Press release

Travel Insurance Market Size, Share & Trends Report 2033

IMARC Group, a leading market research company, has recently released a report titled "Travel Insurance Market Report by Insurance Type (Single Trip Travel Insurance, Annual Multi-Trip Insurance, Long-Stay Travel Insurance), Coverage (Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, and Others), Distribution Channel (Insurance Intermediaries, Banks, Insurance Companies, Insurance Aggregators, Insurance Brokers, and Others), End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, and Others), and Region 2025-2033". The study provides a detailed analysis of the industry, including the global travel insurance market trends, share, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

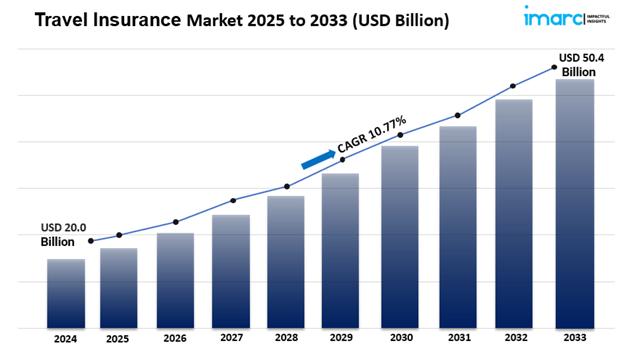

The global travel insurance market size reached USD 20.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 50.4 Billion by 2033, exhibiting a growth rate (CAGR) of 10.77% during 2025-2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/travel-insurance-market/requestsample

Travel Insurance Market Trends

The travel insurance market is on the cusp of significant evolution as key trends emerge, shaping its future landscape. The rising awareness of travel risks is prompting more travelers to seek comprehensive coverage, driven by lessons learned during the pandemic.

Additionally, the resurgence of international travel is fueling demand for insurance products that protect against medical emergencies and trip disruptions. As we approach 2025, technological advancements are revolutionizing the way insurance is purchased and managed, making it more accessible and user-friendly. These trends collectively underscore the growing importance of travel insurance in modern travel planning, highlighting its role in enhancing traveler security and peace of mind.

Market Dynamics of the Travel Insurance Market

Rising Awareness of Travel Risks

The travel insurance market is experiencing significant growth due to a rising awareness of the various risks associated with travel. As more individuals embark on international trips, they are increasingly cognizant of potential challenges such as trip cancellations, medical emergencies, lost luggage, and travel delays. This heightened awareness has led to a greater demand for comprehensive travel insurance policies that provide adequate coverage for unexpected incidents.

Moreover, the COVID-19 pandemic has further emphasized the importance of travel insurance, as travelers seek to protect themselves against unforeseen events that could disrupt their plans. Insurers are responding to this demand by offering tailored policies that address specific travel-related risks, enhancing consumer confidence and driving market growth. As awareness continues to expand, especially among younger travelers and frequent flyers, the travel insurance market is expected to thrive, fostering innovation in policy offerings and customer service.

Increase in International Travel

Another critical dynamic influencing the travel insurance market is the resurgence of international travel. Following the easing of pandemic-related restrictions, there has been a notable uptick in global travel, with individuals eager to explore new destinations. This increase in international travel is accompanied by a growing recognition of the need for insurance coverage to safeguard against potential risks. Travelers are now more inclined to purchase insurance policies that offer protection for medical emergencies, trip cancellations, and other unexpected events that may arise during their journeys.

Additionally, travel agencies and platforms are increasingly promoting travel insurance as an essential component of travel planning, further driving demand. As international travel continues to rebound, the travel insurance market is poised for significant expansion, with insurers adapting their products to meet the diverse needs of global travelers.

Technological Advancements in Insurance Solutions

Technological advancements are playing a transformative role in the travel insurance market, significantly impacting how policies are sold, managed, and claimed. The rise of digital platforms and mobile applications has made it easier for travelers to purchase insurance, compare policies, and access information about coverage options. Insurers are leveraging technology to streamline the claims process, enabling customers to file claims quickly and efficiently through digital channels.

