Press release

UK True Fleet continues to battle to remain Europe’s #1 for volume

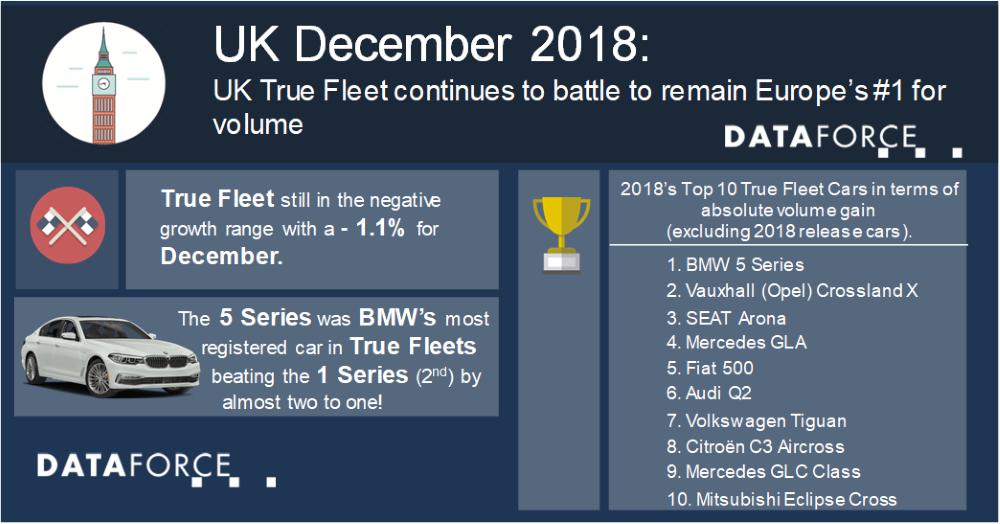

The UK has continued to recover from the massive drop caused by WLTP in September. While still in negative territory it has reduced the gap to December 2017 to only 1.1% (a little over 600 units) and for 2018 vs 2017 to -6.6%. The race to remain Europe’s #1 fleet market in terms of volume is still alive but it is certainly going to be a close race with Germany as both battle on the final straight. The Private market like fleets also continued to recover bringing the December gap to -3.8% though Special channels took their foot off the gas and recorded a -15.3% with both the Short-Term Rental & Dealership/Manufacturer sub-channels playing a somewhat equal role in this result.

Brand performance

Top of the December ranking Christmas tree was VW, it has been consistently in top spot since May 2018 with the only blot on the landscape coming in September when Vauxhall (Opel) took top as WLTP testing became mandatory. Ford were in 2nd place, retaining the same position as last year thanks mostly to a stellar month for Ecosport. Munich OEM BMW had a good growth month, ranking 2nd in highest growth rate in the top ten which secured the final place on the podium. Their number one seller for December was the 5 Series, which almost out registered the 1 Series (number two seller) by two to one!

Vauxhall came next (4th) and Mercedes followed, with both A-Class and GLA Class contributing the most to the +19.4% growth of the brand. Nissan, Skoda, Audi and Hyundai filled out the 6th to 9th positions respectively, Audi was the hardest hit in terms of volume contraction but none of these OEMs managed a positive month. Our final position was yet another reason for Munich and the BMW Group to celebrate as MINI entered the True Fleet top 10 for the first time ever (according to Dataforce records). The maker of diminutive vehicles posted a pretty big growth of 59.3% for December as all versions (One/Cooper, Countryman and Clubman) pitched in to help the brand. Interesting side note was to see the share of Diesel engine versions at 3.6%, its lowest since April 2007 and a far away from the high of 74.0% seen in December 2013.

Vehicle Segments

As we finish out 2018 on what can only be described as a challenging year thanks to various influences both from inside and outside of the industry itself it is worth identifying those vehicle segments which have increased regardless of the climate. On the first level SUV is the only outright segment which can claim growth with a 12.1% increase with three of the SUV sub-segments i.e. Small, Compact and Medium producing 19.7%, 12.9% and 5.6% respectively over YTD December. We see PC Medium-Large with a +8.8% (mostly thanks to the BMW 5 series) and the Utilities Medium eking out a + 1.4% (thanks to the Ford Transit Custom, Toyota Proace, Citroën Dispatch (Jumpy) and VW Transporter).

Flash addendum: Germany numbers are now in-house and have been processed. For the full year 2018, Germany beat the UK to take the highest True Fleet volume in Europe by a slim margin of 974 registrations.

(538 words; 3,059 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Richard Worrow

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-253

Fax: +49 69 95930-333

Email: richard.worrow@dataforce.de

www.dataforce.de

Brand performance

Top of the December ranking Christmas tree was VW, it has been consistently in top spot since May 2018 with the only blot on the landscape coming in September when Vauxhall (Opel) took top as WLTP testing became mandatory. Ford were in 2nd place, retaining the same position as last year thanks mostly to a stellar month for Ecosport. Munich OEM BMW had a good growth month, ranking 2nd in highest growth rate in the top ten which secured the final place on the podium. Their number one seller for December was the 5 Series, which almost out registered the 1 Series (number two seller) by two to one!

Vauxhall came next (4th) and Mercedes followed, with both A-Class and GLA Class contributing the most to the +19.4% growth of the brand. Nissan, Skoda, Audi and Hyundai filled out the 6th to 9th positions respectively, Audi was the hardest hit in terms of volume contraction but none of these OEMs managed a positive month. Our final position was yet another reason for Munich and the BMW Group to celebrate as MINI entered the True Fleet top 10 for the first time ever (according to Dataforce records). The maker of diminutive vehicles posted a pretty big growth of 59.3% for December as all versions (One/Cooper, Countryman and Clubman) pitched in to help the brand. Interesting side note was to see the share of Diesel engine versions at 3.6%, its lowest since April 2007 and a far away from the high of 74.0% seen in December 2013.

Vehicle Segments

As we finish out 2018 on what can only be described as a challenging year thanks to various influences both from inside and outside of the industry itself it is worth identifying those vehicle segments which have increased regardless of the climate. On the first level SUV is the only outright segment which can claim growth with a 12.1% increase with three of the SUV sub-segments i.e. Small, Compact and Medium producing 19.7%, 12.9% and 5.6% respectively over YTD December. We see PC Medium-Large with a +8.8% (mostly thanks to the BMW 5 series) and the Utilities Medium eking out a + 1.4% (thanks to the Ford Transit Custom, Toyota Proace, Citroën Dispatch (Jumpy) and VW Transporter).

Flash addendum: Germany numbers are now in-house and have been processed. For the full year 2018, Germany beat the UK to take the highest True Fleet volume in Europe by a slim margin of 974 registrations.

(538 words; 3,059 characters)

Publication by indication of source (DATAFORCE) and author (as listed below) only

DATAFORCE – Focus on Fleets

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Richard Worrow

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Germany

Phone: +49 69 95930-253

Fax: +49 69 95930-333

Email: richard.worrow@dataforce.de

www.dataforce.de

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...