Press release

SME Insurance Market Projected to Reach USD 1205.35 Billion by 2032

The Small and Medium Enterprises (SME) Insurance Market has become increasingly important for safeguarding businesses and providing financial resilience to SMEs worldwide. With a market valuation of $697.5 billion USD in 2023, the SME Insurance Market is expected to grow from $741.17 billion USD in 2024 to approximately $1,205.35 billion USD by 2032. This growth represents a compound annual growth rate (CAGR) of about 6.26% over the forecast period (2024-2032). Key drivers of this growth include increasing awareness of risk management, regulatory support for SME protection, and the expansion of digital platforms that simplify access to insurance solutions for small businesses.

Key Companies in the SME Insurance Market Include:

Allianz ,AXA ,Zurich ,Chubb ,Hiscox ,AIG ,Liberty Mutual ,Travelers ,The Hartford ,Nationwide ,Progressive ,State Farm ,MetLife ,Farmers ,USAA

Get a FREE Sample Report PDF Here:

https://www.wiseguyreports.com/sample-request?id=542790

Key Market Drivers

Growing Awareness of Risk Management:

SMEs increasingly recognize the importance of insurance to protect their assets, employees, and financial stability. This awareness encourages small businesses to invest in various insurance solutions, such as property insurance, liability insurance, and health coverage for employees.

Expansion of Digital Insurance Platforms:

The digitization of insurance services has made it easier and more affordable for SMEs to access customized insurance solutions. Digital platforms offer quick, paperless options that allow SMEs to compare policies, obtain quotes, and manage claims online, broadening the market's accessibility and appeal.

Regulatory Support and Government Initiatives:

Governments globally are enacting policies to support SME growth and resilience, recognizing their economic importance. This includes incentives and regulations encouraging SMEs to adopt insurance as a standard part of their risk management strategy, further driving market growth.

Increased Cybersecurity Risks:

The rising threat of cyber-attacks has spurred demand for cybersecurity insurance among SMEs. With more small businesses operating digitally, cybersecurity insurance is now seen as a critical component of risk management, which in turn is fueling market expansion.

Market Segmentation

The SME Insurance Market can be segmented by:

Insurance Type:

Property Insurance:

Covering damage to assets, equipment, and business premises, essential for SMEs across various sectors.

Liability Insurance:

Including general liability and professional liability, protecting businesses against claims related to injury, damage, or negligence.

Health and Employee Insurance:

Covering health benefits for employees, increasingly demanded by SMEs to attract and retain talent.

Cybersecurity Insurance:

Providing protection against digital threats, becoming a key insurance type as businesses digitize.

End User:

Micro Enterprises:

Smaller companies with fewer resources, requiring cost-effective insurance options.

Small Enterprises:

Businesses needing basic to moderate levels of coverage tailored to their specific industry.

Medium Enterprises:

Larger SMEs with more assets and employees, often requiring comprehensive policies across various insurance types.

Distribution Channel:

Direct:

Involving policies sold directly by insurers, a model increasingly facilitated by digital platforms.

Agents and Brokers:

Insurance agents and brokers continue to play a vital role in guiding SMEs through the insurance selection process.

Regional Insights

North America:

Dominating the SME Insurance Market, North America has a mature insurance ecosystem and high SME penetration. The U.S., in particular, benefits from an advanced digital infrastructure and strong regulatory support.

Europe:

Europe also has a well-established SME Insurance Market, with significant growth driven by regulatory frameworks such as the EU's SME policy. European SMEs are becoming increasingly reliant on insurance to navigate risks posed by economic fluctuations.

Asia-Pacific:

The Asia-Pacific region represents a high-growth market due to rapid SME expansion, digital transformation, and increasing regulatory initiatives. As businesses in emerging markets become more sophisticated, insurance adoption is on the rise, contributing to market growth.

Market Challenges

Cost Sensitivity Among SMEs:

Small businesses often operate with limited budgets and may hesitate to invest in insurance. Insurers must develop affordable, flexible policies to address this challenge and make insurance solutions accessible to even the smallest enterprises.

Complexity of Insurance Products:

Navigating the variety of available insurance policies can be daunting for SMEs, especially those without dedicated risk management teams. Educating SME owners and simplifying policy options is crucial for enhancing adoption rates.

Rising Cybersecurity Insurance Costs:

As cybersecurity threats grow, so do premiums for cyber insurance. This cost increase may deter some SMEs from opting for cybersecurity coverage despite its importance, limiting market penetration.

Know More about the SME Insurance Market Report:

https://www.wiseguyreports.com/reports/sme-insurance-market

Key Players in the SME Insurance Market

Several prominent companies lead the SME Insurance Market, including:

AXA:

A global insurance provider offering tailored solutions for SMEs, with a strong focus on digital services and cybersecurity insurance.