Furthermore, the use of artificial intelligence and data analytics allows insurers to better assess risks and tailor policies to individual travelers' needs. This shift towards technology-driven solutions is enhancing customer experiences and increasing the appeal of travel insurance products. As we move forward, the integration of technology in the travel insurance sector is expected to drive innovation, improve accessibility, and foster greater consumer trust in insurance solutions.

Buy Now: https://www.imarcgroup.com/checkout?id=2432&method=502

Travel Insurance Market Report Segmentation:

By Insurance Type:

· Single-Trip Travel Insurance

· Annual Multi-Trip Insurance

· Long-Stay Travel Insurance

Annual multi-trip insurance represented the largest segment by insurance type due to its appeal to frequent travelers seeking cost-effective coverage for multiple trips within a year.

By Coverage:

· Medical Expenses

· Trip Cancellation

· Trip Delay

· Property Damage

· Others

Medical expenses represented the largest segment by coverage, reflecting travelers' prioritization of health protection amid increasing healthcare costs globally.

By Distribution Channel:

· Insurance Intermediaries

· Banks

· Insurance Companies

· Insurance Aggregators

· Insurance Brokers

· Others

Insurance intermediaries represented the largest segment by distribution channel, as they offer a diverse range of insurance products and personalized advice, catering to the varied needs of travelers.

By End User:

· Senior Citizens

· Education Travelers

· Business Travelers

· Family Travelers

· Others

Family travelers represented the largest segment by end use, driven by the inclination of families towards comprehensive coverage encompassing medical, trip cancellation, and baggage protection for all members.

Regional Insights:

· North America

· Asia Pacific

· Europe

· Latin America

· Middle East and Africa

North America was the largest market by region, attributed to factors such as high travel expenditure, a large population of frequent travellers, and a robust insurance infrastructure catering to diverse consumer preferences and travel patterns.

Competitive Landscape with Key Players:

The competitive landscape of the travel insurance market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

· Allianz SE

· American Express Company

· American International Group

· AXA SA

· Berkshire Hathaway Specialty Insurance Company

· Generali Group

· Insure & Go Insurance Services (Mapfre S.A.)

· Seven Corners Inc.

· Travel Insured International Inc.

· (Crum & Forster)

· USI Affinity (USI Insurance Services)

· Zurich Insurance Group AG

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2432&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

USA: +1-631-791-1145

The global travel insurance market size reached USD 20.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 50.4 Billion by 2033, exhibiting a growth rate (CAGR) of 10.77% during 2025-2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/travel-insurance-market/requestsample

Travel Insurance Market Trends

The travel insurance market is on the cusp of significant evolution as key trends emerge, shaping its future landscape. The rising awareness of travel risks is prompting more travelers to seek comprehensive coverage, driven by lessons learned during the pandemic.

Additionally, the resurgence of international travel is fueling demand for insurance products that protect against medical emergencies and trip disruptions. As we approach 2025, technological advancements are revolutionizing the way insurance is purchased and managed, making it more accessible and user-friendly. These trends collectively underscore the growing importance of travel insurance in modern travel planning, highlighting its role in enhancing traveler security and peace of mind.

Market Dynamics of the Travel Insurance Market

Rising Awareness of Travel Risks

The travel insurance market is experiencing significant growth due to a rising awareness of the various risks associated with travel. As more individuals embark on international trips, they are increasingly cognizant of potential challenges such as trip cancellations, medical emergencies, lost luggage, and travel delays. This heightened awareness has led to a greater demand for comprehensive travel insurance policies that provide adequate coverage for unexpected incidents.

