Press release

UAE Online Loan Aggregator Market Size and Research 2021, CAGR Status, Growth Analysis, Business Updates and Strategies till 2027: Ken Research

Introduction

Loan aggregator is a middleman organization that gathers an individual personal and financial information on a loan applications and shops it around who might propose an individual a loan. Such aggregators charge some amount of price to deliver the individual end-to-end service in their entire loan application procedure. The online loan aggregator is speedily being accepted around underdeveloped region, for instance, around UAE, the online loan aggregator has emerged as one of the fastest-increasing industry. The effective growth in tie-ups with several banks supporting buyers in loan pre-application and the post-applications procedure has augmented requirement for online loan aggregators.

What are the lending patterns in the uae?

Containing of loans to Government, Business & Industrial sector, Public, Retail & Financial Institutions, gross credit outstanding around the UAE reached AED 1.7 Tn during 2019 recording a CAGR (2014-2019) of ~5%. Occupying the greatest share of ~50%, loans to business & industrial units have been growing majorly from Dubai & Abu Dhabi region while the North Emirates region experienced a decline throughout 2019. With ~2x higher interest rates charged by finance organizations, lending around the UAE is majorly registered by banks obtaining >90%of credit disbursed around the country. The second most required category of the loan was witnessed to be retail lending obtaining a share of about 21%of total credit outstanding.

For More Detail @ https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/uae-online-loan-aggregator-industry-outlook/337074-93.html

Retail loans-second most required loan category in the uae

Retail lending around the UAE entails loans disbursed to individuals for personal consumption purposes comprising Personal Loans, Mortgage/Home loans, Car Loans, and several others. Post-2016 oil crisis, the banking industry witnessed an augmented rate in NPAs & rejection rates thereby retail loan outstanding falling continuously to reach AED 361 Bn by 2019. However, trends such as falling interest rates, property prices, increasing regional requirement (Dubai & Northern Emirates) helped retail loan requirement to gain some momentum during 2019.

Highly concentrated competitive landscape

The key players in UAE Online Loan Aggregator Market are aiming greatly on innovations in technologies to advancing proficiency level. The industry growth outlook is captured by confirming ongoing procedure advancements of players and optimal strategies taken up by organizations to fight COVID-19 situation.

The competitive landscape around UAE Online Aggregator Industry is witnessed to be greatly concentrated with ~90% of market share occupied by top 4 players comprising YallaComapre, Souqalmal, BankOnUs & Paisa Bazaar competing on the basis of parameters such as Conversion rates, Traffic generated, After Loan Assistance, Loan Providers, Tools & Advisory services provided. The foremost strategy adopted by players comprises diversifying product portfolio, delivering comparison services across insurance, telecom, education, property, etc thereby aiming on becoming “One Stop Solution Provider”. With partnerships around all foremost loan providers in the country, the foremost distinguishing aspect among players is the level of customized advisory services delivered in the loan selection procedure.

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=MzM3MDc0

Covid 19 impacting loan industry

An outbreak of COVID 19 Pandemic is projected to leave major foremost across all industries. Adding to the woes, UAE suffered from plunging oil prices during April 2020 thereby contracting the country’s GDP by -3.5%. In order to decrease the dual shocks’ impact, CBUAE launched Targeted Economic Scheme delivering the relaxations around loan categories. In order to meet liquidity expenditures & working capital requirements, requirement for personal loans, credit cards & SME/Commercial loans are projected to augment substantially during 2020.

For More Detail @ https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/uae-online-loan-aggregator-industry-outlook/337074-93.html

Future outlook

A foremost shift in customer behavior can be projected post-pandemic with people preferring contactless online services delivering opportunities for online aggregator services. On the competition front, foremost players are projected to invest in Artificial Intelligence & Machine Learning to match consumer requirement with solutions & in entire customer segmentation.

Related Reports

https://www.kenresearch.com/automotive-transportation-and-warehousing/logistics-and-shipping/uae-e-commerce-logistics-market-outlook-to-2025/466156-100.html

https://www.kenresearch.com/consumer-products-and-retail/consumer-electronics/uae-led-lighting-market/193269-95.html

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

support@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a research based management consulting company. We provide strategic consultancy to aid clients on critical business perspective: strategy, marketing, organization, operations and technology transformation, advanced analytics, corporate finance, mergers & acquisitions and sustainability across all industries and geographies. We provide business intelligence and operational advisory across 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies. Some of top consulting companies and Market leaders seek our intelligence to identify new revenue streams, customer/ vendor paradigm and pain points and due diligence on competition.

Loan aggregator is a middleman organization that gathers an individual personal and financial information on a loan applications and shops it around who might propose an individual a loan. Such aggregators charge some amount of price to deliver the individual end-to-end service in their entire loan application procedure. The online loan aggregator is speedily being accepted around underdeveloped region, for instance, around UAE, the online loan aggregator has emerged as one of the fastest-increasing industry. The effective growth in tie-ups with several banks supporting buyers in loan pre-application and the post-applications procedure has augmented requirement for online loan aggregators.

What are the lending patterns in the uae?

Containing of loans to Government, Business & Industrial sector, Public, Retail & Financial Institutions, gross credit outstanding around the UAE reached AED 1.7 Tn during 2019 recording a CAGR (2014-2019) of ~5%. Occupying the greatest share of ~50%, loans to business & industrial units have been growing majorly from Dubai & Abu Dhabi region while the North Emirates region experienced a decline throughout 2019. With ~2x higher interest rates charged by finance organizations, lending around the UAE is majorly registered by banks obtaining >90%of credit disbursed around the country. The second most required category of the loan was witnessed to be retail lending obtaining a share of about 21%of total credit outstanding.

