Press release

Global Trade Finance Market Size, Share, Research Report 2023

For many businesses, trade finance is an essential subject because it helps them manage risk and is a crucial component of company continuity. Certain projects would be put on hold without trade financing instruments because the risk of conducting business would be too great. Trade finance nowadays is influenced by a variety of circumstances, therefore it's critical for businesses to stay current on these issues in order to streamline the relevant procedures.

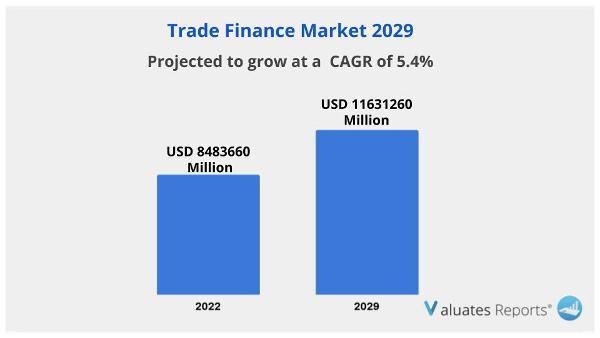

The global Trade Finance market was valued at US$ 8483660 million in 2022 and

is anticipated to reach US$ 11631260 million by 2029, witnessing a CAGR of 5.4%

during the forecast period 2023-2029.

Shipping delays and a lack of some goods have an impact on supply chains. As expenses grow and the supply of goods is delayed or canceled, the risk of conducting business therefore increases. This may have an impact on certain manufacturing lines and income generation in particular businesses, making trade financing even more crucial.

Processes must be thoroughly monitored since there are so many potential problems along the supply chain, but ideally without adding to the workload of the finance and treasury staff. Working together with other departments and managing the workload, trade finance must be able to manage supply chain risk from the beginning of the supply chain to the end.

The fight for talent is partly to blame for the current difficulties in trade financing.

Many businesses are understaffed and overburdened with handling all trade finance activities because they can't find enough qualified candidates for their treasury or trade finance departments. However, we've also seen that it varies by company; some companies, by virtue of their nature, must place a strong emphasis on trade finance, and they devote a lot of resources therein; in contrast, other companies lack an appointed individual in charge of it and view it as a task for the treasury or finance team.

As a result, trade finance experts frequently begin to think about implementing specialized solutions to address the problem of understaffed teams and the potential for process improvement.

Companies are becoming more aware of how crucial it is to handle financial risk in trade financing. To assess where trade finance is required and how it affects the organization, trade finance specialists must now engage effectively with other departments. Trade finance specialists increasingly need great communication skills to interact with a variety of stakeholders, according to recruitment experts.

Many businesses are unaware of how time-consuming trade finance is since it involves handling hundreds of instruments together with all relevant parties. especially when there is a lack of automation, digitization, and efficient procedures. Relying on treasurers to complete this can be equivalent to adding a second full-time job to an already taxing position. Modern equipment or software can lighten the burden, but organizations that use a lot of equipment must assign specialized personnel to the task.

The businesses that do see the value of trade finance are often those that are highly exposed to supply chain disruptions and counterparty dependence and are aware of how crucial it is to maintain operational continuity.

View Full Report

https://reports.valuates.com/market-reports/QYRE-Auto-6X849/global-trade-finance

Similar Reports

https://reports.valuates.com/market-reports/QYRE-Othe-4N372/global-trade-credit-insurance

https://reports.valuates.com/market-reports/QYRE-Othe-3A258/non-bank-trade-finance

https://reports.valuates.com/market-reports/QYRE-Othe-3B386/saudi-arabia-trade-finance

https://reports.valuates.com/market-reports/QYRE-Othe-0P392/trade-management-software

https://reports.valuates.com/market-reports/ALLI-Manu-2V67/canada-financial-guarantee

Valuates Reports

sales@valuates.com

For U.S. Toll-Free Call 1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp: +91-9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

The global Trade Finance market was valued at US$ 8483660 million in 2022 and

is anticipated to reach US$ 11631260 million by 2029, witnessing a CAGR of 5.4%

during the forecast period 2023-2029.

Shipping delays and a lack of some goods have an impact on supply chains. As expenses grow and the supply of goods is delayed or canceled, the risk of conducting business therefore increases. This may have an impact on certain manufacturing lines and income generation in particular businesses, making trade financing even more crucial.

Processes must be thoroughly monitored since there are so many potential problems along the supply chain, but ideally without adding to the workload of the finance and treasury staff. Working together with other departments and managing the workload, trade finance must be able to manage supply chain risk from the beginning of the supply chain to the end.

The fight for talent is partly to blame for the current difficulties in trade financing.

Many businesses are understaffed and overburdened with handling all trade finance activities because they can't find enough qualified candidates for their treasury or trade finance departments. However, we've also seen that it varies by company; some companies, by virtue of their nature, must place a strong emphasis on trade finance, and they devote a lot of resources therein; in contrast, other companies lack an appointed individual in charge of it and view it as a task for the treasury or finance team.

As a result, trade finance experts frequently begin to think about implementing specialized solutions to address the problem of understaffed teams and the potential for process improvement.

Companies are becoming more aware of how crucial it is to handle financial risk in trade financing. To assess where trade finance is required and how it affects the organization, trade finance specialists must now engage effectively with other departments. Trade finance specialists increasingly need great communication skills to interact with a variety of stakeholders, according to recruitment experts.

Many businesses are unaware of how time-consuming trade finance is since it involves handling hundreds of instruments together with all relevant parties. especially when there is a lack of automation, digitization, and efficient procedures. Relying on treasurers to complete this can be equivalent to adding a second full-time job to an already taxing position. Modern equipment or software can lighten the burden, but organizations that use a lot of equipment must assign specialized personnel to the task.

The businesses that do see the value of trade finance are often those that are highly exposed to supply chain disruptions and counterparty dependence and are aware of how crucial it is to maintain operational continuity.

View Full Report

https://reports.valuates.com/market-reports/QYRE-Auto-6X849/global-trade-finance

Similar Reports

https://reports.valuates.com/market-reports/QYRE-Othe-4N372/global-trade-credit-insurance

https://reports.valuates.com/market-reports/QYRE-Othe-3A258/non-bank-trade-finance

https://reports.valuates.com/market-reports/QYRE-Othe-3B386/saudi-arabia-trade-finance

https://reports.valuates.com/market-reports/QYRE-Othe-0P392/trade-management-software

https://reports.valuates.com/market-reports/ALLI-Manu-2V67/canada-financial-guarantee

Valuates Reports

sales@valuates.com

For U.S. Toll-Free Call 1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp: +91-9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...