Press release

Investigation announced for Investors in Continental Resources, Inc. (NYSE: CLR) over potential Wrongdoing in Takeover

An investigation was announced concerning whether the takeover of Continental Resources, Inc. is unfair to NYSE: CLR stockholders.

Investors who purchased shares of Continental Resources, Inc. (NYSE: CLR) and currently hold any of those NYSE: CLR shares have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain officers and directors of Continental Resources, Inc. breached their fiduciary duties owed to NYSE: CLR investors in connection with the proposed acquisition.

Oklahoma City, OK based Continental Resources, Inc. explores for, develops, produces, and manages crude oil, natural gas, and related products primarily in the north, south, and east regions of the United States.

On October 17, 2022, Continental announced that it had agreed to be acquired by Omega Acquisition, Inc. ("Omega"), an entity owned by Continental's founder, Harold G. Hamm. Pursuant to the merger agreement, Omega is expected to commence a tender offer to purchase "any and all of the outstanding shares of Continental's common stock at $74.28 per share," other than CLR shares already owned by Mr. Hamm.

However, given that at least one analyst has set the high target price for NYSE: CLR shares at $100.00 per share, the investigation concerns whether the offer is unfair to NYSE: CLR stockholders. More specifically, the investigation concerns whether the Continental Resources Board of Directors undertook an adequate sales process, adequately shopped the company before entering into the transaction, maximized shareholder value by negotiating the best price, and acted in the shareholders' best interests in connection with the proposed sale.

Continental Resources, Inc. reported that its annual Total Revenue rose from over $2.58 billion in 2020 to over $5.71 billion in 2021, and that its Net Loss of $596.86 million in 2020 turned into a Net Income of over $1.66 billion in 2021.

Those who are current investors in Continental Resources, Inc. (NYSE: CLR) shares have certain options and should contact the Shareholders Foundation.

Contact:

Michael Daniels

Shareholders Foundation, Inc.

3111 Camino Del Rio North

Suite 423

San Diego, CA 92108

Tel: +1-(858)-779-1554

E-Mail: mail@shareholdersfoundation.com

About Shareholders Foundation, Inc.

The Shareholders Foundation, Inc. is a professional portfolio monitoring and settlement claim filing service, and an investor advocacy group, which does research related to shareholder issues and informs investors of securities lawsuits, settlements, judgments, and other legal related news to the stock/financial market. Shareholders Foundation, Inc. is in contact with a large number of shareholders and offers help, support, and assistance for every shareholder. The Shareholders Foundation, Inc. is not a law firm. Referenced cases, investigations, and/or settlements are not filed/initiated/reached and/or are not related to Shareholders Foundation. The information is provided as a public service. It is not intended as legal advice and should not be relied upon.

Investors who purchased shares of Continental Resources, Inc. (NYSE: CLR) and currently hold any of those NYSE: CLR shares have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm concerns whether certain officers and directors of Continental Resources, Inc. breached their fiduciary duties owed to NYSE: CLR investors in connection with the proposed acquisition.

Oklahoma City, OK based Continental Resources, Inc. explores for, develops, produces, and manages crude oil, natural gas, and related products primarily in the north, south, and east regions of the United States.

On October 17, 2022, Continental announced that it had agreed to be acquired by Omega Acquisition, Inc. ("Omega"), an entity owned by Continental's founder, Harold G. Hamm. Pursuant to the merger agreement, Omega is expected to commence a tender offer to purchase "any and all of the outstanding shares of Continental's common stock at $74.28 per share," other than CLR shares already owned by Mr. Hamm.

However, given that at least one analyst has set the high target price for NYSE: CLR shares at $100.00 per share, the investigation concerns whether the offer is unfair to NYSE: CLR stockholders. More specifically, the investigation concerns whether the Continental Resources Board of Directors undertook an adequate sales process, adequately shopped the company before entering into the transaction, maximized shareholder value by negotiating the best price, and acted in the shareholders' best interests in connection with the proposed sale.

Continental Resources, Inc. reported that its annual Total Revenue rose from over $2.58 billion in 2020 to over $5.71 billion in 2021, and that its Net Loss of $596.86 million in 2020 turned into a Net Income of over $1.66 billion in 2021.

Those who are current investors in Continental Resources, Inc. (NYSE: CLR) shares have certain options and should contact the Shareholders Foundation.

Contact:

Michael Daniels

Shareholders Foundation, Inc.

3111 Camino Del Rio North

Suite 423

San Diego, CA 92108

Tel: +1-(858)-779-1554

E-Mail: mail@shareholdersfoundation.com

About Shareholders Foundation, Inc.

The Shareholders Foundation, Inc. is a professional portfolio monitoring and settlement claim filing service, and an investor advocacy group, which does research related to shareholder issues and informs investors of securities lawsuits, settlements, judgments, and other legal related news to the stock/financial market. Shareholders Foundation, Inc. is in contact with a large number of shareholders and offers help, support, and assistance for every shareholder. The Shareholders Foundation, Inc. is not a law firm. Referenced cases, investigations, and/or settlements are not filed/initiated/reached and/or are not related to Shareholders Foundation. The information is provided as a public service. It is not intended as legal advice and should not be relied upon.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

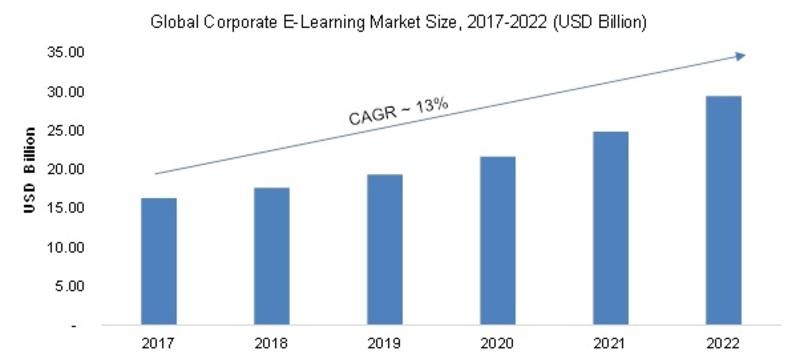

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...