For More Detail @ https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/uae-online-loan-aggregator-industry-outlook/337074-93.html

Retail loans-second most required loan category in the uae

Retail lending around the UAE entails loans disbursed to individuals for personal consumption purposes comprising Personal Loans, Mortgage/Home loans, Car Loans, and several others. Post-2016 oil crisis, the banking industry witnessed an augmented rate in NPAs & rejection rates thereby retail loan outstanding falling continuously to reach AED 361 Bn by 2019. However, trends such as falling interest rates, property prices, increasing regional requirement (Dubai & Northern Emirates) helped retail loan requirement to gain some momentum during 2019.

Highly concentrated competitive landscape

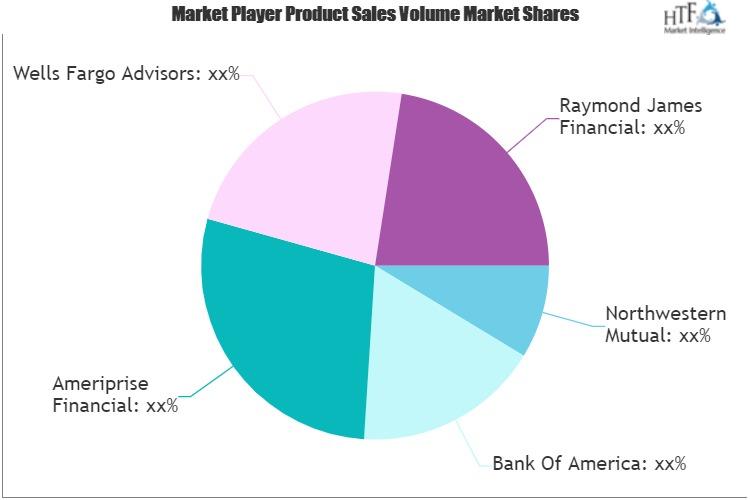

The key players in UAE Online Loan Aggregator Market are aiming greatly on innovations in technologies to advancing proficiency level. The industry growth outlook is captured by confirming ongoing procedure advancements of players and optimal strategies taken up by organizations to fight COVID-19 situation.

The competitive landscape around UAE Online Aggregator Industry is witnessed to be greatly concentrated with ~90% of market share occupied by top 4 players comprising YallaComapre, Souqalmal, BankOnUs & Paisa Bazaar competing on the basis of parameters such as Conversion rates, Traffic generated, After Loan Assistance, Loan Providers, Tools & Advisory services provided. The foremost strategy adopted by players comprises diversifying product portfolio, delivering comparison services across insurance, telecom, education, property, etc thereby aiming on becoming “One Stop Solution Provider”. With partnerships around all foremost loan providers in the country, the foremost distinguishing aspect among players is the level of customized advisory services delivered in the loan selection procedure.

Request For Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=MzM3MDc0

Covid 19 impacting loan industry

An outbreak of COVID 19 Pandemic is projected to leave major foremost across all industries. Adding to the woes, UAE suffered from plunging oil prices during April 2020 thereby contracting the country’s GDP by -3.5%. In order to decrease the dual shocks’ impact, CBUAE launched Targeted Economic Scheme delivering the relaxations around loan categories. In order to meet liquidity expenditures & working capital requirements, requirement for personal loans, credit cards & SME/Commercial loans are projected to augment substantially during 2020.

For More Detail @ https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/uae-online-loan-aggregator-industry-outlook/337074-93.html

Future outlook

A foremost shift in customer behavior can be projected post-pandemic with people preferring contactless online services delivering opportunities for online aggregator services. On the competition front, foremost players are projected to invest in Artificial Intelligence & Machine Learning to match consumer requirement with solutions & in entire customer segmentation.

Related Reports

https://www.kenresearch.com/automotive-transportation-and-warehousing/logistics-and-shipping/uae-e-commerce-logistics-market-outlook-to-2025/466156-100.html

https://www.kenresearch.com/consumer-products-and-retail/consumer-electronics/uae-led-lighting-market/193269-95.html

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

support@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a research based management consulting company. We provide strategic consultancy to aid clients on critical business perspective: strategy, marketing, organization, operations and technology transformation, advanced analytics, corporate finance, mergers & acquisitions and sustainability across all industries and geographies. We provide business intelligence and operational advisory across 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies. Some of top consulting companies and Market leaders seek our intelligence to identify new revenue streams, customer/ vendor paradigm and pain points and due diligence on competition.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

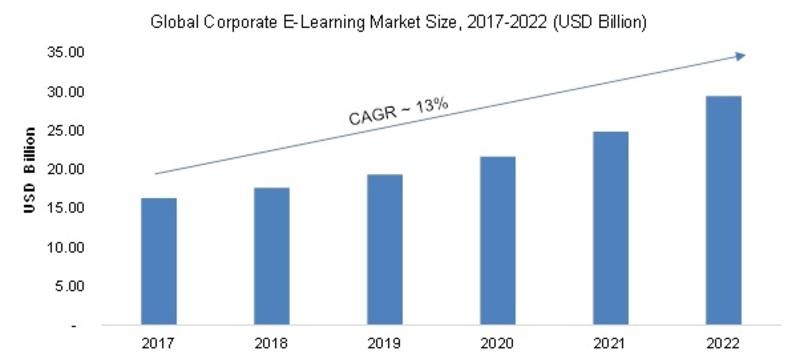

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...