Press release

Merchant Cash Advance Market Projected to Reach $32.66 Billion by 2032 at a 7.2% CAGR: CAN Capital, Fundbox, Lendio

Allied Market Research published a report, titled, "Merchant Cash Advance Market by Repayment Method [MCA Split, Automated Clearing House (ACH), MCA Lockbox], and Application (IT and Telecom, Healthcare, Manufacturing, Retail and E-commerce, Travel and Hospitality, Energy and Utilities, Others): Global Opportunity Analysis and Industry Forecast, 2024-2032". According to the report, the "merchant cash advance market" was valued at $17,886.16 million in 2023, and is estimated to reach $32,658.23 million by 2032, growing at a CAGR of 7.2% from 2024 to 2032.

🔸𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/A323338

A merchant cash advance (MCA) market is a short-term financing option in which a business receives a lump sum of funding and pays the money back incrementally. A percentage of the company's daily or weekly credit or debit card sales is normally deducted as repayment for the funding.

The merchant cash advance industry is quick to embrace technological advancements. As financial technology, or fintech, continues to evolve, it has introduced innovative solutions that enhance the efficiency and accessibility of MCAs. One such instance is the integration of artificial intelligence (AI) and machine learning algorithms to automate the underwriting process, resulting in faster approvals and more accurate risk assessments. While traditional financial underwriting can create a one-size-fits-all approach that overlooks many businesses, fintech-enabled MCAs can analyze revenue patterns and determine the eligibility of a wide range of businesses almost instantly, which drives the merchant cash advance market growth.

Prime determinants of growth

The growth of the merchant cash advance market is influenced by the growing demand for alternative financing. Moreover, the growing adoption of digital payments, including credit and debit cards, has led to an increase in the volume of credit card transactions, making merchant cash advances a more viable option for businesses. On the contrary, the increasing use of technology in the financial services industry, such as the use of artificial intelligence and machine learning for underwriting and risk assessment, presents an opportunity for growth in the merchant cash advance market. In addition, the growing demand for short-term financing options, especially among seasonal businesses, presents an opportunity for growth in the merchant cash advance market.

The MCA split segment to maintain its leadership status throughout the forecast period

By repayment method, the MCA split segment held the highest market share in 2023, accounting for more than two-thirds of the global merchant cash advance market revenue, and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the fact that this method of repayment where a fixed percentage of daily credit card sales is automatically remitted to the lender, makes it a convenient and flexible option for businesses with fluctuating sales. However, the automated clearing house (ACH) segment is projected to manifest the highest CAGR of 10.0% from 2024 to 2032. This method involves the automatic withdrawal of funds from a borrower's bank account to fulfill the repayment obligation. It offers convenience and reliability for lenders by ensuring timely repayments without relying on the borrower's manual initiation of payments. Moreover, it provides a structured and automated repayment process, reducing the risk of missed or delayed payments.

The retail and e-commerce segment to maintain its leadership status throughout the forecast period

By application, the retail and e-commerce segment held the highest market share in 2023, accounting for nearly one-fourth of the global merchant cash advance market revenue, and is estimated to maintain its leadership status throughout the forecast period. Retail and e-commerce businesses often turn to MCAs to navigate fluctuations in cash flow, capitalize on inventory procurement opportunities, or invest in marketing campaigns to bolster sales. The ability to obtain funding swiftly, often without the stringent requirements of traditional loans, makes MCAs an attractive choice for businesses in this sector, allowing them to adapt rapidly to market changes and seize growth opportunities. However, the IT and telecom segment is projected to manifest the highest CAGR of 12.4% from 2024 to 2032. This is attributed to the increasing demand for alternative financing options, the growth of small and medium-sized enterprises (SMEs), and the increasing use of technology in the financial services industry. The merchant cash advance market provides a flexible financing option for SMEs in the IT and telecom sector, which often face challenges in securing traditional financing options.