Zurich Insurance Group:

Known for its comprehensive offerings across general liability, property, and cyber insurance, Zurich is a popular choice among SMEs.

Chubb:

Specializes in providing business insurance solutions tailored to SME needs, with options that include cyber insurance and liability coverage.

Allianz:

Allianz offers a wide range of insurance solutions for SMEs and has invested heavily in digital platforms, making its services more accessible to small businesses.

These companies and others are increasingly using technology to make insurance products more SME-friendly, affordable, and adaptable to the needs of specific industries.

Future Outlook

The SME Insurance Market is positioned for steady growth, driven by an expanding digital landscape, heightened awareness of risk management, and government initiatives supporting SME resilience. With a projected CAGR of 6.26% from 2024 to 2032, the market is expected to reach over $1.2 trillion USD by 2032. As SMEs continue to grow and face evolving risks, the demand for specialized, affordable insurance products will remain robust. The digitization of insurance services, combined with the growing need for cybersecurity and liability coverage, will drive the future expansion of the SME Insurance Market.

Top Trending Research Report:

Lcd Kvm Switches Market- https://www.wiseguyreports.com/reports/lcd-kvm-switches-market

Cloud Computing In Retail Banking Market- https://www.wiseguyreports.com/reports/cloud-computing-in-retail-banking-market

Leisure Boats Electronic Products Market- https://www.wiseguyreports.com/reports/leisure-boats-electronic-products-market

Private Contract Security Service Market- https://www.wiseguyreports.com/reports/private-contract-security-service-market

Source-to-Pay Outsourcing Market- https://www.wiseguyreports.com/reports/source-to-pay-outsourcing-market

Cnc Routers For Engraving Market- https://www.wiseguyreports.com/reports/cnc-routers-for-engraving-market

Gigabit Wi-Fi Access Points Market- https://www.wiseguyreports.com/reports/gigabit-wi-fi-access-points-market

Mortgage Lender Market- https://www.wiseguyreports.com/reports/mortgage-lender-market

Uvc Led Chips Market- https://www.wiseguyreports.com/reports/uvc-led-chips-market

Conditional Access Module Cam Market- https://www.wiseguyreports.com/reports/conditional-access-module-cam-market

About US:

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

Contact US:

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune - 411028

Maharashtra, India 411028

Sales +91 20 6912 2998

Key Companies in the SME Insurance Market Include:

Allianz ,AXA ,Zurich ,Chubb ,Hiscox ,AIG ,Liberty Mutual ,Travelers ,The Hartford ,Nationwide ,Progressive ,State Farm ,MetLife ,Farmers ,USAA

Get a FREE Sample Report PDF Here:

https://www.wiseguyreports.com/sample-request?id=542790

Key Market Drivers

Growing Awareness of Risk Management:

SMEs increasingly recognize the importance of insurance to protect their assets, employees, and financial stability. This awareness encourages small businesses to invest in various insurance solutions, such as property insurance, liability insurance, and health coverage for employees.

Expansion of Digital Insurance Platforms:

The digitization of insurance services has made it easier and more affordable for SMEs to access customized insurance solutions. Digital platforms offer quick, paperless options that allow SMEs to compare policies, obtain quotes, and manage claims online, broadening the market's accessibility and appeal.

Regulatory Support and Government Initiatives:

Governments globally are enacting policies to support SME growth and resilience, recognizing their economic importance. This includes incentives and regulations encouraging SMEs to adopt insurance as a standard part of their risk management strategy, further driving market growth.

Increased Cybersecurity Risks:

The rising threat of cyber-attacks has spurred demand for cybersecurity insurance among SMEs. With more small businesses operating digitally, cybersecurity insurance is now seen as a critical component of risk management, which in turn is fueling market expansion.

Market Segmentation

The SME Insurance Market can be segmented by:

Insurance Type:

Property Insurance:

Covering damage to assets, equipment, and business premises, essential for SMEs across various sectors.

Liability Insurance:

Including general liability and professional liability, protecting businesses against claims related to injury, damage, or negligence.

Health and Employee Insurance:

Covering health benefits for employees, increasingly demanded by SMEs to attract and retain talent.

Cybersecurity Insurance:

Providing protection against digital threats, becoming a key insurance type as businesses digitize.

End User:

Micro Enterprises:

Smaller companies with fewer resources, requiring cost-effective insurance options.

Small Enterprises:

Businesses needing basic to moderate levels of coverage tailored to their specific industry.

Medium Enterprises:

Larger SMEs with more assets and employees, often requiring comprehensive policies across various insurance types.

Distribution Channel:

Direct:

Involving policies sold directly by insurers, a model increasingly facilitated by digital platforms.

Agents and Brokers:

Insurance agents and brokers continue to play a vital role in guiding SMEs through the insurance selection process.

