry vertical and geography. On the basis of service type, the market is segmented into risk management, integrity, forefront portfolio, third party liability, and others.]

On the basis of enterprise size, the global cyber security insurance market is bisected into small & medium enterprises and large enterprise. On the basis of industry vertical, the market is divided into banking and financial services, telecom and IT, government, healthcare, education, manufacturing, travel and hospitality and others. Financial services, energy and utilities, and telecommunications are among the most investigated industries in APAC, highlighting the need for higher awareness levels, stronger mitigation measures, and improved cyber security postures.

Geographically, the global cyber security insurance market is bifurcated into North America, Asia Pacific, Europe, Latin America, and Middle East & Africa. The North America holds the largest market share of cyber security insurance market in 2017.

Competitive Dynamics

Major industry players in cyber security insurance market are adopting different strategic initiatives such as mergers and acquisitions, partnerships, and collaborations for technologies and new product development. For instance, In June 2017, Zurich Brasila, subsidiary of Zurich Insurance Group, has launched insurance coverage for cyber-related risks, amid the fast-growing use of internet among companies and individuals. The company will offers protection in nations more exposed to cyber-attacks, such as the US, the UK and China, will now offer this product in Brazil due to increasing demand. For instance, in June 2014, the UK Government launched a joint initiative with some major British insurers to increase the level of IT security in UK companies called the “Cyber Essentials Scheme”, it is based on certificates and will ensure that certified organizations have a certain amount of security measures in place. Cyber Essentials has been developed in close consultation with the insurance industry and is backed by AIG, Marsh, Swiss Re, the British Insurance Brokers’ Association (BIBA) and the International Underwriting Association (IUA). The global cyber security insurance market includes key players such as XL Group Ltd., American International Group Inc., Zurich Insurance Co. Ltd, AON PLC, Allianz Global Corporate & Specialty, Munich Re Group, Chubb, HSB, BCS financial corporation, Marsh & McLennan Companies, Inc., Markel Corp, Traveler’s group, Hiscox, Beazely Insurance group and others.

By Service Type

• Risk management

• Integrity

• Forefront Portfolio

• Third Party liability

• Others

By Enterprise Size

• Small & Medium Enterprises (SMEs)

• Large Enterprises

By Industry Vertical

• Banking, Financials

• Telecom and IT

• Government

• Healthcare

• Education

• Manufacturing

• Travel and hospitality

• Others

Browse full Research Report@ https://www.blueweaveconsulting.com/cyber-security-insurances/

Contact Us:

info@blueweaveconsulting.com

https://www.blueweaveconsulting.com

Phone Number: 18666586826

About BlueWeave Consulting & Research Pvt Ltd. (BWC)

BlueWeave Consulting provides a full scope of business intelligence solution for solving your toughest challenges. BWC is an emerging global expert & pioneer in the market research and provision of exclusive market INTEL. We optimize your decision making by equipping your industry with an accurate & better market research according to your industry demands through our professionally designed qualitative & quantitative research methods. Our trendy & efficient sample collection methods, integrated data solutions as well as methodologies certainly make us a better partner that you can rely on. With collective experience in the varied fields of retail, market research and reporting, we provide the business insight and business practices that would give the required impetus for your company’s growth.

GD-69, Sector G, East Kolkata Twp,

Cyber insurance helps protect businesses against losses resulting from cyber-attacks or data breaches. Cyber insurance coverage can include data loss and restoration, extortion, legal fees, and more. Cyber security insurance increases and improves cyber security with the benefits of good security, and internalizing of the costs of poor security. There are many benefits that coincide with investing in insurance.

Request for Sample of this Report@ https://bit.ly/2SGnESR

The growth of the US cyber insurance market is due to the introduction of legislation in most states to take appropriate security measures to protect against cyber risks and report serious breaches to national authorities. This led to an increase in demand for cyber insurance products covering personal data breach. The U.S. is the largest market for the cyber security insurance market. The U.S. economy loses US$57 billion-US$109 billion per year due to malicious cyber activity, according to White House Council of Economic Advisers.

Cyber challenges in Asia Pacific region, such as low cyber security investments and long dwell times, can be attributed to the complex geopolitical tensions, exposed critical infrastructure, and the severe shortage of cyber security talents in the region. Brazil is undergoing a digital revolution with few parallels in the developing world. The rate of digital penetration and social media adoption has risen exponentially over the past decade. Over 50% of Brazilians are active Internet users, & Brazilian financial institutions were early adopters of online services. Cyber security and online fraud are major concerns, with annual losses reaching billions of dollars.