🔸𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://bit.ly/3UAwqDV

North America to maintain its dominance by 2032

By region, North America held the highest market share in terms of revenue in 2023, accounting for more than one-third of the merchant cash advance market revenue and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the increasing number of retailers seeking out short-term credit facilities to help cover short-term credit needs, as well as the capital markets tightening and banks becoming increasingly interested in alternative sources of income. However, Asia-Pacific is expected to witness the fastest CAGR of 10.7% from 2024 to 2032. This is attributed to the growing demand for alternative financing options and the growth of small and medium-sized enterprises (SMEs), as well as the increasing use of technology in the financial services industry.

Leading Market Players: -

CAN Capital, Inc.

Fundbox

Kalamata Capital Group

Lendio

Libertas Funding, LLC

National Business Capital

OnDeck

Perfect Alliance Capital

Rapid Finance

Reliant Funding

The report provides a detailed analysis of these key players in the global merchant cash advance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the merchant cash advance market analysis from 2024 to 2032 to identify the prevailing market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network on the merchant cash advance market outlook.

In-depth analysis of the merchant cash advance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as merchant cash advance market trends, key players, market segments, application areas, and market growth strategies.

🔸𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/A323338

Merchant Cash Advance Market Key Segments:

By Repayment Method

MCA Split

Automated Clearing House (ACH)

MCA Lockbox

By Application

Healthcare

Manufacturing

Retail and E-commerce

Travel and Hospitality

Energy and Utilities

Others

IT and Telecom

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

Latin America (Brazil, Argentina, Rest of Latin America)

Middle East and Africa (Gcc Countries, South Africa, Rest of Middle East And Africa)

🔸𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Financial Protection Market https://www.alliedmarketresearch.com/financial-protection-market

U.S. Insurance Third Party Administrator Market https://www.alliedmarketresearch.com/us-insurance-third-party-administrator-market-A14535

Commercial Lending Market https://www.alliedmarketresearch.com/commercial-lending-market-A11617

Account Aggregators Market https://www.alliedmarketresearch.com/account-aggregators-market-A12932

Private Banking Market https://www.alliedmarketresearch.com/private-banking-market-A14753

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

🔸𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/A323338

A merchant cash advance (MCA) market is a short-term financing option in which a business receives a lump sum of funding and pays the money back incrementally. A percentage of the company's daily or weekly credit or debit card sales is normally deducted as repayment for the funding.

The merchant cash advance industry is quick to embrace technological advancements. As financial technology, or fintech, continues to evolve, it has introduced innovative solutions that enhance the efficiency and accessibility of MCAs. One such instance is the integration of artificial intelligence (AI) and machine learning algorithms to automate the underwriting process, resulting in faster approvals and more accurate risk assessments. While traditional financial underwriting can create a one-size-fits-all approach that overlooks many businesses, fintech-enabled MCAs can analyze revenue patterns and determine the eligibility of a wide range of businesses almost instantly, which drives the merchant cash advance market growth.

Prime determinants of growth

The growth of the merchant cash advance market is influenced by the growing demand for alternative financing. Moreover, the growing adoption of digital payments, including credit and debit cards, has led to an increase in the volume of credit card transactions, making merchant cash advances a more viable option for businesses. On the contrary, the increasing use of technology in the financial services industry, such as the use of artificial intelligence and machine learning for underwriting and risk assessment, presents an opportunity for growth in the merchant cash advance market. In addition, the growing demand for short-term financing options, especially among seasonal businesses, presents an opportunity for growth in the merchant cash advance market.

The MCA split segment to maintain its leadership status throughout the forecast period

By repayment method, the MCA split segment held the highest market share in 2023, accounting for more than two-thirds of the global merchant cash advance market revenue, and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the fact that this method of repayment where a fixed percentage of daily credit card sales is automatically remitted to the lender, makes it a convenient and flexible option for businesses with fluctuating sales. However, the automated clearing house (ACH) segment is projected to manifest the highest CAGR of 10.0% from 2024 to 2032. This method involves the automatic withdrawal of funds from a borrower's bank account to fulfill the repayment obligation. It offers convenience and reliability for lenders by ensuring timely repayments without relying on the borrower's manual initiation of payments. Moreover, it provides a structured and automated repayment process, reducing the risk of missed or delayed payments.