Regional Insights

North America:

Dominating the SME Insurance Market, North America has a mature insurance ecosystem and high SME penetration. The U.S., in particular, benefits from an advanced digital infrastructure and strong regulatory support.

Europe:

Europe also has a well-established SME Insurance Market, with significant growth driven by regulatory frameworks such as the EU's SME policy. European SMEs are becoming increasingly reliant on insurance to navigate risks posed by economic fluctuations.

Asia-Pacific:

The Asia-Pacific region represents a high-growth market due to rapid SME expansion, digital transformation, and increasing regulatory initiatives. As businesses in emerging markets become more sophisticated, insurance adoption is on the rise, contributing to market growth.

Market Challenges

Cost Sensitivity Among SMEs:

Small businesses often operate with limited budgets and may hesitate to invest in insurance. Insurers must develop affordable, flexible policies to address this challenge and make insurance solutions accessible to even the smallest enterprises.

Complexity of Insurance Products:

Navigating the variety of available insurance policies can be daunting for SMEs, especially those without dedicated risk management teams. Educating SME owners and simplifying policy options is crucial for enhancing adoption rates.

Rising Cybersecurity Insurance Costs:

As cybersecurity threats grow, so do premiums for cyber insurance. This cost increase may deter some SMEs from opting for cybersecurity coverage despite its importance, limiting market penetration.

Know More about the SME Insurance Market Report:

https://www.wiseguyreports.com/reports/sme-insurance-market

Key Players in the SME Insurance Market

Several prominent companies lead the SME Insurance Market, including:

AXA:

A global insurance provider offering tailored solutions for SMEs, with a strong focus on digital services and cybersecurity insurance.

Zurich Insurance Group:

Known for its comprehensive offerings across general liability, property, and cyber insurance, Zurich is a popular choice among SMEs.

Chubb:

Specializes in providing business insurance solutions tailored to SME needs, with options that include cyber insurance and liability coverage.

Allianz:

Allianz offers a wide range of insurance solutions for SMEs and has invested heavily in digital platforms, making its services more accessible to small businesses.

These companies and others are increasingly using technology to make insurance products more SME-friendly, affordable, and adaptable to the needs of specific industries.

Future Outlook

The SME Insurance Market is positioned for steady growth, driven by an expanding digital landscape, heightened awareness of risk management, and government initiatives supporting SME resilience. With a projected CAGR of 6.26% from 2024 to 2032, the market is expected to reach over $1.2 trillion USD by 2032. As SMEs continue to grow and face evolving risks, the demand for specialized, affordable insurance products will remain robust. The digitization of insurance services, combined with the growing need for cybersecurity and liability coverage, will drive the future expansion of the SME Insurance Market.

Top Trending Research Report:

Lcd Kvm Switches Market- https://www.wiseguyreports.com/reports/lcd-kvm-switches-market

Cloud Computing In Retail Banking Market- https://www.wiseguyreports.com/reports/cloud-computing-in-retail-banking-market

Leisure Boats Electronic Products Market- https://www.wiseguyreports.com/reports/leisure-boats-electronic-products-market

Private Contract Security Service Market- https://www.wiseguyreports.com/reports/private-contract-security-service-market

Source-to-Pay Outsourcing Market- https://www.wiseguyreports.com/reports/source-to-pay-outsourcing-market

Cnc Routers For Engraving Market- https://www.wiseguyreports.com/reports/cnc-routers-for-engraving-market

Gigabit Wi-Fi Access Points Market- https://www.wiseguyreports.com/reports/gigabit-wi-fi-access-points-market

Mortgage Lender Market- https://www.wiseguyreports.com/reports/mortgage-lender-market

Uvc Led Chips Market- https://www.wiseguyreports.com/reports/uvc-led-chips-market

Conditional Access Module Cam Market- https://www.wiseguyreports.com/reports/conditional-access-module-cam-market

About US:

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

Contact US:

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune - 411028

Maharashtra, India 411028

Sales +91 20 6912 2998

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

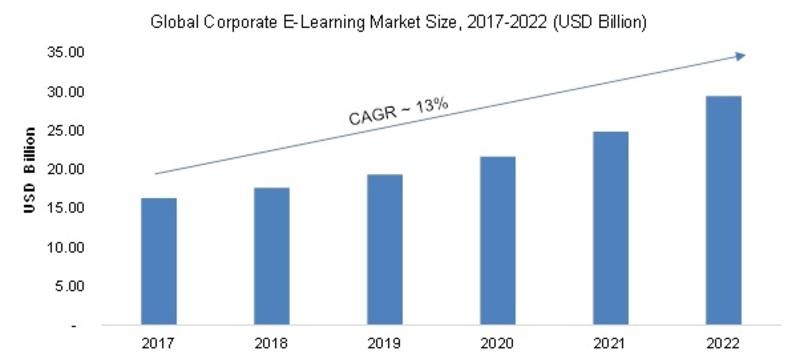

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...