Press release

Unsecured Business Loans Market Report, Size, Share, Growth, Trends, Industry Forecast to 2033

"Gain a competitive edge with up to 30% off in-depth market reports-uncover key trends, growth drivers, and forecasts today!

The new report published by The Business Research Company, titled Unsecured Business Loans Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.

As per the report, the unsecured business loans market size has grown rapidly in recent years. It will grow from $4,509.08 billion in 2023 to $5,005.68 billion in 2024 at a compound annual growth rate (CAGR) of 11.0%. The unsecured business loans market size is expected to see rapid growth in the next few years. It will grow to $7,674.60 billion in 2028 at a compound annual growth rate (CAGR) of 11.3%.

Download Free Sample Report: https://www.thebusinessresearchcompany.com/sample.aspx?id=18762&type=smp

What Is Driving The Growth Of The Global Unsecured Business Loans Market?

The Rise Of SMEs And The Unsecured Business Loans Fueling Their Growth

The increase in small and medium-sized enterprises (SMEs) is expected to propel the growth of the unsecured business loans market going forward. Small and medium-sized enterprises (SMEs) operate within specific limits on revenue, assets, or the number of employees. The increasing number of SMEs is due to economic growth, job creation, government support and policies, and social and community needs. Unsecured business loans allow SMEs to meet their diverse financial needs without collateral, enabling them to grow, manage operations efficiently, and navigate financial challenges. For instance, according to the European Commission (EC), a Belgium-based executive body of the European Union, the number of SMEs in the European Union increased by 2.7% in 2022, with significant growth observed in several member states. Therefore, the increase in small and medium-sized enterprises (SMEs) is driving the growth of the unsecured business loans market.

What Is The Key Trend In The Global Unsecured Business Loans Market?

Top Lenders Offer Innovative Unsecured Business Loans For MSMEs In India

Major companies operating in the unsecured business loans market are focused on providing annotative loans such as unsecured business loans for micro, small, and medium-sized enterprises (MSMEs) to achieve their business objectives and drive economic development. Unsecured business loans for micro, small, and medium-sized enterprises (MSMEs) are types of financing that do not require the borrower to provide collateral. These loans are based primarily on the creditworthiness and financial health of the business and its owners rather than any pledged assets. For instance, in July 2023, Godrej Capital, an India-based financial services company, announced the launch of unsecured business loans specifically for MSMEs. These loans are designed to cater to the unique financing needs of a diverse range of businesses, from startups and MSMEs to established enterprises. It offers innovative repayment structures that align with the cash flow cycles of companies, allowing for more manageable repayment schedules. This initiative aims to tackle these businesses' specific challenges, especially in obtaining flexible financing options.

How Is The Global Unsecured Business Loans Market Segmented?

The unsecured business loans market covered in this report is segmented -

1) By Type: Term Business Loan, Overdrafts, Loan On Business Credit Cards, Working Capital Loan, Other Types

2) By Provider: Banks, Non-Banking Financial Company (NBFCs), Credit Unions

3) By Application: Banking, Financial Services, And Insurance (BFSI), Retail, Information Technology (IT) And Telecom, Healthcare, Manufacturing, Energy And Utility, Other Applications

4) By End-User: Small And Medium-Sized Enterprises, Large Enterprises

You Can Pre-Book The Global Market Report Of Your Requirement For A Swift Delivery And Also Get An Exclusive Discount On This Report, Checkout Link:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18762

How Is The Competitive Landscape Of The Global Unsecured Business Loans Market?

Major companies operating in the unsecured business loans market are Bank of America Corporation, Wells Fargo and Co., Bank of China Limited, American Express Company, Deutsche Bank AG, HDFC Bank Ltd., Standard Chartered PLC, Bajaj Finserv Ltd., Axis Bank Ltd., Bank of Ireland Group PLC, Enova International Inc., Hero FinCorp Ltd., Bluevine Inc., Poonawalla Fincorp Ltd., Starling Bank, Funding Circle Holdings PLC, OnDeck Capital, National Funding Inc., Rapid Finance, Biz2Credit Inc., Clix Capital Services Private Limited

Contents Of The Global Unsecured Business Loans Market

1. Executive Summary

2. Unsecured Business Loans Market Report Structure

3. Unsecured Business Loans Market Trends And Strategies

4. Unsecured Business Loans Market - Macro Economic Scenario

5. Unsecured Business Loans Market Size And Growth

…..