Scope of the Report

The global market for cyber security insurance is segmented on the basis of service type, enterprise size, industry vertical and geography. On the basis of service type, the market is segmented into risk management, integrity, forefront portfolio, third party liability, and others.]

On the basis of enterprise size, the global cyber security insurance market is bisected into small & medium enterprises and large enterprise. On the basis of industry vertical, the market is divided into banking and financial services, telecom and IT, government, healthcare, education, manufacturing, travel and hospitality and others. Financial services, energy and utilities, and telecommunications are among the most investigated industries in APAC, highlighting the need for higher awareness levels, stronger mitigation measures, and improved cyber security postures.

Geographically, the global cyber security insurance market is bifurcated into North America, Asia Pacific, Europe, Latin America, and Middle East & Africa. The North America holds the largest market share of cyber security insurance market in 2017.

Competitive Dynamics

Major industry players in cyber security insurance market are adopting different strategic initiatives such as mergers and acquisitions, partnerships, and collaborations for technologies and new product development. For instance, In June 2017, Zurich Brasila, subsidiary of Zurich Insurance Group, has launched insurance coverage for cyber-related risks, amid the fast-growing use of internet among companies and individuals. The company will offers protection in nations more exposed to cyber-attacks, such as the US, the UK and China, will now offer this product in Brazil due to increasing demand. For instance, in June 2014, the UK Government launched a joint initiative with some major British insurers to increase the level of IT security in UK companies called the “Cyber Essentials Scheme”, it is based on certificates and will ensure that certified organizations have a certain amount of security measures in place. Cyber Essentials has been developed in close consultation with the insurance industry and is backed by AIG, Marsh, Swiss Re, the British Insurance Brokers’ Association (BIBA) and the International Underwriting Association (IUA). The global cyber security insurance market includes key players such as XL Group Ltd., American International Group Inc., Zurich Insurance Co. Ltd, AON PLC, Allianz Global Corporate & Specialty, Munich Re Group, Chubb, HSB, BCS financial corporation, Marsh & McLennan Companies, Inc., Markel Corp, Traveler’s group, Hiscox, Beazely Insurance group and others.

By Service Type

• Risk management

• Integrity

• Forefront Portfolio

• Third Party liability

• Others

By Enterprise Size

• Small & Medium Enterprises (SMEs)

• Large Enterprises

By Industry Vertical

• Banking, Financials

• Telecom and IT

• Government

• Healthcare

• Education

• Manufacturing

• Travel and hospitality

• Others

Browse full Research Report@ https://www.blueweaveconsulting.com/cyber-security-insurances/

Contact Us:

info@blueweaveconsulting.com

https://www.blueweaveconsulting.com

Phone Number: 18666586826

About BlueWeave Consulting & Research Pvt Ltd. (BWC)

BlueWeave Consulting provides a full scope of business intelligence solution for solving your toughest challenges. BWC is an emerging global expert & pioneer in the market research and provision of exclusive market INTEL. We optimize your decision making by equipping your industry with an accurate & better market research according to your industry demands through our professionally designed qualitative & quantitative research methods. Our trendy & efficient sample collection methods, integrated data solutions as well as methodologies certainly make us a better partner that you can rely on. With collective experience in the varied fields of retail, market research and reporting, we provide the business insight and business practices that would give the required impetus for your company’s growth.

GD-69, Sector G, East Kolkata Twp,

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

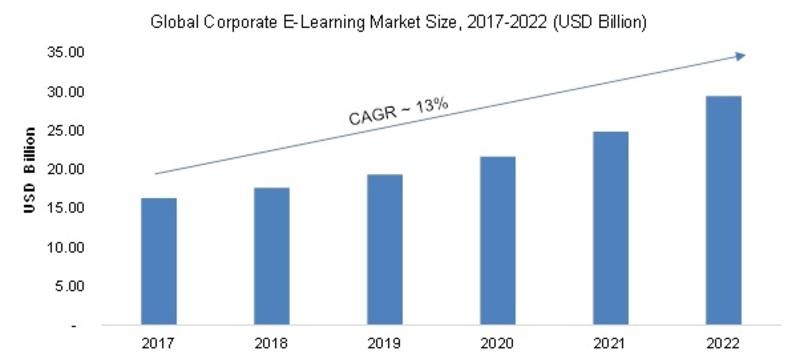

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...