Press release

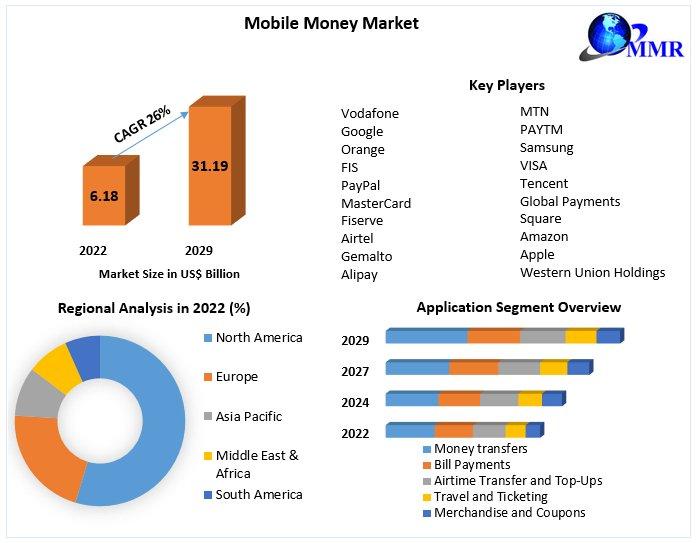

Mobile Money Market to reach USD 31.19 Bn by 2029, emerging at a CAGR of 26 percent and forecast 2023-2029

Mobile Money Market Report Scope and Research Methodology

The Mobile Money Market, valued at US$ 6.18 Bn in 2022, is projected to experience a substantial growth rate of 26% from 2023 to 2029, reaching an estimated US$ 31.19 Bn.

Maximize Market Research Pvt Ltd, a leading market research firm, has released an in-depth report on the Mobile Money Market. The report encompasses a thorough analysis of market dynamics, drivers, restraints, and regional insights.

The research methodology employed by Maximize Market Research involves a comprehensive approach, ensuring the accurate representation of market trends and dynamics. For detailed insights, please refer to the full report available for review.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/7166

Mobile Money Market Dynamics:

The surge in mobile phone users is a key driver propelling the Mobile Money Market's growth. The escalating number of mobile subscribers indicates a burgeoning potential for monetary transactions via mobile phones, fostering exponential market expansion.

Mobile money systems serve as a strategic gateway for online financial service providers to tap into extensive, untapped market avenues, given that a significant portion of the population is yet to embrace this technology. Companies, by cultivating digital financial capabilities, position themselves to explore additional submarkets such as micropayments, data-driven financial services, and potential digital markets.

The Mobile Money Market is being propelled by the increasing number of mobile phone users, making it an engine for financial inclusion and a lucrative opportunity for emerging markets. The efficiency of mobile money transactions, the rise of mobile banking services, and the growth of e-commerce contribute to market expansion. However, factors such as accessibility issues and regulatory challenges pose restraints.

Mobile Money Market Regional Insights:

In 2022, the Middle East and Africa asserted dominance in the mobile money market, commanding a substantial 38% share. The region's market growth is propelled by the facilitation of easy allocation and designated savings for women, alongside the seamless and cost-effective transfer of funds during unforeseen adverse events. Beyond conventional transfers and payments, the market is evolving to embrace more sophisticated products like credit, savings, and insurance, contributing to the region's expanding financial landscape. Notably, this development has empowered previously financially excluded individuals in Africa, fostering a formal savings culture and providing a means to better secure their financial future.

In 2022, the Middle East and Africa dominated the market with a 38% share. Factors such as easy allocation and savings for women, affordable money transfers, and the adoption of sophisticated financial products contribute to the region's market growth. Asia Pacific is expected to grow at a CAGR of 4.6% through the forecast period, driven by increased smartphone penetration and rapid adoption of mobile money solutions.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/7166

Mobile Money Market Segmentation:

by Payment Type

Remote Payments

Proximity Payments

by Industry

BFSI

Telecom and IT

Media and entertainment

Healthcare

Travel and hospitality

Transportation

Others

by Transaction Mode

Point of Sale (PoS)

Mobile Apps

QR codes

by Nature of Payment

Person to Person (P2P)

Person to Business (P2B)

Business to Person (B2P)

Business to Business (B2B)

by Application

Money transfers

Bill Payments

Airtime Transfer and Top-Ups

Travel and Ticketing

Merchandise and Coupons

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/7166

Mobile Money Market Key Players:

1. odafone

2. Google

3. Orange

4. FIS

5. PayPal

6. MasterCard

7. Fiserve

8. Airtel

9. Gemalto

10. Alipay

11. MTN

12. PAYTM

13. Samsung

14. VISA

15. Tencent

16. Global Payments

17. Square

18. Amazon

19. Apple

20. Western Union Holdings

21. Comviva

22. T- Mobile

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/global-mobile-money-market/7166/

Table of content for the Mobile Money Market includes:

1. Global Mobile Money Market: Research Methodology

2. Global Mobile Money Market: Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

3.Global Mobile Money Market: Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

M&A by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

4 . Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Key Offerings:

Past Market Size and Competitive Landscape (2022 to 2029)

Past Pricing and price curve by region (2022 to 2029)

Market Size, Share, Size and Forecast by different segment | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by growth and trend

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 mailto:sales@maximizemarketresearch.com

🌐 https://www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

The Mobile Money Market, valued at US$ 6.18 Bn in 2022, is projected to experience a substantial growth rate of 26% from 2023 to 2029, reaching an estimated US$ 31.19 Bn.