27. Unsecured Business Loans Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore The Report Store To Make A Direct Purchase Of The Report: https://www.thebusinessresearchcompany.com/report/unsecured-business-loans-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ "

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

The new report published by The Business Research Company, titled Unsecured Business Loans Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.

As per the report, the unsecured business loans market size has grown rapidly in recent years. It will grow from $4,509.08 billion in 2023 to $5,005.68 billion in 2024 at a compound annual growth rate (CAGR) of 11.0%. The unsecured business loans market size is expected to see rapid growth in the next few years. It will grow to $7,674.60 billion in 2028 at a compound annual growth rate (CAGR) of 11.3%.

Download Free Sample Report: https://www.thebusinessresearchcompany.com/sample.aspx?id=18762&type=smp

What Is Driving The Growth Of The Global Unsecured Business Loans Market?

The Rise Of SMEs And The Unsecured Business Loans Fueling Their Growth

The increase in small and medium-sized enterprises (SMEs) is expected to propel the growth of the unsecured business loans market going forward. Small and medium-sized enterprises (SMEs) operate within specific limits on revenue, assets, or the number of employees. The increasing number of SMEs is due to economic growth, job creation, government support and policies, and social and community needs. Unsecured business loans allow SMEs to meet their diverse financial needs without collateral, enabling them to grow, manage operations efficiently, and navigate financial challenges. For instance, according to the European Commission (EC), a Belgium-based executive body of the European Union, the number of SMEs in the European Union increased by 2.7% in 2022, with significant growth observed in several member states. Therefore, the increase in small and medium-sized enterprises (SMEs) is driving the growth of the unsecured business loans market.

What Is The Key Trend In The Global Unsecured Business Loans Market?

Top Lenders Offer Innovative Unsecured Business Loans For MSMEs In India

Major companies operating in the unsecured business loans market are focused on providing annotative loans such as unsecured business loans for micro, small, and medium-sized enterprises (MSMEs) to achieve their business objectives and drive economic development. Unsecured business loans for micro, small, and medium-sized enterprises (MSMEs) are types of financing that do not require the borrower to provide collateral. These loans are based primarily on the creditworthiness and financial health of the business and its owners rather than any pledged assets. For instance, in July 2023, Godrej Capital, an India-based financial services company, announced the launch of unsecured business loans specifically for MSMEs. These loans are designed to cater to the unique financing needs of a diverse range of businesses, from startups and MSMEs to established enterprises. It offers innovative repayment structures that align with the cash flow cycles of companies, allowing for more manageable repayment schedules. This initiative aims to tackle these businesses' specific challenges, especially in obtaining flexible financing options.

How Is The Global Unsecured Business Loans Market Segmented?

The unsecured business loans market covered in this report is segmented -

1) By Type: Term Business Loan, Overdrafts, Loan On Business Credit Cards, Working Capital Loan, Other Types

2) By Provider: Banks, Non-Banking Financial Company (NBFCs), Credit Unions

3) By Application: Banking, Financial Services, And Insurance (BFSI), Retail, Information Technology (IT) And Telecom, Healthcare, Manufacturing, Energy And Utility, Other Applications

4) By End-User: Small And Medium-Sized Enterprises, Large Enterprises

You Can Pre-Book The Global Market Report Of Your Requirement For A Swift Delivery And Also Get An Exclusive Discount On This Report, Checkout Link:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=18762

How Is The Competitive Landscape Of The Global Unsecured Business Loans Market?

