Press release

Trade Finance Market Report 2024-2032 | Industry Size, Share, Demand, Trends, Companies and Segmentation

According to the latest report by IMARC Group, titled "Trade Finance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032,"offers a detailed analysis of the global trade finance market trends, size, drivers, segmentation, growth opportunities and competitive landscape to understand the current and future market scenarios.

How Big is the Trade Finance Market?

The global trade finance market size reached US$ 51.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 82.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.3% during 2024-2032.

𝐅𝐨𝐫 𝐚𝐧 𝐢𝐧-𝐝𝐞𝐩𝐭𝐡 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐘𝐨𝐮 𝐂𝐚𝐧 𝐑𝐞𝐟𝐞𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/trade-finance-market/requestsample

Factors Affecting the Growth of the Trade Finance Industry:

Globalization of Trade:

The expansion of global trade is a primary factor driving the growth of the trade finance market. As businesses increasingly engage in international transactions, the demand for trade finance solutions to mitigate risks associated with cross-border trade, such as currency fluctuations and non-payment, rises. The globalization of supply chains has also led to more complex trading relationships, necessitating sophisticated financial instruments to manage these interactions. The integration of emerging markets into the global trade system further amplifies this need, as companies seek secure ways to navigate diverse and sometimes volatile economic environments.

Technological Advancements:

Technological advancements significantly influence the trade finance market. The integration of digital technologies like blockchain, artificial intelligence, and machine learning streamlines trade finance processes, making them more efficient, transparent, and secure. These technologies facilitate faster verification, reduce paperwork, and lower the risk of fraud, enhancing the overall efficiency of trade transactions. Digital platforms are also enabling the automation of trade finance operations, leading to quicker transaction processing and improved customer experience. This digital transformation is particularly crucial in addressing the challenges of cross-border transactions, making trade finance more accessible and reliable.

Regulatory Environment:

The regulatory environment plays a crucial role in shaping the trade finance market. Regulations aimed at preventing money laundering and financing of terrorism have increased the compliance requirements for trade finance, impacting the way financial institutions conduct business. On the other hand, supportive regulatory frameworks, and initiatives, such as the establishment of trade agreements and the standardization of trade finance practices, facilitate international trade. Regulatory bodies are also increasingly recognizing the importance of trade finance in economic development, leading to policies that promote trade finance, especially in developing economies. This evolving regulatory landscape influences the risk assessment, due diligence processes, and availability of trade finance solutions.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=2031&flag=C

Trade Finance Market Report Segmentation:

Breakup by Finance Type:

Structured Trade Finance

Supply Chain Finance

Traditional Trade Finance

Supply chain finance is the largest finance type segment in the global trade finance sector, as it provides critical support for optimizing working capital and enhancing liquidity, which is essential for businesses in managing their complex supply chains efficiently.

Breakup by Offering:

Letters of Credit

Bill of Lading

Export Factoring

Insurance

Others

Letters of credit dominate the offering segment of the trade finance market, as they provide a high level of security in international trade transactions by assuring payment, thus reducing the risk of default for both exporters and importers.

Breakup by Service Provider:

Banks

Trade Finance Houses

Banks are the largest market by service provider in global trade finance, due to their extensive international networks, established relationships, and a wide range of financial services that cater to the diverse needs of global trade participants.

Breakup by End-User:

Small and Medium Sized Enterprises (SMEs)

Large Enterprises

Large enterprises constitute the largest end-user segment in the trade finance market, as they often engage in high-volume international trade activities that require substantial and varied financing solutions to manage and mitigate the risks associated with global transactions.

Breakup by Region:

North America (United States, Canada)

Europe (Germany, France, United Kingdom, Italy, Spain, Others)

Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Others)

North America is the largest market by region in the global trade finance sector, driven by the presence of many multinational corporations engaged in extensive international trade, coupled with a well-developed financial sector that provides sophisticated trade financing solutions.

Trade Finance Market Trends:

The increasing digitization and automation of trade finance processes enhances efficiency, reduces transaction times, and minimizes errors which represents one of the key factors influencing the growth of the trade finance market across the globe. This shift includes the adoption of technologies like blockchain and AI, offering greater transparency and security in transactions. The market is also driven by the growing focus on sustainability-linked trade finance, where financing is tied to achieving specific environmental and social goals, reflecting the global shift towards responsible business practices.

Additionally, there's a rising demand for supply chain finance solutions, driven by the need for better working capital management and liquidity in complex global supply chains. The market is also seeing a shift towards more inclusive trade finance, aiming to provide better access to funding for small and medium-sized enterprises (SMEs), which are often underserved.

Leading Companies Operating in the Global Trade Finance Industry:

Asian Development Bank

Banco Santander SA

Bank of America Corp.

BNP Paribas SA

Citigroup Inc.

Crédit Agricole Group

Euler Hermes

Goldman Sachs Group Inc.

HSBC Holdings Plc

JPMorgan Chase & Co.

Mitsubishi Ufj Financial Group Inc.

Morgan Stanley

Royal Bank of Scotland

Standard Chartered Bank

Wells Fargo & Co.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

How Big is the Trade Finance Market?

The global trade finance market size reached US$ 51.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 82.7 Billion by 2032, exhibiting a growth rate (CAGR) of 5.3% during 2024-2032.