Maximize Market Research Pvt Ltd, a leading market research firm, has released an in-depth report on the Mobile Money Market. The report encompasses a thorough analysis of market dynamics, drivers, restraints, and regional insights.

The research methodology employed by Maximize Market Research involves a comprehensive approach, ensuring the accurate representation of market trends and dynamics. For detailed insights, please refer to the full report available for review.

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/7166

Mobile Money Market Dynamics:

The surge in mobile phone users is a key driver propelling the Mobile Money Market's growth. The escalating number of mobile subscribers indicates a burgeoning potential for monetary transactions via mobile phones, fostering exponential market expansion.

Mobile money systems serve as a strategic gateway for online financial service providers to tap into extensive, untapped market avenues, given that a significant portion of the population is yet to embrace this technology. Companies, by cultivating digital financial capabilities, position themselves to explore additional submarkets such as micropayments, data-driven financial services, and potential digital markets.

The Mobile Money Market is being propelled by the increasing number of mobile phone users, making it an engine for financial inclusion and a lucrative opportunity for emerging markets. The efficiency of mobile money transactions, the rise of mobile banking services, and the growth of e-commerce contribute to market expansion. However, factors such as accessibility issues and regulatory challenges pose restraints.

Mobile Money Market Regional Insights:

In 2022, the Middle East and Africa asserted dominance in the mobile money market, commanding a substantial 38% share. The region's market growth is propelled by the facilitation of easy allocation and designated savings for women, alongside the seamless and cost-effective transfer of funds during unforeseen adverse events. Beyond conventional transfers and payments, the market is evolving to embrace more sophisticated products like credit, savings, and insurance, contributing to the region's expanding financial landscape. Notably, this development has empowered previously financially excluded individuals in Africa, fostering a formal savings culture and providing a means to better secure their financial future.

In 2022, the Middle East and Africa dominated the market with a 38% share. Factors such as easy allocation and savings for women, affordable money transfers, and the adoption of sophisticated financial products contribute to the region's market growth. Asia Pacific is expected to grow at a CAGR of 4.6% through the forecast period, driven by increased smartphone penetration and rapid adoption of mobile money solutions.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/7166

Mobile Money Market Segmentation:

by Payment Type

Remote Payments

Proximity Payments

by Industry

BFSI

Telecom and IT

Media and entertainment

Healthcare

Travel and hospitality

Transportation

Others

by Transaction Mode

Point of Sale (PoS)

Mobile Apps

QR codes

by Nature of Payment

Person to Person (P2P)

Person to Business (P2B)

Business to Person (B2P)

Business to Business (B2B)

by Application

Money transfers

Bill Payments

Airtime Transfer and Top-Ups

Travel and Ticketing

Merchandise and Coupons

Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/7166

Mobile Money Market Key Players:

1. odafone

2. Google

3. Orange

4. FIS

5. PayPal

6. MasterCard

7. Fiserve

8. Airtel

9. Gemalto

10. Alipay

11. MTN

12. PAYTM

13. Samsung

14. VISA

15. Tencent

16. Global Payments

17. Square

18. Amazon

19. Apple

20. Western Union Holdings

21. Comviva

22. T- Mobile

Get to Know More About This Market Study:https://www.maximizemarketresearch.com/market-report/global-mobile-money-market/7166/

Table of content for the Mobile Money Market includes:

1. Global Mobile Money Market: Research Methodology

2. Global Mobile Money Market: Executive Summary

Market Overview and Definitions

Introduction to the Global Market

Summary

Key Findings

Recommendations for Investors

Recommendations for Market Leaders

Recommendations for New Market Entry

3.Global Mobile Money Market: Competitive Analysis

MMR Competition Matrix

Market Structure by region

Competitive Benchmarking of Key Players

Consolidation in the Market

M&A by region

Key Developments by Companies

Market Drivers

Market Restraints

Market Opportunities

Market Challenges

Market Dynamics

PORTERS Five Forces Analysis

PESTLE

Regulatory Landscape by region

North America

Europe

Asia Pacific

Middle East and Africa

South America

COVID-19 Impact

4 . Company Profile: Key players

Company Overview

Financial Overview

Global Presence

Capacity Portfolio

Business Strategy

Recent Developments

Key Offerings:

Past Market Size and Competitive Landscape (2022 to 2029)

Past Pricing and price curve by region (2022 to 2029)

Market Size, Share, Size and Forecast by different segment | 2022-2029

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Market Segmentation - A detailed analysis by growth and trend

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 444 West Lake Street, Floor 17,

Chicago, IL, 60606, USA.

✆ +1 800 507 4489

✆ +91 9607365656

🖂 mailto:sales@maximizemarketresearch.com

🌐 https://www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of the majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...