Major companies operating in the unsecured business loans market are Bank of America Corporation, Wells Fargo and Co., Bank of China Limited, American Express Company, Deutsche Bank AG, HDFC Bank Ltd., Standard Chartered PLC, Bajaj Finserv Ltd., Axis Bank Ltd., Bank of Ireland Group PLC, Enova International Inc., Hero FinCorp Ltd., Bluevine Inc., Poonawalla Fincorp Ltd., Starling Bank, Funding Circle Holdings PLC, OnDeck Capital, National Funding Inc., Rapid Finance, Biz2Credit Inc., Clix Capital Services Private Limited

Contents Of The Global Unsecured Business Loans Market

1. Executive Summary

2. Unsecured Business Loans Market Report Structure

3. Unsecured Business Loans Market Trends And Strategies

4. Unsecured Business Loans Market - Macro Economic Scenario

5. Unsecured Business Loans Market Size And Growth

…..

27. Unsecured Business Loans Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore The Report Store To Make A Direct Purchase Of The Report: https://www.thebusinessresearchcompany.com/report/unsecured-business-loans-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ "

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage

to this press release on woodPRI. woodPRI disclaims liability for any content contained in

this release.

Recommend

/newsMicroencapsulation Market Deep Analysis on Key Players - Dow Corning, Encapsys, Syngenta Crop Protection, Evonik Industries, 3M and Bayer

Market Study Report Adds Global Microencapsulation Market Size, Status and Forecast 2024 added to its database. The report provides key statistics on the current state of the industry and other analytical data to understand the market.

Extensive research is required for choosing the appropriate cor...

/newsGermany Airbag Market Size 2023: Global Share, Industry And Report Analysis By 2030 | Hyundai Mobis Co., Ltd. Key Safety Systems, Inc. Robert Bosch GmbH

Germany airbag market is expected to grow at a CAGR of around 6% during the forecast period. Germany Airbag Market research report refers to gathering and analyzing significant market data serve as best medium for various industry players to launch novel product or service. It is vital for key firms...

/newsSecurities Brokerages And Stock Exchanges Market Outlook 2021: Big Things are Happening

A new intelligence report released by HTF MI with title "Global Securities Brokerages And Stock Exchanges Market Survey & Outlook" is designed covering micro level of analysis by Insurers and key business segments, offerings and sales channels. The Global Securities Brokerages And Stock Exchange...

/newsRenewable Chemicals Market Emerging Trends and Competitive Landscape Forecast to 2028

The renewable chemicals market was valued at US$ 80,566.30 million in 2021 and is projected to reach US$ 1,76,750.76 million by 2028 it is expected to grow at a CAGR of 11.9% from 2021 to 2028. The research report focuses on the current market trends, opportunities, future potential of the market, a...

/newsHow Coronavirus is Impacting Cold Brew Coffee, Global Market Volume Analysis, Size, Share and Key Trends 2020-2026

"Market Latest Research Report 2020:

Los Angles United States, February 2020: The Cold Brew Coffee market has been garnering remarkable momentum in the recent years. The steadily escalating demand due to improving purchasing power is projected to bode well for the global market. QY Research's lates...

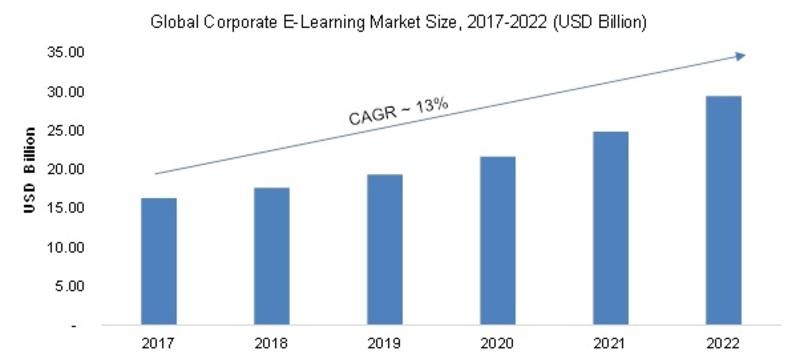

/newsCorporate E-Learning Market - Global Industry Size, Share, Key Players Analysis that are Infor, SkillSoft Corporation, Adrenna, CERTPOINT Systems and others with Regional Forecast to 2022

Overview:

E-Learning is used to enhance the learning procedures for newer job requirements and to make employees sound about the internal and external changes in the market and respective organizations. This method has created considerable differences in the ways of training and developing employee...