Moreover, the COVID-19 pandemic has further emphasized the importance of travel insurance, as travelers seek to protect themselves against unforeseen events that could disrupt their plans. Insurers are responding to this demand by offering tailored policies that address specific travel-related risks, enhancing consumer confidence and driving market growth. As awareness continues to expand, especially among younger travelers and frequent flyers, the travel insurance market is expected to thrive, fostering innovation in policy offerings and customer service.

Increase in International Travel

Another critical dynamic influencing the travel insurance market is the resurgence of international travel. Following the easing of pandemic-related restrictions, there has been a notable uptick in global travel, with individuals eager to explore new destinations. This increase in international travel is accompanied by a growing recognition of the need for insurance coverage to safeguard against potential risks. Travelers are now more inclined to purchase insurance policies that offer protection for medical emergencies, trip cancellations, and other unexpected events that may arise during their journeys.

Additionally, travel agencies and platforms are increasingly promoting travel insurance as an essential component of travel planning, further driving demand. As international travel continues to rebound, the travel insurance market is poised for significant expansion, with insurers adapting their products to meet the diverse needs of global travelers.

Technological Advancements in Insurance Solutions

Technological advancements are playing a transformative role in the travel insurance market, significantly impacting how policies are sold, managed, and claimed. The rise of digital platforms and mobile applications has made it easier for travelers to purchase insurance, compare policies, and access information about coverage options. Insurers are leveraging technology to streamline the claims process, enabling customers to file claims quickly and efficiently through digital channels.

Furthermore, the use of artificial intelligence and data analytics allows insurers to better assess risks and tailor policies to individual travelers' needs. This shift towards technology-driven solutions is enhancing customer experiences and increasing the appeal of travel insurance products. As we move forward, the integration of technology in the travel insurance sector is expected to drive innovation, improve accessibility, and foster greater consumer trust in insurance solutions.

Buy Now: https://www.imarcgroup.com/checkout?id=2432&method=502

Travel Insurance Market Report Segmentation:

By Insurance Type:

· Single-Trip Travel Insurance

· Annual Multi-Trip Insurance

· Long-Stay Travel Insurance

Annual multi-trip insurance represented the largest segment by insurance type due to its appeal to frequent travelers seeking cost-effective coverage for multiple trips within a year.

By Coverage:

· Medical Expenses

· Trip Cancellation

· Trip Delay

· Property Damage

· Others

Medical expenses represented the largest segment by coverage, reflecting travelers' prioritization of health protection amid increasing healthcare costs globally.

By Distribution Channel:

· Insurance Intermediaries

· Banks

· Insurance Companies

· Insurance Aggregators

· Insurance Brokers

· Others

Insurance intermediaries represented the largest segment by distribution channel, as they offer a diverse range of insurance products and personalized advice, catering to the varied needs of travelers.

By End User:

· Senior Citizens

· Education Travelers

· Business Travelers

· Family Travelers

· Others

Family travelers represented the largest segment by end use, driven by the inclination of families towards comprehensive coverage encompassing medical, trip cancellation, and baggage protection for all members.

Regional Insights:

· North America

· Asia Pacific

· Europe

· Latin America

· Middle East and Africa

North America was the largest market by region, attributed to factors such as high travel expenditure, a large population of frequent travellers, and a robust insurance infrastructure catering to diverse consumer preferences and travel patterns.

Competitive Landscape with Key Players:

The competitive landscape of the travel insurance market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

· Allianz SE

· American Express Company

· American International Group

· AXA SA

· Berkshire Hathaway Specialty Insurance Company

· Generali Group

· Insure & Go Insurance Services (Mapfre S.A.)

· Seven Corners Inc.

· Travel Insured International Inc.

· (Crum & Forster)

· USI Affinity (USI Insurance Services)

· Zurich Insurance Group AG

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2432&flag=C

Key Highlights of the Report:

· Market Performance (2018-2023)

· Market Outlook (2024-2032)

· Market Trends

· Market Drivers and Success Factors

· Impact of COVID-19

· Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: sales@imarcgroup.com

USA: +1-631-791-1145

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...