Press release

Investigation announced for Investors in shares of PowerFleet, Inc. (NASDAQ: PWFL) over possible Violations of Securities Laws

An investigation was announced for investors of PowerFleet, Inc. (NASDAQ: PWFL) shares over potential securities laws violations by PowerFleet, Inc.

Investors who purchased shares of PowerFleet, Inc. (NASDAQ: PWFL), have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm focuses on possible claims on behalf of purchasers of the securities of PowerFleet, Inc. (NASDAQ: PWFL) concerning whether a series of statements by PowerFleet, Inc. regarding its business, its prospects and its operations were materially false and misleading at the time they were made.

Wodcliff Lake, NJ based PowerFleet, Inc. provides wireless Internet-of-Things (IoT) asset management solutions in the United States, Israel, and internationally. PowerFleet, Inc. declined from $135.91 million in 2022 to $133.73 million in 2023, and that its Net Loss declined from $6.75 million in 2022 to $5.67 million in 2023.

On April 5, 2024, PowerFleet, Inc. disclosed in a filing with the U.S. Securities and Exchange Commission ("SEC") that the Company had "received written notice (the 'Nasdaq Notification Letter') from the Listing Qualifications Department of The Nasdaq Stock Market LLC ('Nasdaq') notifying the Company that it did not timely file its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the '2023 Form 10-K'), as required for continued listing on The Nasdaq Global Market pursuant to Nasdaq Listing Rule 5250(c)(1). Under Nasdaq rules, the Company has 60 calendar days from the date of the Nasdaq Notification Letter to submit to Nasdaq a plan to regain compliance with Nasdaq Listing Rule 5250(c)(1)." In the same filing, the Company also stated "that the Company's previously released financial statements for the fiscal years ended December 31, 2021 and 2022, and for each of the interim periods during the 2022 and 2023 fiscal years (collectively, the 'Non-Reliance Periods'), should no longer be relied upon" and will be restated.

Specifically, PowerFleet, Inc. stated that "the accounting treatment relating to the redemption premium associated with the Company's Series A convertible preferred stock (the 'Series A Preferred Stock') required correction to comply with U.S. generally accepted accounting principles", which "are expected to result in increases in 'net loss attributable to common stockholders' by approximately $5 million, $6 million and $5 million for each of the fiscal years ended December 31, 2021, December 31, 2022 and nine months ended September 30, 2023, respectively, increases in 'convertible redeemable preferred stock' by approximately $11 million, $16 million and $21 million as of December 31, 2021, December 31, 2022 and September 30, 2023, respectively, and decreases in 'additional paid-in capital' by approximately $11 million, $16 million and $21 million as of December 31, 2021, December 31, 2022 and September 30, 2023, respectively." PowerFleet also disclosed that it "expect[s] to report a material weakness" in internal control over financial reporting.

Shares of PowerFleet, Inc. (NASDAQ: PWFL) declined from $5.67 per share on April 02, 2024, to as low as $3.85 per share on April 19, 2024.

Those who purchased shares of PowerFleet, Inc. (NASDAQ: PWFL) have certain options and should contact the Shareholders Foundation.

Contact:

Michael Daniels

Shareholders Foundation, Inc.

3111 Camino Del Rio North

Suite 423

San Diego, CA 92108

Tel: +1-(858)-779-1554

E-Mail: mail@shareholdersfoundation.com

About Shareholders Foundation, Inc.

The Shareholders Foundation, Inc. is a professional portfolio monitoring and settlement claim filing service, and an investor advocacy group, which does research related to shareholder issues and informs investors of securities lawsuits, settlements, judgments, and other legal related news to the stock/financial market. Shareholders Foundation, Inc. is in contact with a large number of shareholders and offers help, support, and assistance for every shareholder. The Shareholders Foundation, Inc. is not a law firm. Referenced cases, investigations, and/or settlements are not filed/initiated/reached and/or are not related to Shareholders Foundation. The information is provided as a public service. It is not intended as legal advice and should not be relied upon.

Investors who purchased shares of PowerFleet, Inc. (NASDAQ: PWFL), have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm focuses on possible claims on behalf of purchasers of the securities of PowerFleet, Inc. (NASDAQ: PWFL) concerning whether a series of statements by PowerFleet, Inc. regarding its business, its prospects and its operations were materially false and misleading at the time they were made.