𝐅𝐨𝐫 𝐚𝐧 𝐢𝐧-𝐝𝐞𝐩𝐭𝐡 𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬, 𝐘𝐨𝐮 𝐂𝐚𝐧 𝐑𝐞𝐟𝐞𝐫 𝐒𝐚𝐦𝐩𝐥𝐞 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.imarcgroup.com/trade-finance-market/requestsample

Factors Affecting the Growth of the Trade Finance Industry:

Globalization of Trade:

The expansion of global trade is a primary factor driving the growth of the trade finance market. As businesses increasingly engage in international transactions, the demand for trade finance solutions to mitigate risks associated with cross-border trade, such as currency fluctuations and non-payment, rises. The globalization of supply chains has also led to more complex trading relationships, necessitating sophisticated financial instruments to manage these interactions. The integration of emerging markets into the global trade system further amplifies this need, as companies seek secure ways to navigate diverse and sometimes volatile economic environments.

Technological Advancements:

Technological advancements significantly influence the trade finance market. The integration of digital technologies like blockchain, artificial intelligence, and machine learning streamlines trade finance processes, making them more efficient, transparent, and secure. These technologies facilitate faster verification, reduce paperwork, and lower the risk of fraud, enhancing the overall efficiency of trade transactions. Digital platforms are also enabling the automation of trade finance operations, leading to quicker transaction processing and improved customer experience. This digital transformation is particularly crucial in addressing the challenges of cross-border transactions, making trade finance more accessible and reliable.

Regulatory Environment:

The regulatory environment plays a crucial role in shaping the trade finance market. Regulations aimed at preventing money laundering and financing of terrorism have increased the compliance requirements for trade finance, impacting the way financial institutions conduct business. On the other hand, supportive regulatory frameworks, and initiatives, such as the establishment of trade agreements and the standardization of trade finance practices, facilitate international trade. Regulatory bodies are also increasingly recognizing the importance of trade finance in economic development, leading to policies that promote trade finance, especially in developing economies. This evolving regulatory landscape influences the risk assessment, due diligence processes, and availability of trade finance solutions.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=2031&flag=C

Trade Finance Market Report Segmentation:

Breakup by Finance Type:

Structured Trade Finance

Supply Chain Finance

Traditional Trade Finance

Supply chain finance is the largest finance type segment in the global trade finance sector, as it provides critical support for optimizing working capital and enhancing liquidity, which is essential for businesses in managing their complex supply chains efficiently.

Breakup by Offering:

Letters of Credit

Bill of Lading

Export Factoring

Insurance

Others

Letters of credit dominate the offering segment of the trade finance market, as they provide a high level of security in international trade transactions by assuring payment, thus reducing the risk of default for both exporters and importers.

Breakup by Service Provider:

Banks

Trade Finance Houses

Banks are the largest market by service provider in global trade finance, due to their extensive international networks, established relationships, and a wide range of financial services that cater to the diverse needs of global trade participants.

Breakup by End-User:

Small and Medium Sized Enterprises (SMEs)

Large Enterprises

Large enterprises constitute the largest end-user segment in the trade finance market, as they often engage in high-volume international trade activities that require substantial and varied financing solutions to manage and mitigate the risks associated with global transactions.

Breakup by Region:

North America (United States, Canada)

Europe (Germany, France, United Kingdom, Italy, Spain, Others)

Asia Pacific (China, Japan, India, Australia, Indonesia, Korea, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa (United Arab Emirates, Saudi Arabia, Qatar, Iraq, Others)

North America is the largest market by region in the global trade finance sector, driven by the presence of many multinational corporations engaged in extensive international trade, coupled with a well-developed financial sector that provides sophisticated trade financing solutions.

Trade Finance Market Trends:

The increasing digitization and automation of trade finance processes enhances efficiency, reduces transaction times, and minimizes errors which represents one of the key factors influencing the growth of the trade finance market across the globe. This shift includes the adoption of technologies like blockchain and AI, offering greater transparency and security in transactions. The market is also driven by the growing focus on sustainability-linked trade finance, where financing is tied to achieving specific environmental and social goals, reflecting the global shift towards responsible business practices.

Additionally, there's a rising demand for supply chain finance solutions, driven by the need for better working capital management and liquidity in complex global supply chains. The market is also seeing a shift towards more inclusive trade finance, aiming to provide better access to funding for small and medium-sized enterprises (SMEs), which are often underserved.

Leading Companies Operating in the Global Trade Finance Industry:

Asian Development Bank

Banco Santander SA

Bank of America Corp.

BNP Paribas SA

Citigroup Inc.

Crédit Agricole Group

Euler Hermes

Goldman Sachs Group Inc.

HSBC Holdings Plc

JPMorgan Chase & Co.

Mitsubishi Ufj Financial Group Inc.

Morgan Stanley

Royal Bank of Scotland

Standard Chartered Bank

Wells Fargo & Co.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

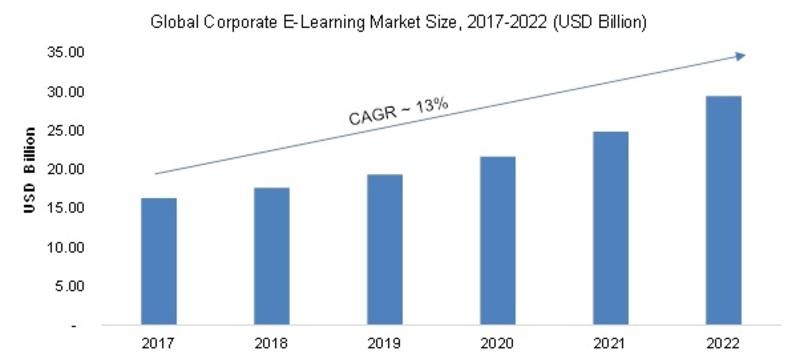

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...