The retail and e-commerce segment to maintain its leadership status throughout the forecast period

By application, the retail and e-commerce segment held the highest market share in 2023, accounting for nearly one-fourth of the global merchant cash advance market revenue, and is estimated to maintain its leadership status throughout the forecast period. Retail and e-commerce businesses often turn to MCAs to navigate fluctuations in cash flow, capitalize on inventory procurement opportunities, or invest in marketing campaigns to bolster sales. The ability to obtain funding swiftly, often without the stringent requirements of traditional loans, makes MCAs an attractive choice for businesses in this sector, allowing them to adapt rapidly to market changes and seize growth opportunities. However, the IT and telecom segment is projected to manifest the highest CAGR of 12.4% from 2024 to 2032. This is attributed to the increasing demand for alternative financing options, the growth of small and medium-sized enterprises (SMEs), and the increasing use of technology in the financial services industry. The merchant cash advance market provides a flexible financing option for SMEs in the IT and telecom sector, which often face challenges in securing traditional financing options.

🔸𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://bit.ly/3UAwqDV

North America to maintain its dominance by 2032

By region, North America held the highest market share in terms of revenue in 2023, accounting for more than one-third of the merchant cash advance market revenue and is estimated to maintain its leadership status throughout the forecast period. This is attributed to the increasing number of retailers seeking out short-term credit facilities to help cover short-term credit needs, as well as the capital markets tightening and banks becoming increasingly interested in alternative sources of income. However, Asia-Pacific is expected to witness the fastest CAGR of 10.7% from 2024 to 2032. This is attributed to the growing demand for alternative financing options and the growth of small and medium-sized enterprises (SMEs), as well as the increasing use of technology in the financial services industry.

Leading Market Players: -

CAN Capital, Inc.

Fundbox

Kalamata Capital Group

Lendio

Libertas Funding, LLC

National Business Capital

OnDeck

Perfect Alliance Capital

Rapid Finance

Reliant Funding

The report provides a detailed analysis of these key players in the global merchant cash advance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the merchant cash advance market analysis from 2024 to 2032 to identify the prevailing market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

The Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network on the merchant cash advance market outlook.

In-depth analysis of the merchant cash advance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as merchant cash advance market trends, key players, market segments, application areas, and market growth strategies.

🔸𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/A323338

Merchant Cash Advance Market Key Segments:

By Repayment Method

MCA Split

Automated Clearing House (ACH)

MCA Lockbox

By Application

Healthcare

Manufacturing

Retail and E-commerce

Travel and Hospitality

Energy and Utilities

Others

IT and Telecom

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

Latin America (Brazil, Argentina, Rest of Latin America)

Middle East and Africa (Gcc Countries, South Africa, Rest of Middle East And Africa)

🔸𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Financial Protection Market https://www.alliedmarketresearch.com/financial-protection-market

U.S. Insurance Third Party Administrator Market https://www.alliedmarketresearch.com/us-insurance-third-party-administrator-market-A14535

Commercial Lending Market https://www.alliedmarketresearch.com/commercial-lending-market-A11617

Account Aggregators Market https://www.alliedmarketresearch.com/account-aggregators-market-A12932

Private Banking Market https://www.alliedmarketresearch.com/private-banking-market-A14753

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

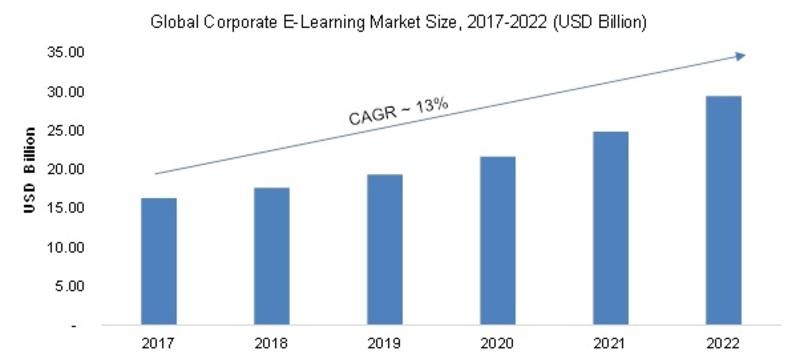

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...