Wodcliff Lake, NJ based PowerFleet, Inc. provides wireless Internet-of-Things (IoT) asset management solutions in the United States, Israel, and internationally. PowerFleet, Inc. declined from $135.91 million in 2022 to $133.73 million in 2023, and that its Net Loss declined from $6.75 million in 2022 to $5.67 million in 2023.

On April 5, 2024, PowerFleet, Inc. disclosed in a filing with the U.S. Securities and Exchange Commission ("SEC") that the Company had "received written notice (the 'Nasdaq Notification Letter') from the Listing Qualifications Department of The Nasdaq Stock Market LLC ('Nasdaq') notifying the Company that it did not timely file its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the '2023 Form 10-K'), as required for continued listing on The Nasdaq Global Market pursuant to Nasdaq Listing Rule 5250(c)(1). Under Nasdaq rules, the Company has 60 calendar days from the date of the Nasdaq Notification Letter to submit to Nasdaq a plan to regain compliance with Nasdaq Listing Rule 5250(c)(1)." In the same filing, the Company also stated "that the Company's previously released financial statements for the fiscal years ended December 31, 2021 and 2022, and for each of the interim periods during the 2022 and 2023 fiscal years (collectively, the 'Non-Reliance Periods'), should no longer be relied upon" and will be restated.

Specifically, PowerFleet, Inc. stated that "the accounting treatment relating to the redemption premium associated with the Company's Series A convertible preferred stock (the 'Series A Preferred Stock') required correction to comply with U.S. generally accepted accounting principles", which "are expected to result in increases in 'net loss attributable to common stockholders' by approximately $5 million, $6 million and $5 million for each of the fiscal years ended December 31, 2021, December 31, 2022 and nine months ended September 30, 2023, respectively, increases in 'convertible redeemable preferred stock' by approximately $11 million, $16 million and $21 million as of December 31, 2021, December 31, 2022 and September 30, 2023, respectively, and decreases in 'additional paid-in capital' by approximately $11 million, $16 million and $21 million as of December 31, 2021, December 31, 2022 and September 30, 2023, respectively." PowerFleet also disclosed that it "expect[s] to report a material weakness" in internal control over financial reporting.

Shares of PowerFleet, Inc. (NASDAQ: PWFL) declined from $5.67 per share on April 02, 2024, to as low as $3.85 per share on April 19, 2024.

Those who purchased shares of PowerFleet, Inc. (NASDAQ: PWFL) have certain options and should contact the Shareholders Foundation.

Contact:

Michael Daniels

Shareholders Foundation, Inc.

3111 Camino Del Rio North

Suite 423

San Diego, CA 92108

Tel: +1-(858)-779-1554

E-Mail: mail@shareholdersfoundation.com

About Shareholders Foundation, Inc.

The Shareholders Foundation, Inc. is a professional portfolio monitoring and settlement claim filing service, and an investor advocacy group, which does research related to shareholder issues and informs investors of securities lawsuits, settlements, judgments, and other legal related news to the stock/financial market. Shareholders Foundation, Inc. is in contact with a large number of shareholders and offers help, support, and assistance for every shareholder. The Shareholders Foundation, Inc. is not a law firm. Referenced cases, investigations, and/or settlements are not filed/initiated/reached and/or are not related to Shareholders Foundation. The information is provided as a public service. It is not intended as legal advice and should not be relied upon.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

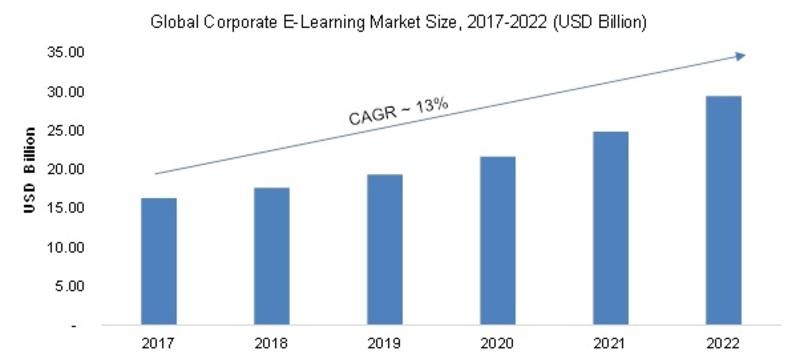

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...